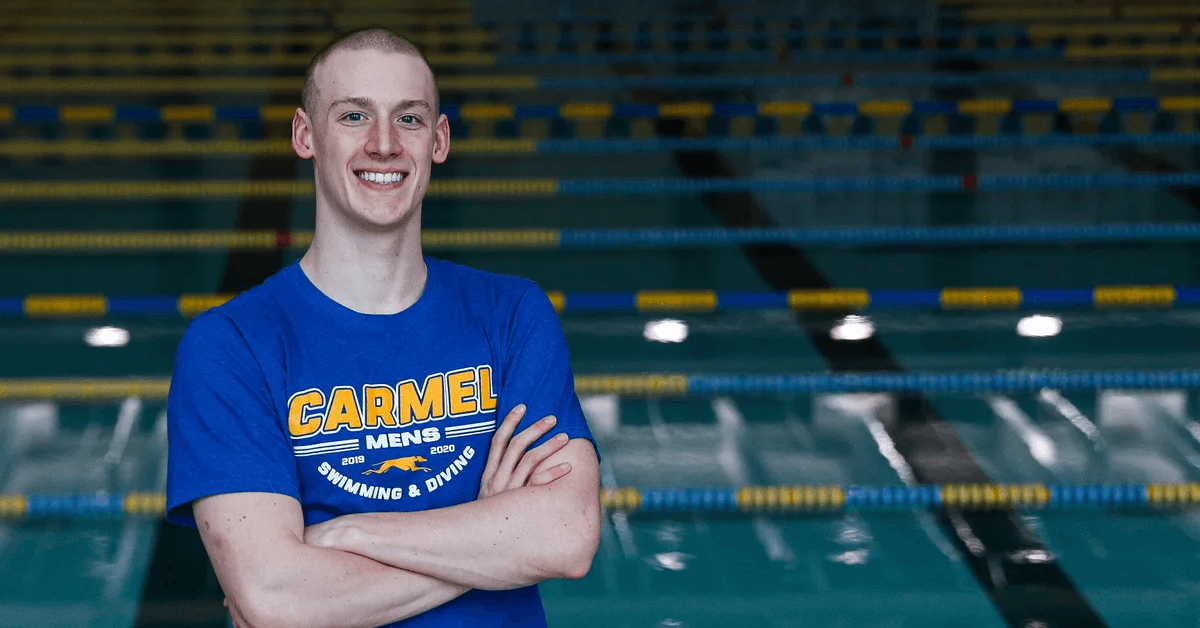

Wyatt Davis, Former Michigan Swimmer, Suspended for Cannabis Violation

In a recent announcement by the United States Anti-Doping Agency (USADA), Wyatt Davis, a former World Junior champion and Michigan Wolverine, has been handed a three-month suspension following a positive test for a cannabis-related substance. The test was conducted in June 2023, and the suspension was officially declared on January 16th, 2024.

At 22 years old, Davis was found to have levels of 11-nor-9-carboxy-tetrahydrocannabinol (Carboxy-THC), a primary psychoactive component of cannabis, marijuana, and hashish, exceeding the permissible limit in a drug test. This test was administered during the U.S. National Championships on June 30th, 2023.

Davis, known for his exceptional swimming prowess, demonstrated notable performances at the U.S. Nationals. He secured third place in the men's 50 backstroke with a time of 24.62 seconds and sixth in the 100 backstroke at 53.43 seconds, both personal bests. Additionally, he finished 18th in the 200 backstroke and 34th in the 100 butterfly.

The implications of his positive test are significant. Davis has been stripped of all competitive results commencing from June 30th, 2023. This decision particularly affects his 100 backstroke performance at the Nationals, as it falls under the disqualification timeline. His performances in the 200 backstroke, 50 backstroke, and 100 butterfly remain unaffected as they occurred before June 30.

The three-month suspension period for Davis began on January 2nd, 2024, the date he accepted the sanction. During the interim period, while the case was under review, USADA found that Davis breached his provisional suspension by participating in activities under the governance of USA Swimming. Consequently, the time spent under provisional suspension will not be credited towards his ineligibility period.

Davis argued that his use of cannabis occurred out-of-competition and was not related to enhancing sport performance. This claim, accepted by USADA, allowed for a reduction in his sanction, adhering to the provisions of the World Anti-Doping Code. This code classifies THC as a "Substance of Abuse," permitting reduced penalties under certain circumstances.

Since the U.S. Nationals, Davis has not participated in any competitive swimming events, although he is still listed as a senior on the University of Michigan's team roster for the 2023-24 season. His suspension will conclude on April 2nd, 2024, resulting in him missing the entire college swimming season.

This case mirrors a similar incident from 2021 involving former University of Texas sprinter Tate Jackson, who received a one-month suspension from USADA for a positive THC test. Notably, athletes can have their suspension period reduced to one month if they successfully complete a Substance of Abuse treatment program approved by USADA.

Before joining the University of Michigan in the 2020-21 season, Davis had a distinguished career, including a gold medal in the boys' 200 backstroke and a silver in the 50 backstroke at the 2019 World Junior Championships in Indianapolis.

Agrify Corporation Takes Steps to Maintain Nasdaq Listing Amid Financial Reorganization

Agrify Corporation (NASDAQ: AGFY), a key player in the cannabis technology sector, has been working diligently to retain its listing on the Nasdaq stock exchange. The company, based in Troy, Michigan, is navigating through financial restructuring to meet the Nasdaq's stringent requirements regarding minimum stockholders' equity.

Recently, Agrify has undertaken several strategic moves to strengthen its financial position:

-

Increased Authorized Shares: The company has raised its maximum number of authorized shares from 10 million to 35 million. This expansion paves the way for future equity transactions that could bolster Agrify's financial stability.

-

Debt Consolidation and Conversion: Agrify has consolidated its debts under CP Acquisitions, a lender affiliated with Agrify CEO Raymond Chang and board member I-Tseng Jenny Chan. Notably, $3.9 million of this debt has been converted into equity at a premium rate. This move is aimed at reducing the company's liabilities and improving its equity stance.

-

Warrant Exercise by Lenders: A previous secured lender has chosen to exercise warrants in exchange for shares, which has significantly reduced the number of outstanding warrants. This action is part of Agrify's broader strategy to streamline its financial structure.

These strategic efforts are in direct response to the requirements of the Nasdaq Capital Market's equity-standard rule, which necessitates a listed company's primary equity security to have at least $2.5 million in stockholders' equity.

In a recent development, Agrify announced that following a January 11th hearing with a Nasdaq panel, it has been granted an extension until April 15th to align with the rule. The company is actively working on settling various legal and trade payables to decrease liabilities and improve its equity status.

Agrify has had previous challenges with Nasdaq's listing requirements, including delays in filing financial reports and consolidating shares in 2023 to meet the stock exchange's minimum bid-price requirement. The stockholders' equity warning, issued on December 1st, remains the only outstanding noncompliance issue for Agrify on Nasdaq.

CEO Raymond Chang has expressed a strong commitment to turning the business profitable as quickly as possible. Despite these efforts, the company's shares (traded under AGFY on the Nasdaq) have recently dipped below $1 per share.

Agrify's recent notification from the Nasdaq Hearings Panel granting an extension for compliance reflects the company's proactive approach in addressing the challenges. The consolidation of debts and the conversion of a significant portion of this debt into equity at a favorable rate demonstrate the company's strategic financial management. The issuance of additional shares in response to warrant exercises by a previous lender further indicates Agrify's active engagement in restructuring its financials to meet Nasdaq's standards.

In summary, Agrify Corporation is in the midst of a crucial phase of financial reorganization, aiming to satisfy Nasdaq's requirements and maintain its listing. The company's recent actions reflect a concerted effort to improve its financial health and secure a stable future in the cannabis technology sector.

For those interested in the financial side of the cannabis industry, an exclusive opportunity awaits. By signing up through our Robinhood referral link, you might secure a free portion of Agrify stock, making you a part of the groundbreaking journey of companies like Agrify in the cannabis sector. Explore this chance and potentially start your investment journey in the burgeoning cannabis market.

Big Rapids Bids Farewell to Lake Life Farms Dispensary

In a recent development in the Michigan cannabis market, Lake Life Farms, a well-known cannabis dispensary located at 208 S. Michigan Ave., Big Rapids, has announced its impending closure. The dispensary, which opened its doors to the public in December 2020, has been serving the community for over two years and will cease operations after its final day of sales on Sunday, February 4th, from 11 a.m. to 7 p.m.

Store manager Heather Strong confirmed the closure of the Big Rapids location, marking an end to a significant chapter for Lake Life Farms in the region. In a statement, Strong mentioned, "We are closing in early February." She also highlighted that in the lead-up to the closure, customers can expect a 35% discount on all products, with an additional offer on pre-rolls, which will be available at 10 for $20.

Known for its unique retail approach, Lake Life Farms in Big Rapids adopted a deli-style service model, which has been well-received by customers. This distinctive method allows patients to closely inspect and select their cannabis products, which are then weighed and prepared in their presence, ensuring transparency and a personalized shopping experience.

Despite the closure of the Big Rapids outlet, Lake Life Farms continues to operate in other Michigan locations, including Cedar Springs, Stanton, and Lansing. These branches remain open and continue to serve their respective communities.

The closure of the Big Rapids store signifies a change in the local cannabis retail landscape and reflects the dynamic nature of the cannabis industry in Michigan.

New Baltimore City Council Approves Marijuana License Transfer

In New Baltimore, the landscape of the marijuana business is witnessing a significant change with the transition of ownership of Cloud Cannabis Co. The New Baltimore City Council, in a narrow vote of 3-2 on January 22nd, sanctioned a medical and recreational marijuana application from Stash Ventures LLC, which is set to become the new proprietor of Cloud Cannabis. This company is recognized for its substantial presence in Michigan, operating close to a dozen dispensaries, including one on Cricklewood Boulevard in New Baltimore.

Doug Manson, representing Stash Ventures LLC, emphasized that the visible aspects of the business, such as the branding, structural design, and overall appearance, would remain unchanged post-acquisition. "The Cloud name and the physical attributes of the facility will stay the same, ensuring a seamless transition for customers," Manson stated. He further explained that the primary alteration would be in the ownership, largely invisible to the public.

The process of ownership transfer is contingent on local and state approval, as elucidated by Manson. He noted that the state of Michigan does not directly transfer licenses but instead issues new licenses concurrently with the rescission of existing ones. The completion of the state application depends on the city council's endorsement.

Manson also mentioned that a state inspection is anticipated following the finalization of the application. The city officials will be notified of any discrepancies found during this inspection. However, he anticipates minimal issues given the business's history of passing previous inspections.

The council meeting saw an extended debate on the application process. Council member Ryan Covert remarked on the novelty of such a transfer for the council, emphasizing their aim for consistency in handling these applications. Some council members, including Jacob Dittrich and Jason Harvey, expressed a desire for a more rigorous review process for transfer applications, akin to the procedure for new applications. They highlighted the need for greater familiarity with the new owners and their operations.

Comparisons were drawn between this application and a liquor license transfer. City Attorney Tim Tomlinson pointed out similarities in the operational processes, underscoring the necessity for compliance with legal requirements. He also commented on the ongoing consolidation trend within the industry, noting the larger scale of operations of companies like Stash Ventures LLC and their adherence to legal standards.

Nonetheless, Dittrich called for increased oversight, citing the relative novelty of marijuana licenses compared to liquor licenses. Mayor Tom Semaan and Tomlinson addressed the procedural aspects, suggesting possible amendments to the current ordinance for future transfers.

The approval of the application was motioned by council member David Duffy and supported by Mel Eason, while Harvey and Dittrich opposed. Mayor Pro-Tem Flo Hayman was not present for the vote.

Bear Lake Village on the Verge of Embracing Cannabis Industry

Bear Lake Village, located in Michigan, is actively exploring the possibility of welcoming cannabis businesses into its community. The village's President, Shelly Lynnes, is spearheading efforts to potentially revise local ordinances to permit marijuana sales or transportation operations.

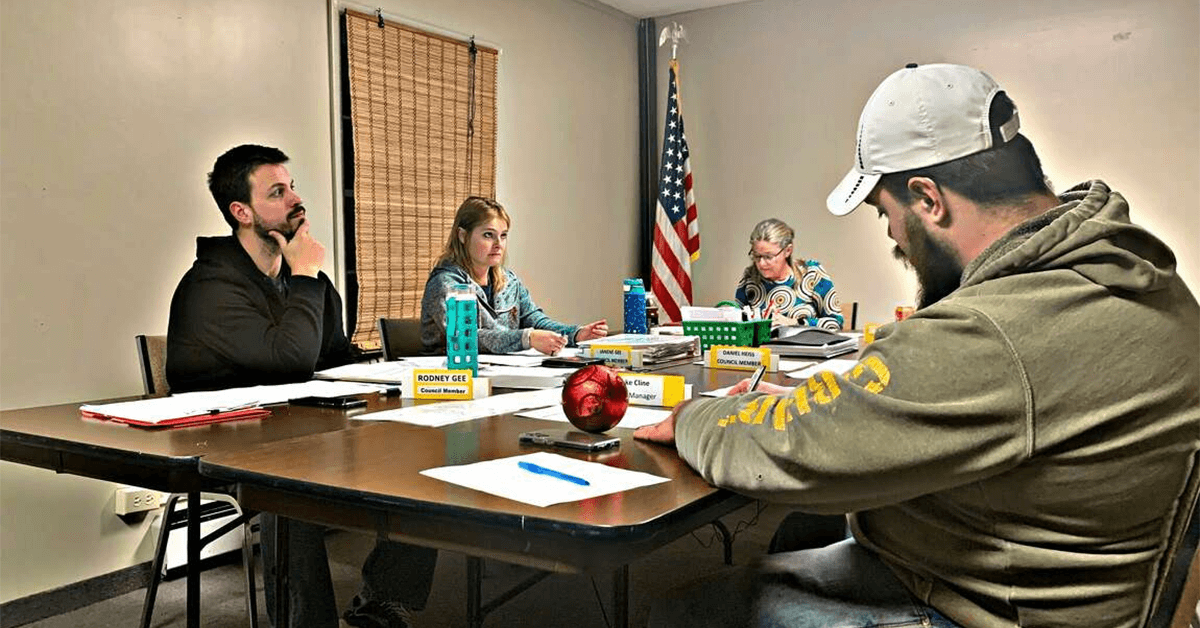

During a council meeting on January 25th, 2024, the council members unanimously agreed to authorize Lynnes to consult with Rob Carson, the Regional Director of Community Development at Networks Northwest, or other relevant experts. This decision marks a significant step towards drafting an ordinance that could pave the way for cannabis businesses in Bear Lake Village.

Lynnes, recognizing the potential benefits of such businesses, noted that Bear Lake already has suitable buildings for this purpose. She highlighted that legalizing cannabis has not led to increased crime or negative impacts on communities. Instead, Lynnes pointed out that it has spurred growth in neighboring towns.

The council's meeting also included input from Trever Johnson of Authentic 231, a cannabis business based in Manistee. Johnson emphasized the economic benefits that a retail cannabis location could bring to the village, such as increased spending and community engagement, especially during local events like lake and music days.

Lynnes also reflected on the evolving public perception of recreational marijuana sales. She cited the growth and positive impacts observed in nearby counties, such as Benzie, Manistee, and Grand Traverse, that have allowed cannabis establishments.

Johnson discussed financial benefits from the Michigan Regulation and Taxation of Marihuana Act. Counties and municipalities hosting marijuana businesses receive annual funds from the state's excise tax on cannabis. For instance, in Fiscal Year 2022, Manistee City received over $259,000, Marilla Township got about $51,800, and Manistee County received approximately $311,000 for their respective licensees. These funds also contribute to the state's school aid and transportation funds, supporting education and infrastructure.

Furthermore, Johnson suggested that Bear Lake Village could explore cannabis transportation operations if a retail outlet isn't feasible. In Michigan, cannabis growers and processors are required to use third-party transport services, licensed through the Cannabis Regulatory Agency, to move their products securely.

This potential shift in Bear Lake Village's stance on cannabis businesses signifies a broader trend of communities reevaluating the role of cannabis in economic development and societal progress.

Michigan Woman Sues Cannabis Firm Over Wrongful Termination and Medical Leave Dispute

In a significant legal confrontation within Michigan's legal system, a lawsuit has been filed against the cannabis conglomerate TerrAscend Corp. by a woman alleging wrongful termination following her requests for medical leave accommodations. The case, which was initiated in a federal court in Michigan, highlights complex issues surrounding workplace accommodations and disability rights.

Lawsuit Claims Against TerrAscend Corp. Emerge Amid Health Concerns

Kristina Emiry, the plaintiff in this case, has brought forward a lawsuit claiming wrongful termination by TerrAscend Corp., a prominent figure in the cannabis industry. Emiry alleges that her dismissal came after she sought accommodations for a chronic medical condition. According to the lawsuit, Emiry was employed by a company that was subsequently acquired by TerrAscend Corp. Around the same time, she began to experience a chronic health condition that significantly impacted her work life.

Allegations of Workplace Retaliation and Discrimination

The lawsuit details Emiry's attempts to navigate her medical condition while maintaining her employment. She claims to have requested a protected medical leave under the Family and Medical Leave Act (FMLA), which was initially approved until mid-August of the following year. Despite this approval, Emiry alleges she received emails from her manager, Luke Espinoza, which threatened her employment and created a hostile work environment.

Emiry's efforts to seek clarity on her job responsibilities and her preference for written communication due to her condition were reportedly met with silence. Her termination, allegedly for attendance issues, came abruptly, raising questions about the company's adherence to federal and state laws regarding employee rights and accommodations.

Legal Arguments and TerrAscend's Silence

The lawsuit against TerrAscend Corp. raises several legal issues, including alleged interference with FMLA rights, retaliation, and violations of Michigan's Persons with Disabilities Civil Rights Act of 1976, as well as the Fair Labor Standards Act. Emiry's legal representation, led by Noah Hurwitz of Hurwitz Law PLLC, argues that the case exemplifies a broader issue of employers failing to engage in an interactive process to accommodate medical conditions as required by law.

TerrAscend Corp. has not publicly responded to the allegations, and efforts to reach the company for comment have been unsuccessful. The silence from TerrAscend Corp. adds an element of anticipation as the legal proceedings unfold.

The Broader Implications of the Lawsuit

This legal battle is not just about one individual's allegations of wrongful termination; it underscores the critical importance of understanding and respecting employees' rights to medical leave and accommodations. It also highlights the potential legal consequences for companies that fail to comply with federal and state laws designed to protect workers with disabilities.

The case, filed as Emiry v. TerrAscend Corp., is being closely watched for its implications on employment law, particularly in the evolving cannabis industry in Michigan and beyond. As the proceedings advance, they promise to shed light on the challenges and responsibilities of employers in accommodating employees with health conditions.

Helpful Links

Helpful Links