New Partnership Aims to Streamline Cannabis Delivery in Southwest Michigan

In a recent move within Michigan's cannabis industry, LeafLink and Cannadelivery have partnered to enhance cannabis delivery services in Southwest Michigan. The collaboration seeks to make the delivery process more efficient, ensure compliance with regulatory requirements, and improve the overall customer experience. LeafLink's logistics technology combined with Cannadelivery's local market knowledge aims to create a more reliable and streamlined service for both cannabis businesses and consumers in the region.

Boosting Delivery Efficiency

This partnership aims to improve the efficiency of cannabis deliveries for businesses in Southwest Michigan. LeafLink, known for its B2B platform, brings sophisticated logistics solutions that streamline order fulfillment. Key features include real-time tracking, route optimization, and automated compliance checks, all of which contribute to smoother, faster, and legally compliant deliveries.

Cannadelivery, with its deep understanding of local market dynamics, complements these technological tools by offering expertise in customer service and local operations. The integration of LeafLink's platform with Cannadelivery's local presence aims to reduce delivery times and increase service reliability, offering tangible benefits to both businesses and end consumers.

This partnership also addresses persistent operational challenges for cannabis businesses, such as inventory management and order tracking. Through LeafLink's platform, businesses gain access to data analytics and reporting features, enabling more informed decision-making and better service management. These tools help cannabis companies enhance their operations, ensuring more reliable deliveries and higher customer satisfaction.

Enhancing the Customer Experience

A key focus of this partnership is the improvement of the consumer experience in Southwest Michigan's cannabis delivery market. By offering features such as real-time order tracking and flexible delivery options, the collaboration seeks to provide a more convenient and reliable service. This added transparency can increase consumer confidence in the delivery process and promote customer loyalty.

Cannadelivery's local expertise plays a central role in shaping the customer experience, allowing the service to cater to the specific needs and preferences of the Southwest Michigan market. By combining this local understanding with LeafLink's advanced logistics, the partnership aims to create a more responsive and user-friendly delivery service. For consumers, this means faster, more reliable deliveries and a better overall shopping experience.

Ensuring Regulatory Compliance and Safety

Compliance remains a critical concern in the cannabis industry, and the LeafLink-Cannadelivery partnership places a strong emphasis on meeting Michigan's regulatory standards. LeafLink's platform offers automated compliance features that help ensure deliveries are conducted within the bounds of state law. These features include verifying customer age, tracking product movement, and maintaining detailed records for legal audits.

Additionally, Cannadelivery's knowledge of local regulations and enforcement practices further strengthens compliance efforts. The partnership aims to meet both state and local delivery requirements, using secure transportation methods and providing compliance training for delivery personnel. Safety protocols such as tamper-evident packaging and secure delivery processes are also in place to protect both the integrity of the products and the security of the delivery teams.

By focusing on compliance and safety, the partnership sets a high standard for cannabis delivery operations in Southwest Michigan, seeking to ensure that all deliveries are legal, secure, and efficient.

Saginaw's Newest Dispensary, Bloom & Blaze, Shines with Women at the Helm

A new recreational cannabis dispensary, Bloom & Blaze, has opened its doors in Saginaw, aiming to offer an enhanced customer experience. Located at 1724 E. Genesee Ave., the dispensary is co-owned by local entrepreneurs Laquanda Hoskins and Letisha Randle, who are expanding their business ventures in the region.

In addition to their work with Bloom & Blaze, Hoskins and Randle manage two other businesses, PRH Group and I Heart Mac and Cheese, also based in Saginaw. Randle emphasized that their businesses are rooted in community improvement, noting, "We strive to find things that help our community because we definitely have strong ties in the Saginaw area."

Bloom & Blaze's storefront features a modern design with a welcoming atmosphere. Upon arrival, customers are greeted by staff who guide them through a personalized shopping experience with the help of knowledgeable budtenders. The dispensary places a strong emphasis on educating both its employees and customers, ensuring that individuals receive comprehensive information about the products and their potential benefits.

The owners have put significant thought into the dispensary's aesthetic and community presence. According to Randle, "We really wanted to provide something different from what we've seen out there as far as cannabis dispensaries," highlighting their focus on education, engagement, and community beautification.

One of the goals of Bloom & Blaze is to address misconceptions surrounding cannabis use. Hoskins remarked that they aim to educate customers not only about recreational uses but also potential health benefits, such as pain relief. They also highlight how cannabis may assist with specific health issues, including menstrual discomfort.

Inside the dispensary, customers can find a wide array of cannabis products, including flower, edibles, concentrates, pre-rolls, topicals, and unique items like cannabis-infused cereal. Hoskins and Randle are committed to providing a diverse selection, catering to both new and experienced consumers.

By establishing Bloom & Blaze, Hoskins and Randle continue to contribute to Saginaw's business landscape. Their efforts are driven by a desire to create value for the community and combat negative stereotypes surrounding cannabis.

Chris Webber's $175 Million Cannabis Venture Faces Market Challenges, Plans Revised

Chris Webber's $175 million cannabis venture, Players Only, has faced significant challenges since its initial announcement in 2021. Planned for southwest Detroit, the ambitious project aimed to establish a state-of-the-art facility that would include a cannabis cultivation center, consumption lounge, dispensary, and a job training complex focused on helping communities disproportionately affected by cannabis-related legal issues. However, nearly two years later, the project remains incomplete.

One of the key obstacles has been the sharp decline in cannabis prices in Michigan, which have dropped by around 56% since construction began. This price crash forced Webber and his partners to rethink their approach, recognizing that their original plans would no longer be financially viable under current market conditions. As Webber noted, "The cannabis industry has really shifted in Michigan," leading them to reassess their goals and scale down the project to avoid potential financial losses.

Despite the setbacks, Webber remains committed to the venture, emphasizing that his team is working on a revised plan that will still benefit the local community while adapting to the new economic realities. Webber also aims to secure the necessary licenses to open a dispensary in Detroit, which remains a core component of the project's vision. Additionally, he continues to push forward with his broader mission to foster equity in the cannabis industry, including initiatives that support minority-owned cannabis businesses through a $100 million equity fund.

Michigan Cannabis Market Breaks Records with $295 Million in August Sales

Michigan's cannabis market experienced unprecedented growth in August 2024, reaching record sales of $295.4 million. This milestone signifies the state's position as a leading player in the national cannabis industry, driven by a combination of factors such as regulatory support, market expansion, and a resilient consumer base.

Regulatory Framework and Market Expansion

Michigan's regulatory framework has been instrumental in creating a mature and competitive cannabis market. The state's Cannabis Regulatory Agency (CRA) has implemented policies that encourage business growth and consumer safety. A streamlined licensing and permitting process has enabled businesses to meet the rising demand efficiently, fostering a market environment conducive to both competition and innovation.

The continued expansion of dispensaries across the state has also played a crucial role in driving sales. With 8.7 dispensaries per 100,000 people, Michigan far surpasses California's 3.2 dispensaries per 100,000, making it more convenient for consumers to access legal cannabis. This ease of access has been further bolstered by the diversity of product offerings, including flower, concentrates, vape cartridges, and edibles, catering to a wide range of consumer preferences.

Market Resilience Amid Regional Changes

Despite the launch of recreational cannabis sales in neighboring Ohio on August 6th, 2024, Michigan's market showed remarkable resilience. Rather than experiencing a decline, Michigan's sales continued to soar, demonstrating the strength of its established market. Factors contributing to this resilience include Michigan's loyal customer base, well-established market presence, and a diverse product range. Additionally, the state's relatively lower 16% tax on cannabis sales compared to California's 35%-45% has made legal cannabis more affordable, drawing more consumers into Michigan's market.

Sales Breakdown and Pricing Trends

August's record sales marked the third consecutive month of growth, with a 2.7% increase over July's $287.7 million in sales. Adult-use sales dominated the market, accounting for over $294.1 million, while medical cannabis sales made up less than 1% at $1.3 million. Year-over-year, August 2024 saw a nearly 7% increase in sales compared to August 2023, when total sales were $276.3 million.

One notable trend in the market is the declining price of cannabis flower. In August, the average price per ounce for adult-use flower was $80.14, nearing a record low. This decline in price is partly due to the increasing supply, with Michigan dispensaries selling a monthly record of 100,894 pounds of flower in August. The average price per pound stood at $1,282, a slight 0.6% increase from July but a 15% decrease from August 2023. With the outdoor harvest season approaching in October, prices may decrease further, potentially fueling additional sales growth.

Sales Composition and Consumer Preferences

Flower remains the dominant product category in Michigan's cannabis market, accounting for 44% of retail revenue in August. Concentrates, vape cartridges, and infused edibles followed, making up 19.6%, 18.5%, and 9% of sales, respectively. This diverse product landscape caters to varying consumer preferences, contributing to the market's sustained growth.

Projections and National Comparisons

Michigan's cannabis market is on track to surpass $3.32 billion in total sales for 2024, an 8.6% increase from the $3.06 billion recorded in 2023. The state is also projected to sell nearly 1.1 million pounds of adult-use flower by the year's end, representing a 12.8% increase from 2023. These projections highlight Michigan's rapid growth and position it as a formidable competitor to larger markets like California.

California, with nearly four times Michigan's population, is expected to finish 2024 with $4.75 billion in total cannabis sales. However, California's market has faced its third consecutive year of decline due to limited access to licensed dispensaries, high taxation, and complex regulations. In contrast, Michigan's more accessible market and lower tax rates have driven per capita sales to roughly $330 per year, compared to California's $120.

Conclusion

August 2024 marks a significant milestone for Michigan's cannabis industry, with record sales reflecting the state's thriving market. Michigan's success can be attributed to its robust regulatory framework, expanding market presence, consumer trust, and competitive pricing. As the state continues to innovate and expand, its cannabis market is poised for further growth, setting an example for other states in the evolving landscape of the cannabis industry.

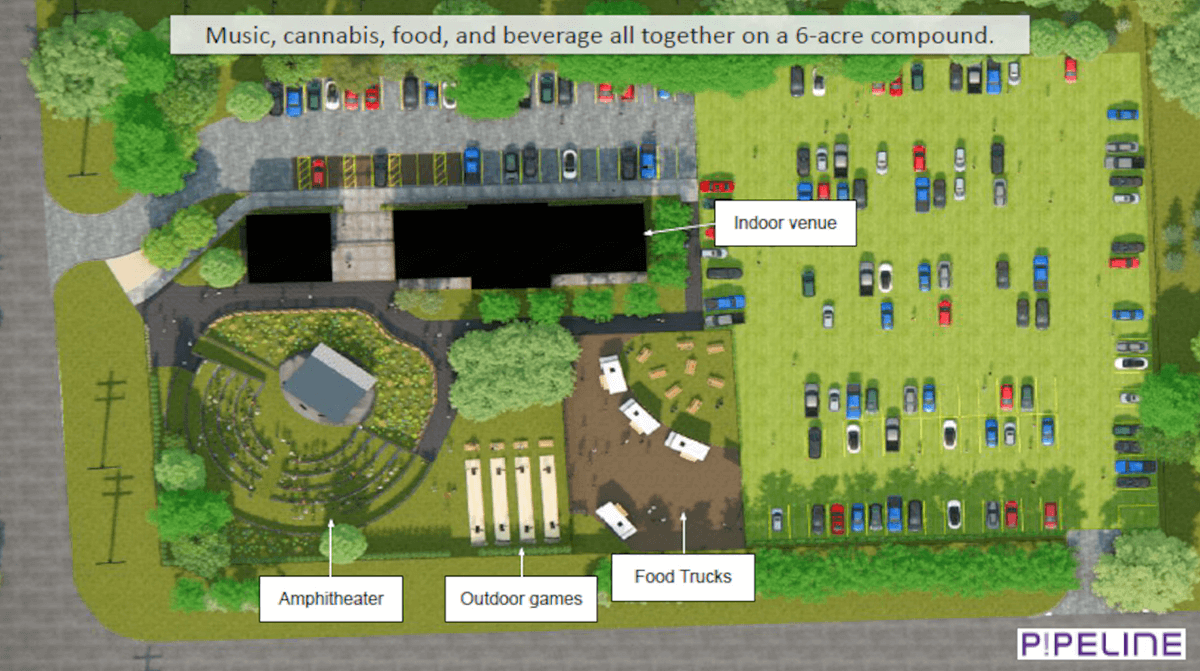

Michigan's First Music and Cannabis Lounge Could Open Near Ypsilanti

A developer has proposed what could become Michigan's first combined music venue and cannabis-consumption lounge near Ypsilanti. The project, preliminarily approved by the Ypsilanti Township Planning Commission on August 27th, involves transforming 3.87 acres at 2525 S. State St. into a unique space that integrates live music and cannabis use.

The plan includes a 4,300-square-foot indoor lounge, an outdoor amphitheater, and a 1,260-square-foot storage building. Michael Ludtke, the landowner and applicant, who is also developing a nearby dispensary, has named the venue "Pipeline" as a nod to the underground cannabis market, often referred to as the "black market."

Ludtke, who has long envisioned blending music with cannabis in a permanent setting, emphasized the lack of spaces where cannabis consumers can enjoy the substance in a social, experiential environment. "As a cannabis consumer, we really don't have anywhere to enjoy cannabis with any type of experience," Ludtke stated.

According to Ludtke, this venue would be the first in the state to offer both indoor and outdoor cannabis consumption. The indoor facility would host events year-round and welcome a broad range of music genres. Ludtke mentioned that Detroit's rap scene, classic hippie-style bands reminiscent of the Woodstock era, electronica, and DJ performances are among the potential genres that could be featured, all within a cannabis-friendly environment.

The outdoor amphitheater will include spaces for food trucks and will be enclosed by a non-visibility fence to comply with state regulations. The venue plans to operate three days a week, accessible to anyone aged 21 or older for a $25 entry fee, or for free with a $50 purchase at the adjoining dispensary. Planned operating hours range from noon to 10 p.m. or 5 to 10 p.m., depending on the day, with one day each week reserved for private events such as weddings or parties.

Pipeline will be situated just south of where Ludtke is establishing Frost Cannabis, a dispensary and cultivation facility at 1250 Watson Ave. Although these projects are distinct, both developments are on Ludtke's six-acre property, which was divided into two parcels in April 2023 to comply with state requirements for separate parcels.

Security at the venue will be stringent, with indoor and outdoor areas under continuous video surveillance. Footage will be stored for 60 days, with access provided to law enforcement as required by state law. Additionally, Ludtke mentioned that a noise study has been conducted, and adjustments have been made to minimize noise impact on the nearby West Willow Neighborhood.

Ludtke also commented on the broader concept of cannabis consumption lounges, describing them as a "hollow idea" if they only offer a space to consume cannabis without additional experiences. He believes that combining cannabis use with music and social activities will create a more appealing environment.

In Michigan, only three cannabis consumption lounges currently operate, the most recent of which opened in February in Kalamazoo. For the Pipeline project to proceed, developers must finalize an agreement with the township board, addressing conditions such as the number of large events, temporary parking needs, security measures, portable toilets, capacity, hours of operation, lighting, and waste management.

Lume Cannabis Employees in Escanaba Vote to Unionize

Employees at Lume Cannabis in Escanaba are on the verge of making history by forming the first unionized cannabis workforce in Michigan's Upper Peninsula. The group, known internally as "luminaries," recently took significant steps toward unionizing, signaling a new chapter in the labor movement within the region's cannabis industry.

The decision to unionize was driven by the workers themselves, as noted by Marie Werth, secretary-treasurer of UFCW Local 1473. "They were encountering issues within their company," Werth explained. "They wanted to ensure their voices were heard. Organizing into a union was the path they chose to achieve that."

Currently, there are 290 cannabis dispensaries across the country affiliated with the United Food and Commercial Workers International Union (UFCW). If successful, Lume's Escanaba location would be the first in the Upper Peninsula to join their ranks.

The unionization process is being guided by UFCW Local 1473, with President Jake Bailey outlining the crucial steps involved. "You never file for an election until you've reached out to everyone eligible in the unit and secured support from at least 70% of them through authorization cards," Bailey said. "That support is essential before moving forward with a petition to the National Labor Relations Board."

On July 23rd, 14 out of the 18 budtenders at Lume Escanaba voted in favor of unionizing, surpassing the required threshold with a 78% approval rate.

In response, Lume Cannabis Co-President and COO Doug Hellyar expressed the company's commitment to its employees. "At Lume, we value and respect our amazing employees," Hellyar stated. He highlighted the company's efforts to provide industry-leading wages, benefits, and professional growth opportunities. According to Hellyar, over 500 Lume employees have been promoted internally, reflecting the company's focus on developing talent from within.

Hellyar also pointed to Lume's contributions to the Upper Peninsula, including donations of $25,000 to the Marshfield Medical Center-Dickinson Cancer Center in Iron Mountain and $17,000 to the Walton Blesch Stadium Legacy Foundation for infrastructure improvements at a historic high school field in Menominee.

For the Lume Escanaba luminaries, the primary motivations behind their unionization effort are wages, benefits, and guaranteed working hours. With the initial vote completed, negotiation meetings for the collective bargaining agreement are expected to commence in the coming months.

Helpful Links

Helpful Links