3Fifteen Cannabis Fights for Asset Control in Skymint Acquisition Dispute

The ongoing legal saga between Michigan-based cannabis operator 3Fifteen Cannabis and Skymint, a fellow cannabis company, continues to unfold. Initially, 3Fifteen was set to be acquired by Skymint, but Skymint's financial woes complicated the process. Despite Skymint not completing payment for the acquisition, a court ruling denied 3Fifteen's request to terminate the deal and retrieve their assets.

Mitch Baruchowitz, an investor in 3Fifteen through Merida Capital, revealed that their appeal against the initial court decision has been approved. This development freezes the receivership status for four months, delaying any action until 3Fifteen's appeal is heard.

Background of the Dispute

The acquisition agreement dates back to September 2021, when Skymint agreed to acquire 3Fifteen, which operated 12 dispensaries in Michigan. This move was expected to position Skymint as a dominant player in Michigan's burgeoning adult-use cannabis market.

In April 2022, Skymint announced the closure of this deal and appointed Baruchowitz to its board. However, the situation took a turn as Skymint began struggling financially, incurring substantial debt and monthly cash burn of $3 million. Bankruptcy wasn't an option due to federal cannabis laws, leading Skymint to enter receivership.

Allegations of Misconduct and Legal Challenges

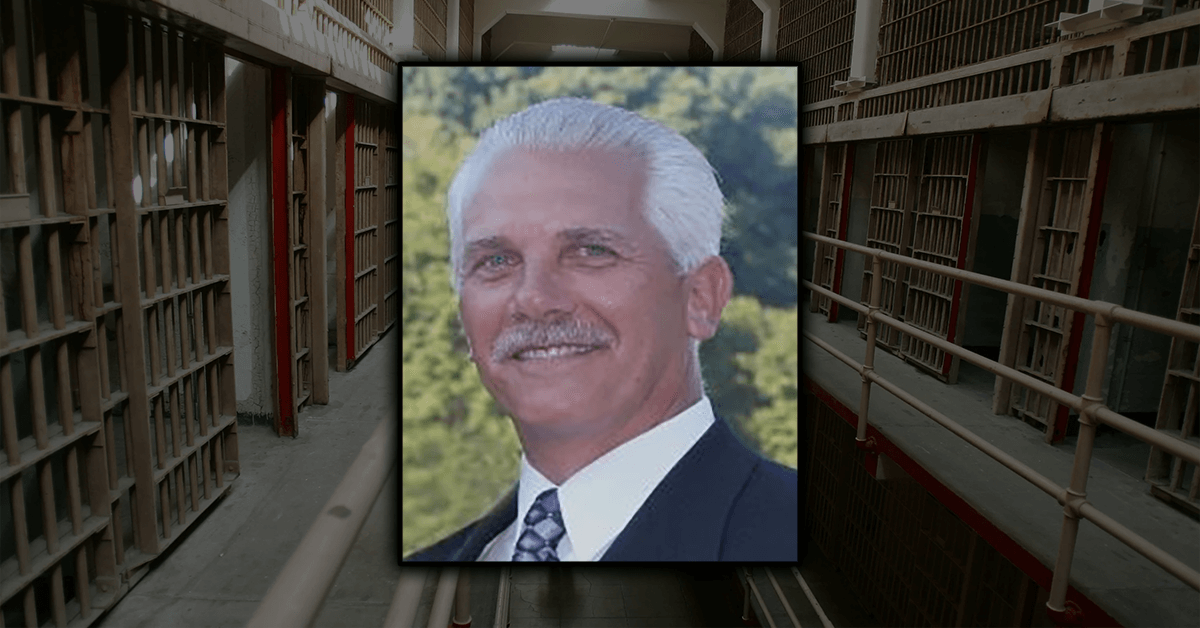

There are reported accusations against Skymint's former CEO Jeff Radway, involving misuse of company funds. These allegations were part of the reasons 3Fifteen sought to terminate the deal, though the court initially ruled against them.

Persisting with their legal fight, 3Fifteen amended their complaint and appealed. The revised complaint alleges that Skymint's lenders, SNDL and its joint venture with SAF Group, Sunstream, pressured Skymint to take over 3Fifteen's assets without full disclosure of relevant information about Sunstream's loans to Skymint.

The complaint further accuses SNDL of SEC violations, alleging non-disclosure of material details about Sunstream's governance and the joint venture agreement with SAF Group. It also highlights Skymint's financial losses under SNDL/Sunstream's guidance.

3Fifteen's Position and Future Prospects

3Fifteen argues that the acquisition should not have proceeded due to the lack of accurate information and alleges that Sunstream aims to enhance its portfolio by acquiring the assets. The appeal seeks the return of all 3Fifteen dispensaries.

Baruchowitz commented on the prolonged timeline for resolution and drew parallels between this case and another investor lawsuit, suggesting a pattern in Sunstream's business strategy.

As the legal battle continues, the future of 3Fifteen's assets and the acquisition by Skymint remains uncertain, highlighting the complexities of mergers and acquisitions in the evolving cannabis industry.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links