Comprehensive Overview of CRA's June 2024 Disciplinary Actions

The Cannabis Regulatory Agency (CRA) has published its June 2024 Disciplinary Action Report, detailing administrative formal complaints and disciplinary actions taken against various adult-use and medical cannabis licensees. This report highlights the CRA's ongoing efforts to ensure compliance with state regulations and maintain the integrity of Michigan's cannabis industry.

The disciplinary actions this month involve a range of issues, from METRC non-compliance to failures in reporting material changes and security deficiencies. The following is a summary of the actions taken:

Harrison Township:

- SSQ Industries, LLC dba Tango Jack (License: GR-C-000695, AU-G-C-000559) was cited for failing to report material changes related to their physical location and operations.

River Rouge:

- RR Process, LLC (License: PR-000253) faced action for failure to report material changes in physical location and operations.

- RR Process, LLC (License: AU-P-000267) was also cited for AFS non-compliance.

- Royal Highness, LLC dba Herbology Cannabis Co. (License: AU-R-000126) received a citation for METRC non-compliance.

Jackson:

- MLKJ Ventures, LLC dba Mood Cannabis (License: AU-R-000410, PC-000562) was penalized for failing to report material changes, along with surveillance and security violations.

Madison Heights:

- GS Ashley, LLC dba Holistic Industries (License: AU-G-C-000604) faced penalties for METRC non-compliance and issues related to sampling and testing.

Detroit:

- 13775 Buena Vista LLC dba Empire Brands (License: GR-C-000022, AU-G-C-000977) received citations for general operational issues, METRC non-compliance, and non-compliant transfers between cannabis businesses.

Hanover:

- K Farm Organics, LLC (License: GR-A-000148, AU-G-C-001315) was cited for surveillance and security deficiencies.

Wayne:

- Wayne Wellness, Inc dba Wayne Releaf (License: AU-R-000291, PC-000449) was penalized for failing to report material changes related to physical location and operations.

Bangor:

- Dragonfly Kitchen II, Inc (License: AU-P-000131) faced issues with packaging and advertising compliance.

Warren:

- Oasis Wellness Center of Lansing, LLC (License: AU-G-C-000968) was cited for failing to report material changes and METRC non-compliance.

- Kassab Investments, LLC dba Packwoods Distribution (License: PR-000161) received a citation for METRC non-compliance.

- PDS Ventures, LLC (License: AU-P-000288, AU-G-C-001029) faced penalties for AFS non-compliance.

Caro:

- Emerald Thumb, LLC dba Wellbudds (License: AU-G-B-000204, GR-A-000175) was cited for AFS non-compliance.

Au Gres:

- Pure Green, LLC dba Glorious Cannabis Company (License: GR-C-000181, GR-C-000193, GR-C-000204, GR-C-000256, GR-C-000292, GR-C-000294, PR-000077) faced AFS non-compliance citations.

- Hello Farms Licensing MI, LLC (License: GR-C-000519, GR-C-000514, GR-C-000521, GR-C-000520) was penalized for failing to report material changes in their legal entity.

Lapeer:

- Atwater Management, LLC dba Culture Complex (License: PR-000212, AU-P-000262) received citations for failing to report material changes in their legal entity.

Constantine:

- Constantine Products, LLC dba The Dude Abides Provisioning Center (License: PC-000560) faced multiple citations including METRC non-compliance, non-compliant waste disposal, and surveillance/security issues.

Linwood:

- Uncle Buds Provisioning Center, LLC (License: PC-000150) was penalized for METRC non-compliance.

Tekonsha:

- Old 27 Buds Etc., LLC (License: GR-C-000863, GR-C-000829) received citations for METRC non-compliance.

Chesaning:

- CLC 94, LLC (License: GR-C-000816) was cited for METRC non-compliance.

Muskegon:

- Root Weaver, LLC (License: GR-C-000541) received multiple citations for METRC non-compliance.

Jackson, Bay City, Muskegon, Big Rapids, Lowell:

- Windsor Township OG, LLC (License: GR-C-000296, GR-C-000298, GR-C-000299, GR-C-000301, PR-000080, PC-000515, PC-000573, PC-000627) faced AFS non-compliance citations.

- Windsor Township OG, LLC (License: AU-G-C-000124, AU-G-C-000125, AU-G-C-000126, AU-P-000110, AU-R-000315, AU-R-000372, AU-R-000442, AU-R-000544) was also penalized for AFS non-compliance.

Ferndale:

- Cafiero Family Ventures, LLC dba King of Budz Ferndale (License: AU-R-000990) received citations for general operational issues.

Saginaw:

- Makana Fields, LLC dba Primo Provisioning - Saginaw (License: AU-R-000972) was cited for METRC non-compliance.

Traverse City:

- Leoni Wellness, LLC dba Puff TC (License: AU-R-000952) faced penalties for non-compliant sales.

Lansing:

- Gram Slam Holdings, LLC (License: AU-R-000658) received citations for non-compliant sales.

Center Line:

- BRT Capital 1, LLC dba Joyology of Center Line (License: AU-R-000421) faced multiple citations for non-compliant sales, packaging and advertising issues, and surveillance/security violations.

Paw Paw:

- Great Lakes Holistics, LLC (License: AU-R-000253) was cited for packaging and advertising compliance issues.

Ann Arbor:

- Pure Roots LLC (License: AU-R-000229) received penalties for non-compliant sales.

Cheboygan:

- 600 Riggs OpCo, LLC dba LaHaze Cannabis Company (License: AU-P-000367) faced issues with sampling and testing compliance.

Orion Charter Township:

- Ferndale Maize LLC (License: AU-P-000253) received citations for general operational issues, METRC non-compliance, and non-compliant sales.

Marshall:

- EPS I LLC (License: AU-P-000143) was penalized for failing to report material changes related to their physical location and operations.

Morenci:

- 325HTD Growers, LLC dba Amber Waves Cannabis Co. (License: AU-G-C-001093, AU-G-C-000950) received multiple citations including failure to report material changes, general operational issues, METRC non-compliance, and non-compliant waste disposal.

Fennville:

- 236 Culver, LLC (License: AU-G-C-000322, AU-G-C-000281) faced penalties for METRC non-compliance.

For more detailed information on the specific disciplinary actions and to access the full report, please visit the CRA's public-facing database.

Federal Lawsuit Filed Against 305 Farms for Unpaid Employee Wages

Fourteen former employees of 305 Farms have initiated a federal lawsuit against the West Michigan cannabis company, alleging that they were not paid thousands of dollars in wages and that deductions for benefits were taken without being provided.

Robert Lusk, the attorney representing the former employees, filed the lawsuit on Tuesday in the U.S. District Court for the Western District of Michigan. He stated, "Apparently, they ran out of money and thought it was appropriate to withhold wages until they got themselves reorganized."

Jan Verleur, a partner in The Verleur Group, a Miami-based venture capital firm controlling 305 Brands, acknowledged that the company fell behind on employee payments following a "catastrophic harvest failure." This failure was reportedly due to a defective HVAC system at their cultivation facility in Lawrence, located about 30 miles west of Kalamazoo. Verleur emphasized that the company is collaborating with the Michigan Department of Labor and Economic Growth to resolve the unpaid wages issue and anticipates making the final $35,000 in payments later this month.

"Our intention is to ensure that anyone who was employed with us is compensated," Verleur stated.

The state Department of Labor and Economic Growth did not respond to requests for information regarding the case.

Lusk noted that the deadline for his clients to receive their wages had already passed.

305 Farms began operations in March 2022, with plans to become Michigan's largest single-site indoor cannabis cultivation campus, licensed to grow up to 80,000 plants. However, General Manager D.J. Howley explained that the company was misled about the HVAC system specifications, leading to significant operational issues.

According to Howley, the company spent much of the past year diagnosing and attempting to rectify the HVAC problems. Verleur reported a loss of $1.7 million in potential revenue between November and February, contributing to a significant staff reduction.

In February, the company held several meetings to inform employees about the financial difficulties. Jacqueline Morgan, a security guard, chose to stay despite the delayed payments because she believed in the company's future. "We were all given the opportunity to seek other employment or take a leave of absence. Once everything was resolved, we could return without any issues, at the same pay and benefits," Morgan said.

Verleur noted that the company's financial situation has improved in recent months. "We've been paying down debts and making corrections. We are also in the process of recapitalizing, both through equity and exploring mortgage options on the farm to support our growth trajectory," he said, highlighting the $45 million invested by shareholders. "We are here to stay."

However, Lusk criticized the company's handling of the situation. "Their approach seems to assume that one of their choices is to do something illegal, which is not paying people for the work they do. It's just not an option," Lusk asserted.

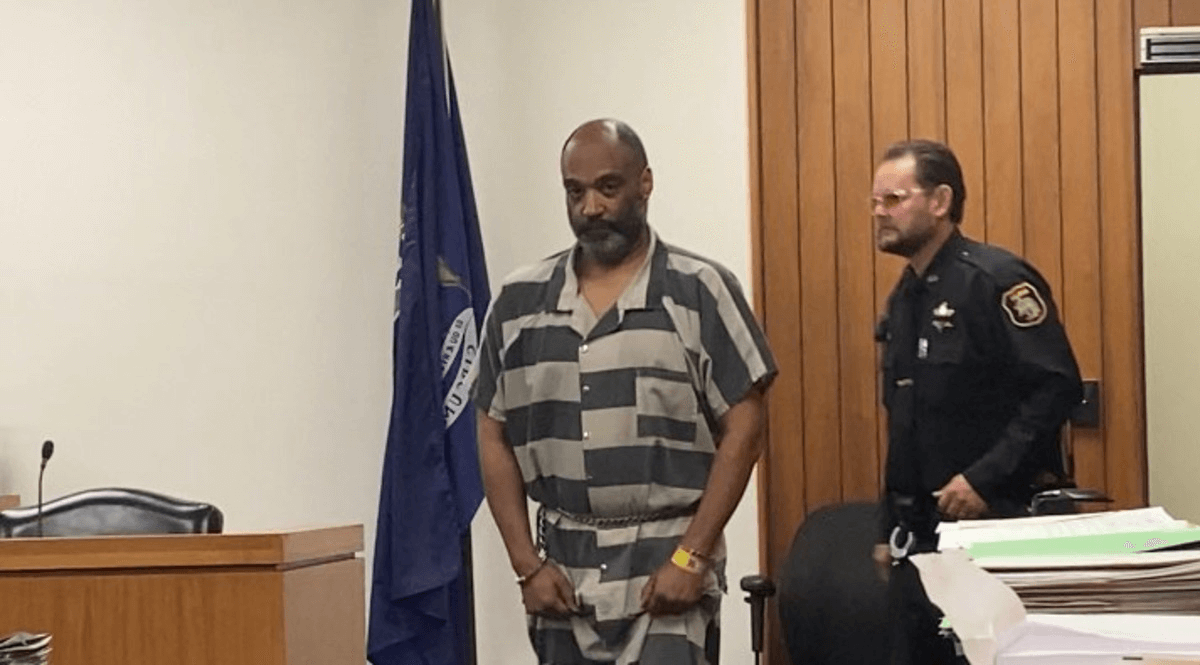

Saginaw Man Briefly Dies After Shooting at Unauthorized Cannabis Grow Site

A Saginaw man, Jerry Bryant, survived a gunshot wound to the chest at an unauthorized cannabis cultivation site but was left with a severed spinal cord. The alleged shooter, Owen M. Pipkins, his roommate and coworker, is now facing charges of attempted murder.

The preliminary hearing for 51-year-old Pipkins took place on Monday, July 1st, before Saginaw County District Judge David D. Hoffman. Saginaw County Assistant Prosecutor Melissa J. Hoover presented the case, with Hampton Township Public Safety Department Officer David Wheaton as the primary witness.

Wheaton, formerly a Saginaw Police detective, testified about responding to the incident at a commercial building at 2006 S. Niagara St. on June 10th. Pipkins had called 911, reporting that he had shot Bryant, 42.

The site housed a cannabis growing operation owned by multiple partners. Pipkins and Bryant also resided there, sleeping in two beds located on the premises.

When police arrived, they found Pipkins outside, and Bryant was transported to a local hospital. Pipkins was taken into custody and later interviewed by Wheaton at police headquarters, where he waived his Miranda rights.

According to Wheaton, Pipkins recounted that he and Bryant had prior altercations, including instances where Bryant allegedly used racial slurs and threatened him with a shovel. On the morning of June 10, Pipkins was asleep in a boat when Bryant entered, shouting and using a racial slur. Pipkins, who is Black, said Bryant, who is white, called him lazy.

In response, Pipkins fired a single shot from a handgun without seeing Bryant clearly, hitting him in the chest. Pipkins then contacted one of the owners of the cannabis operation before calling 911. While awaiting the police, Bryant told Pipkins he could not feel his legs.

Bryant had to be resuscitated at the hospital and remains bedridden, unable to move, Wheaton testified. No further witnesses were called by the prosecution.

Defense attorney Matthew M. Evans argued that there was no evidence of intent to kill. However, Judge Hoffman ruled in favor of the prosecution and moved the case to Circuit Court on charges of assault with intent to murder and felony firearm.

Pipkins has a criminal history, with four convictions in Sacramento, California. These include three from 1991 and a 2015 conviction for carrying a loaded firearm in public, for which he served 120 days in jail and three years' probation.

CRA Calls for Public Help to Combat Illegal Cannabis Transport

The Cannabis Regulatory Agency (CRA) is amplifying its efforts to maintain the integrity of Michigan's regulated cannabis market through both proactive enforcement and community engagement. Recognizing the vital role that public tips play in uncovering illegal activities, the CRA is calling on citizens to report any knowledge of "brokers" transporting cannabis with a THC percentage greater than 0.3% across or through state lines into Michigan's regulated market.

Public involvement can significantly impact the success of enforcement investigations. Even minor observations or details can provide the crucial information needed to expose unlawful activities and maintain the safety and accountability of the cannabis community. The CRA emphasizes that those who comply with the state's cannabis laws should have the opportunity to thrive without the threat of illegal competition.

The CRA invites individuals to submit tips via email to [email protected], including relevant names, phone numbers, and email addresses. Each report will be thoroughly evaluated, and the CRA may collaborate with federal and state law enforcement agencies to address the reported activities.

By working together, Michigan can ensure a fair and law-abiding cannabis industry where legitimate businesses can flourish.

Incident Highlights Need for Better ADA Compliance in Michigan Cannabis Industry

An incident involving potential discrimination against a disabled combat veteran at a provisioning center in Ann Arbor has sparked concerns about the cannabis industry's adherence to the Americans with Disabilities Act (ADA). The event, which took place on June 29th, 2024, underscores the necessity for better education and awareness among cannabis business operators regarding their legal obligations toward customers with disabilities.

A disabled veteran, whose name has been withheld due to an impending formal complaint, reported being denied entry to a provisioning center because of their service dog. According to the veteran, the situation escalated until they mentioned contacting the Cannabis Regulatory Agency (CRA), which led to a sudden change in the employees' demeanor. The veteran also reported being asked for documentation for their service animal, a request that is explicitly prohibited under the ADA.

This veteran's distressing experience is not an isolated case. Reports of similar incidents have surfaced in recent months, with at least four veterans reporting denial of entry to cannabis provisioning centers due to their service animals. Such incidents highlight a troubling pattern of non-compliance with ADA regulations, which mandate that businesses must allow individuals with service animals to enter their premises without requiring any special documentation or identification for the animals.

ADA Requirements and Industry Responsibilities

Under the ADA, businesses must accommodate individuals with disabilities and their service animals. The law is clear: service animals are not required to wear special vests, nor can businesses ask for documentation proving the animal's status. The only permissible inquiries are whether the animal is required because of a disability and what work or task the animal has been trained to perform. Failure to comply with these requirements constitutes discrimination, regardless of whether the violation stems from ignorance or deliberate action.

The incident in Ann Arbor is a reminder of the cannabis industry's duty to adhere to these laws. Licensees must ensure their staff are fully aware of and compliant with ADA requirements as a condition of maintaining their licenses. Discrimination, whether intentional or due to lack of knowledge, poses significant legal risks and can damage the reputation of the businesses involved.

Call for Enhanced Education and Industry Standards

In response to the incident, the concerned party who alerted the CRA has pledged to address this issue directly with CRA Director Brian Hanna. The aim is to ensure that the provisioning center involved, as well as the broader industry, receives proper education on ADA compliance. This proactive approach seeks to prevent future incidents and promote a more inclusive environment for all customers.

The repeated nature of these complaints highlights a need for systemic change. The CRA has been urged to issue educational reminders to all licensees, reinforcing the importance of ADA compliance and the rights of individuals with service animals. Education and awareness are crucial to prevent unnecessary legal conflicts and to foster a welcoming atmosphere for veterans and other individuals with disabilities.

Industry Reactions and Broader Implications

Reactions within the industry have been mixed. Some argue that the lack of familiarity with service animals in dispensaries could lead to misunderstandings, emphasizing the need for education rather than punitive measures. Others stress that ignorance of the law is not an excuse for non-compliance and that businesses must be held accountable for their actions.

Veterans, in particular, are a significant demographic within the cannabis community, often using cannabis for therapeutic purposes. Ensuring their rights and comfort within provisioning centers is not only a legal obligation but also a matter of respect and gratitude for their service.

Moving Forward

The cannabis industry in Michigan must prioritize ADA compliance to avoid discrimination and create an inclusive environment for all customers. This incident serves as a crucial reminder of the importance of education and the need for continuous efforts to uphold the rights of individuals with disabilities.

For further information on ADA requirements, please refer to the official ADA website.

Cannabis Dispensary Owner Receives 24-Month Prison Sentence for Tax Fraud

In a significant legal development, Ryan Richmond, a businessman from Bloomfield Hills, Michigan, has been sentenced to 24 months in prison for tax evasion, failure to file tax returns, and obstruction of an IRS audit. Richmond, the owner and operator of Relief Choices LLC, a cannabis dispensary in Warren, Michigan, was found guilty of orchestrating a scheme to conceal the true extent of his business's income through cash transactions and third-party credit card payments.

Legal Proceedings and Sentencing

U.S. District Judge Linda V. Parker for the Eastern District of Michigan handed down the prison sentence, emphasizing the severity of Richmond's financial misconduct. In addition to the prison term, Richmond was ordered to serve one year of supervised release following his incarceration and to pay $2,777,684 in restitution to the IRS.

Financial Deception Unveiled

Evidence presented during the trial revealed that Richmond directed Relief Choices to conduct significant financial transactions in cash and routed credit card payments through unrelated third-party bank accounts. These actions were intended to obscure the business's gross receipts and evade regulatory scrutiny.

Richmond's legal troubles stemmed from his deliberate failure to report Relief Choices' substantial earnings on his personal tax returns for the years 2012 through 2014. This omission deprived the IRS of significant tax revenue and highlighted the extent of his financial deception.

Obstruction of IRS Audit

The situation worsened for Richmond when he obstructed an IRS audit in 2015 and 2016. Court records indicate that Richmond misled auditors by downplaying his involvement in Relief Choices and misrepresenting the business's profits. This obstruction impeded the IRS's efforts to uncover the truth and compounded Richmond's legal issues.

Government Response and Commitment

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department's Tax Division highlighted the case's importance, reaffirming the government's commitment to prosecuting individuals involved in tax evasion schemes. This case underscores the government's stance that financial misconduct will be met with severe consequences.

Investigation and Prosecution

The investigation into Richmond's activities was led by IRS Criminal Investigation, demonstrating the agency's dedication to combating financial fraud. Trial Attorneys Mark McDonald and Christopher P. O'Donnell from the Justice Department's Tax Division prosecuted the case, showcasing the collaborative efforts of regulatory and legal bodies to ensure justice is served.

Conclusion

Ryan Richmond's sentencing serves as a powerful reminder of the severe consequences of financial deceit and tax evasion. As regulatory agencies intensify their efforts to combat financial crimes, individuals engaging in illicit schemes must be prepared to face significant repercussions. Transparency and compliance with tax laws are essential to maintaining the integrity of the financial system and protecting public trust.

Helpful Links

Helpful Links