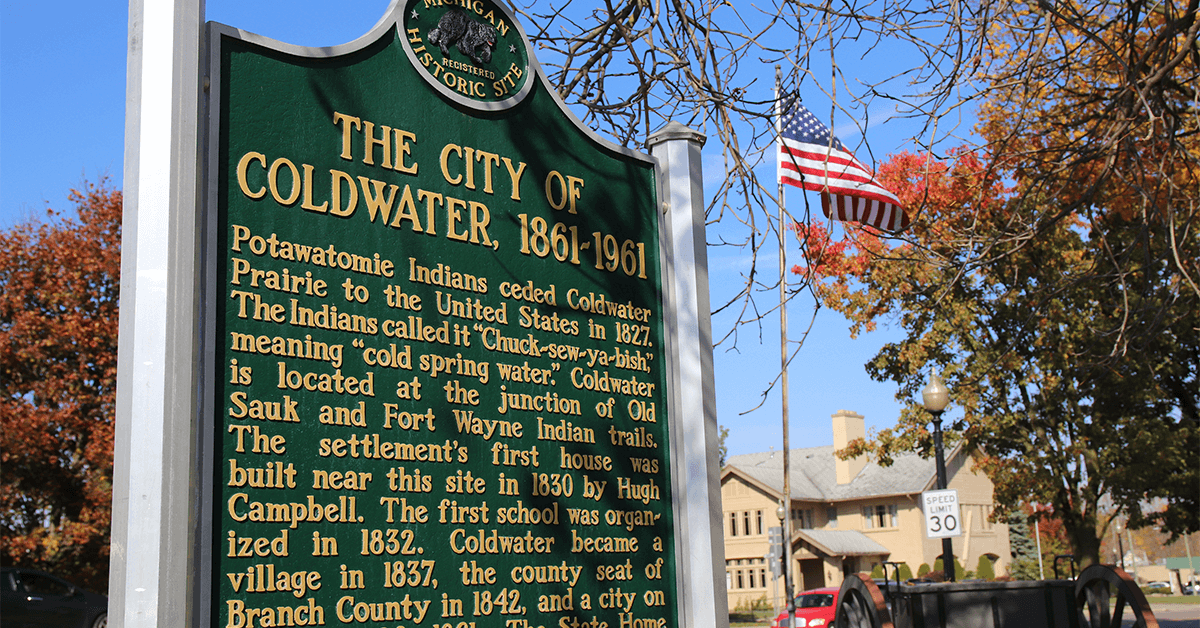

Coldwater Mayor Proposes Ban on Cannabis Grow Facilities in Industrial Zones

Coldwater Mayor Tom Kramer is advocating for the cessation of cannabis grow facilities within the city's D-2 heavy industry zones.

In August of last year, the Coldwater Planning Commission approved a motion initiated by Kramer to begin phasing out special use permits for cannabis grow operations in the industrial park. Despite this approval, no further action has been taken since.

During a Planning Commission meeting on Monday, Kramer suggested that with Amanda O'Boyle succeeding the retiring Meghan Angell as City Attorney, there is now an opportunity to advance this initiative.

Kramer acknowledged that market conditions might ultimately influence the future of these grow facilities.

Notably, retail cannabis operations in the city would remain unaffected by this proposed change.

Following further discussions, the Planning Commission members reached a consensus in support of Kramer's proposal.

City Manager Keith Baker mentioned that a draft of the proposed changes could be prepared for review at the next Planning Commission meeting.

Senator Gary Peters Proposes DOOBIE Act to Modernize Federal Hiring Practices

Senator Gary Peters, a Democrat from Michigan, has introduced a new bill aimed at preventing federal agencies from using past cannabis use as a factor in employment and security clearance decisions. The bill, known as the Dismantling Outdated Obstacles and Barriers to Individual Employment (DOOBIE) Act, represents a significant effort to modernize federal employment practices in light of evolving cannabis laws.

Senator Peters submitted the DOOBIE Act last week, marking the latest legislative push to ensure that prior cannabis consumption does not negatively impact an individual's eligibility for federal employment. This initiative reflects growing recognition of the need to align federal employment policies with the broader legalization trends seen across many states.

The DOOBIE Act specifies that federal agencies covered by the legislation "may not base a suitability determination with respect to an individual solely on the past use of marijuana by the individual." Additionally, the White House Office of Personnel Management (OPM) would be required to adopt and enforce this policy.

Furthermore, the bill stipulates that "the head of a Federal agency may not base a determination that a covered person is ineligible for a security clearance solely on the past use of marijuana by the covered person." This provision aims to prevent prior cannabis use from being a barrier to obtaining the necessary credentials for federal employment.

Under the proposed legislation, federal agencies would also be prohibited from using past cannabis use as a reason to deny a personal identity verification credential. This credential is essential for federal employees to access various facilities and information, making this an important aspect of the DOOBIE Act.

The Director of National Intelligence (DNI) would be tasked with updating regulations to align with the new cannabis policies and assist other federal agencies in implementing these changes. Notably, the DNI has previously stated that it is not the current policy of the federal government to deny security clearances based solely on past cannabis use, acknowledging that such practices can hinder recruitment efforts, especially as cannabis legalization becomes more widespread.

Senator Peters' legislation parallels a bipartisan House bill introduced last year, which aimed to provide employment protections and prevent security clearance denials for past and current cannabis use. However, an amendment in committee narrowed the scope of that bill to address only past consumption.

The DOOBIE Act is part of a broader movement to modernize federal employment and security clearance policies, ensuring they reflect contemporary attitudes towards cannabis use and support the recruitment and retention of qualified individuals in the federal workforce.

Michigan Cannabis Market Sees Slowdown in June Sales

Michigan's cannabis market saw a minor decline in June 2024, with total sales reaching $278.8 million, marking a 0.3% decrease from April. Despite the slowdown, sales increased 6.9% year-over-year, the slowest annual growth in over two years. Medical cannabis sales plummeted 78.4% year-over-year to $1.4 million, while adult-use sales rose 9.1% to $277.4 million, although they experienced a slight 0.2% sequential drop. The average price of adult-use cannabis flower continued to decline, reflecting an ongoing expansion in supply.

Detailed Analysis

-

Overall Market Performance:

- June 2024 sales: $278.8 million

- Sequential decrease from April: 0.3%

- Year-over-year increase: 6.9%

-

Medical vs. Adult-Use Sales:

- Medical sales: $1.4 million (down 78.4% YoY, 10.7% sequentially)

- Adult-use sales: $277.4 million (up 9.1% YoY, down 0.2% sequentially)

-

Pricing Trends:

- Average price for adult-use flower: $1384 per pound

- Price decline: 1.9% sequentially, 3.1% year-over-year

Growth Trajectory

- 2021: Sales increased by 82.1% to $1.79 billion

- 2022: Sales grew by 27.9% to $2.29 billion

- 2023: Sales rose by 33.3% to $3.06 billion

- 2024 (to date): Growth of 14.3%

The expansion of supply and distribution networks is expected to continue driving the market forward.

Comprehensive Overview of CRA's June 2024 Disciplinary Actions

The Cannabis Regulatory Agency (CRA) has published its June 2024 Disciplinary Action Report, detailing administrative formal complaints and disciplinary actions taken against various adult-use and medical cannabis licensees. This report highlights the CRA's ongoing efforts to ensure compliance with state regulations and maintain the integrity of Michigan's cannabis industry.

The disciplinary actions this month involve a range of issues, from METRC non-compliance to failures in reporting material changes and security deficiencies. The following is a summary of the actions taken:

Harrison Township:

- SSQ Industries, LLC dba Tango Jack (License: GR-C-000695, AU-G-C-000559) was cited for failing to report material changes related to their physical location and operations.

River Rouge:

- RR Process, LLC (License: PR-000253) faced action for failure to report material changes in physical location and operations.

- RR Process, LLC (License: AU-P-000267) was also cited for AFS non-compliance.

- Royal Highness, LLC dba Herbology Cannabis Co. (License: AU-R-000126) received a citation for METRC non-compliance.

Jackson:

- MLKJ Ventures, LLC dba Mood Cannabis (License: AU-R-000410, PC-000562) was penalized for failing to report material changes, along with surveillance and security violations.

Madison Heights:

- GS Ashley, LLC dba Holistic Industries (License: AU-G-C-000604) faced penalties for METRC non-compliance and issues related to sampling and testing.

Detroit:

- 13775 Buena Vista LLC dba Empire Brands (License: GR-C-000022, AU-G-C-000977) received citations for general operational issues, METRC non-compliance, and non-compliant transfers between cannabis businesses.

Hanover:

- K Farm Organics, LLC (License: GR-A-000148, AU-G-C-001315) was cited for surveillance and security deficiencies.

Wayne:

- Wayne Wellness, Inc dba Wayne Releaf (License: AU-R-000291, PC-000449) was penalized for failing to report material changes related to physical location and operations.

Bangor:

- Dragonfly Kitchen II, Inc (License: AU-P-000131) faced issues with packaging and advertising compliance.

Warren:

- Oasis Wellness Center of Lansing, LLC (License: AU-G-C-000968) was cited for failing to report material changes and METRC non-compliance.

- Kassab Investments, LLC dba Packwoods Distribution (License: PR-000161) received a citation for METRC non-compliance.

- PDS Ventures, LLC (License: AU-P-000288, AU-G-C-001029) faced penalties for AFS non-compliance.

Caro:

- Emerald Thumb, LLC dba Wellbudds (License: AU-G-B-000204, GR-A-000175) was cited for AFS non-compliance.

Au Gres:

- Pure Green, LLC dba Glorious Cannabis Company (License: GR-C-000181, GR-C-000193, GR-C-000204, GR-C-000256, GR-C-000292, GR-C-000294, PR-000077) faced AFS non-compliance citations.

- Hello Farms Licensing MI, LLC (License: GR-C-000519, GR-C-000514, GR-C-000521, GR-C-000520) was penalized for failing to report material changes in their legal entity.

Lapeer:

- Atwater Management, LLC dba Culture Complex (License: PR-000212, AU-P-000262) received citations for failing to report material changes in their legal entity.

Constantine:

- Constantine Products, LLC dba The Dude Abides Provisioning Center (License: PC-000560) faced multiple citations including METRC non-compliance, non-compliant waste disposal, and surveillance/security issues.

Linwood:

- Uncle Buds Provisioning Center, LLC (License: PC-000150) was penalized for METRC non-compliance.

Tekonsha:

- Old 27 Buds Etc., LLC (License: GR-C-000863, GR-C-000829) received citations for METRC non-compliance.

Chesaning:

- CLC 94, LLC (License: GR-C-000816) was cited for METRC non-compliance.

Muskegon:

- Root Weaver, LLC (License: GR-C-000541) received multiple citations for METRC non-compliance.

Jackson, Bay City, Muskegon, Big Rapids, Lowell:

- Windsor Township OG, LLC (License: GR-C-000296, GR-C-000298, GR-C-000299, GR-C-000301, PR-000080, PC-000515, PC-000573, PC-000627) faced AFS non-compliance citations.

- Windsor Township OG, LLC (License: AU-G-C-000124, AU-G-C-000125, AU-G-C-000126, AU-P-000110, AU-R-000315, AU-R-000372, AU-R-000442, AU-R-000544) was also penalized for AFS non-compliance.

Ferndale:

- Cafiero Family Ventures, LLC dba King of Budz Ferndale (License: AU-R-000990) received citations for general operational issues.

Saginaw:

- Makana Fields, LLC dba Primo Provisioning - Saginaw (License: AU-R-000972) was cited for METRC non-compliance.

Traverse City:

- Leoni Wellness, LLC dba Puff TC (License: AU-R-000952) faced penalties for non-compliant sales.

Lansing:

- Gram Slam Holdings, LLC (License: AU-R-000658) received citations for non-compliant sales.

Center Line:

- BRT Capital 1, LLC dba Joyology of Center Line (License: AU-R-000421) faced multiple citations for non-compliant sales, packaging and advertising issues, and surveillance/security violations.

Paw Paw:

- Great Lakes Holistics, LLC (License: AU-R-000253) was cited for packaging and advertising compliance issues.

Ann Arbor:

- Pure Roots LLC (License: AU-R-000229) received penalties for non-compliant sales.

Cheboygan:

- 600 Riggs OpCo, LLC dba LaHaze Cannabis Company (License: AU-P-000367) faced issues with sampling and testing compliance.

Orion Charter Township:

- Ferndale Maize LLC (License: AU-P-000253) received citations for general operational issues, METRC non-compliance, and non-compliant sales.

Marshall:

- EPS I LLC (License: AU-P-000143) was penalized for failing to report material changes related to their physical location and operations.

Morenci:

- 325HTD Growers, LLC dba Amber Waves Cannabis Co. (License: AU-G-C-001093, AU-G-C-000950) received multiple citations including failure to report material changes, general operational issues, METRC non-compliance, and non-compliant waste disposal.

Fennville:

- 236 Culver, LLC (License: AU-G-C-000322, AU-G-C-000281) faced penalties for METRC non-compliance.

For more detailed information on the specific disciplinary actions and to access the full report, please visit the CRA's public-facing database.

2Pac Tribute Collection by Death Row Records Cannabis Coming to Michigan

In a move to honor one of hip-hop's most iconic figures, Snoop Dogg's Death Row Records (DRR) Cannabis is set to launch a limited edition collection dedicated to the legendary rapper, 2Pac. This release signifies a major milestone for DRR Cannabis, which Snoop Dogg initiated in January 2023 following his acquisition of the historic label in 2022. Committed to reviving the glory of Death Row Records, Snoop Dogg's efforts encompass both music and cannabis culture, and this tribute to 2Pac encapsulates that vision.

2Pac's association with Death Row Records began in 1995, marking a transformative era for the label and hip-hop at large. Renowned not only for his musical prowess but also for his outspoken activism, 2Pac leveraged his platform to advocate for political and social change, particularly within Black America. His legacy endures through his art and advocacy, making him an enduring symbol of cultural and societal influence.

Choosing 2Pac for the inaugural artist collaboration of DRR Cannabis was a poignant decision for Snoop Dogg. Their relationship transcended professional ties, rooted in personal history and mutual respect. Snoop recalls a defining moment when 2Pac handed him his first blunt, a gesture that sparked a deep friendship. This memory was highlighted during Snoop's speech at 2Pac's Rock & Roll Hall of Fame induction in 2017.

"That first blunt sparked a friendship that ran deep," Snoop reminisces. "We'll always have his music, but this is another way I can bring what was meaningful to 2Pac to his fans."

The limited edition collection offers consumers five distinct strains: a popular crowd favorite, Alien OG, and four phenotypes named Take 1, Take 2, Take 3, and Take 4, all derived from the same parent genetics. Fans are invited to participate in selecting the best phenotype through a QR code voting system. The winning "Take" will be featured in the exclusive and permanent 2Pac collection set for release this fall.

Adding to the exclusivity of the release, each jar of flower will come with one of four collectible photographs of 2Pac, depicting him in front of a graffiti-covered Death Row Records wall. Additionally, a matchbook, precisely recreated from the photo shoot, will be included, enhancing the nostalgic value for fans.

The initial release of this collection is scheduled for Friday, July 19th, available at select dispensaries in California. Later this year, Michigan residents will also have the opportunity to purchase this unique offering through DRR Cannabis' partnership with Pleasantrees.

Michigan Leads the Way in Cannabis Concentrate Market

In the evolving cannabis industry, Michigan has established itself as a significant player, particularly in the cannabis concentrate market. This rise is marked by the presence of numerous top-performing brands, setting the state apart in a competitive landscape.

The Appeal of Concentrates

In a saturated cannabis market, consumers increasingly seek out premium products with superior quality and unique attributes. Cannabis concentrates have become a favored choice due to their high potency, refined flavors, and sophisticated packaging. According to BDSA data, the popularity of cannabis concentrates has surged, with sales rising significantly. This makes them an attractive option for companies aiming to enhance profit margins.

Key Brands in Michigan

Michigan has become a hub for several standout cannabis concentrate brands, reflecting strong growth and market performance. Brands such as Goodlyfe Farms, Galactic, and Society C have each surpassed $5 million in sales, demonstrating robust demand and customer loyalty. These brands are not only excelling in the concentrates market but are also making significant strides in other product categories.

Comparative Performance in Other States

While Michigan leads with its top-performing brands, other states also show notable activity in the cannabis concentrate market. Massachusetts, for instance, is home to successful brands like LivWell and Happy Valley, both exhibiting strong sales trends. Additionally, Sauce Essentials, which operates in Massachusetts and other states, has seen sales exceed $1 million, highlighting the cross-state appeal of premium concentrates.

Market Insights and Performance Trends

Analyzing the broader market landscape, Headset data provides insights into the performance of various brands across different states:

- Ozone: This brand has shown remarkable performance in Illinois, consistently ranking high in multiple cannabis categories. Ozone held the second position in concentrates from April to June 2024.

- Rythm: Although Rythm experienced fluctuations, it maintained a fourth-place ranking in Illinois concentrates from March to May 2024 before dropping out of the top 30 by June.

- Good Chemistry Nurseries: Demonstrating consistent growth, this brand reached over $2 million in sales by June 2024. In Massachusetts, it achieved the top spot in concentrates in June.

- Goodlyfe Farms: In Michigan, Goodlyfe Farms climbed to third place in pre-rolls by June 2024, showing notable progress from sixth in March. However, its entry into the concentrates category in May at 32nd and subsequent rise to 22nd by June indicates both potential and challenges in this market.

Emerging Players and Market Potential

Several emerging brands are making significant strides in Michigan, underscoring the state's dynamic market growth. Brands such as Distro 10, Mischief, The Limit, and Traphouse Cannabis Co. have all surpassed $1 million in sales, indicating strong market penetration and potential for future growth.

Top Cannabis Concentrate Brands by Sales and Locations

- Ozone: Illinois, Massachusetts, Maryland, Michigan, Ohio

- Rythm: Illinois, Massachusetts, Maryland, Nevada, New York, Ohio

- Good Chemistry Nurseries: Colorado, Massachusetts

- Goodlyfe Farms: Michigan

- Galactic: Massachusetts, Michigan, Missouri

- LivWell: Maryland, Michigan, New York

- Society C: Michigan

- Distro 10: Michigan

- Happy Valley: Massachusetts

- Sauce Essentials: Arizona, California, Michigan, Nevada, Ohio, Oregon

- Muha Meds: California, Michigan

- Mischief: Michigan

- The Limit: Michigan

- Traphouse Cannabis Co.: Michigan

Conclusion

Michigan's prominence in the cannabis concentrate market is evident from the success of its local brands, which continue to outperform in sales and market presence. The state's robust market environment, coupled with consumer demand for high-quality concentrates, positions Michigan as a critical player in the national cannabis industry.

Helpful Links

Helpful Links