Landlord and Cannabis Entrepreneur Head to Trial Over Lease and Zoning Conflict

A commercial landlord and a cannabis entrepreneur will head to trial over allegations of unpaid rent, following a ruling by a Michigan state judge. The dispute centers on whether a local government's decision to force the cannabis business to cease operations voids their lease agreement.

Judge Victoria A. Valentine of the Oakland County Circuit Court determined that neither Mel Belovicz, the property owner, nor Paul Weinstock, the tenant operating a combined medical marijuana grow and sign-making business, could be declared in breach of the lease without a jury's input.

The conflict involves the responsibility for the final six months of rent, totaling at least $21,000, for a property in Redford, Michigan. According to court documents, Weinstock's business, Radiant Sign Co. LLC, had leased the property from Belovicz's company, 312 Redford LLC, for the entirety of 2022. Besides making signs, Radiant Sign Co. also intended to cultivate and sell medical cannabis, a legal activity in Michigan. However, Redford Township prohibits marijuana establishments within its boundaries.

Despite this prohibition, Belovicz contends that the township had implicitly permitted cannabis cultivation in 2020, provided all necessary permits were obtained. This understanding led to the signing of a lease containing a crucial clause: if Redford Township deemed the cannabis cultivation contrary to its zoning or ordinances, the lease would become null and void, and the tenant would have to vacate the premises immediately.

In the summer of 2022, Redford officials discovered Weinstock's cannabis grow operation and ordered its cessation. Weinstock returned the property keys to Belovicz later that year. Subsequently, in February 2023, Belovicz's company sued Weinstock for breach of contract and other claims, with Weinstock countersuing on similar grounds.

The pivotal issue is whether the lease provision concerning Redford's actions obligates Weinstock to pay the last six months of rent. Both parties sought summary judgment on this matter, but Judge Valentine ruled that key facts must be determined at trial.

"Accordingly, neither party is entitled to summary disposition as to Count I — Breach of Contract," Judge Valentine stated.

However, the landlord achieved a partial victory, securing summary judgment against Weinstock's fraudulent misrepresentation claims. Weinstock alleged that Belovicz falsely claimed Redford tacitly allowed cannabis cultivation. The judge found that, at the time, this statement might have been true.

In November 2021, Redford Township explicitly reaffirmed its prohibition on medical and recreational marijuana facilities. This change indicated that the township's regulatory stance might have evolved, making it uncertain whether Belovicz's earlier statements about Redford's tacit allowance were false when made in 2020. Judge Valentine noted that Weinstock was aware of potential zoning issues and had a duty to verify the legality of his grow operation independently.

Attorneys Brian E. Etzel and William C. DiSess of Williams Williams Rattner & Plunkett PC represent Belovicz and his company. Sarah Prout Rennie of the Law Offices of Sarah Prout Rennie PLLC represents Weinstock and his business. Neither party has commented publicly on the case.

Snoop Dogg's Tour Bus Makes Surprise Stop at Michigan Cannabis Dispensary

Rap legend Snoop Dogg made an unexpected stop in New Buffalo Township over the weekend, with his tour bus spotted outside a local cannabis dispensary on Michigan 239 on Saturday.

Dani Fellows, a receptionist at The Bloomery, recounted the event, stating that the tour bus, adorned with large images of the rap icon, arrived around 10 a.m. According to Fellows, a few individuals from the bus entered the dispensary, purchased several products, and left after about 20 minutes. "The Dogg Squad, they called them, came in and bought some pre-rolls and other items," Fellows said.

Fellows mentioned she took photos of the tour bus after her shift but did not see Snoop Dogg, who possibly stayed on the bus. Despite his absence, the bus itself drew significant attention, with many people stopping to take pictures.

"I think they said he was sleeping. He had a tour that night, and it seemed like a last-minute stop, likely for security reasons," she explained.

Fellows, a 31-year-old New Buffalo native now living in Weesaw Township, expressed her excitement at seeing the tour bus, especially as a fan of the rap legend. "It was thrilling. There are so many dispensaries, but the fact that they stopped here was pretty awesome," she said.

Snoop Dogg, born Calvin Cordozar Broadus Jr., emerged in the early 1990s and quickly became a notable figure in the rap scene, collaborating with influential artists like Dr. Dre. He is also well-known for his public persona, which prominently features his affinity for cannabis consumption.

Michigan's Economic Evolution: From Autos to Cannabis

Michigan, known for its natural beauty and rich history, has experienced significant economic shifts over the decades. Surrounded by the largest freshwater lakes globally, Michigan boasts vast forests, sandy beaches, beautiful state parks, pristine inland lakes, and some of the top golf courses in the country. Often referred to as the "Winter, Water Wonderland," Michigan is a top vacation destination featuring historic sites like Mackinac Island, which USA Today recently named the "Best Travel Destination" in the United States for 2024.

After World War II, Michigan epitomized economic prosperity. The state was home to the Big Three automakers – General Motors, Ford, and Chrysler – headquartered in Detroit. The booming auto industry created a prosperous middle class, attracting talent from across the nation and the globe, as people flocked to Michigan in pursuit of the American Dream.

However, the economic landscape has dramatically changed over the years. Starting in the 1980s, General Motors began shedding jobs, and since 1990, employment in auto plants, parts factories, and corporate offices has declined by 35%, according to the Bureau of Labor Statistics. This decline also affected ancillary businesses such as restaurants, hotels, gas stations, and real estate. Edmunds reports that domestic auto sales by GM, Ford, and Stellantis (formerly Fiat Chrysler) have plummeted from nearly 70% of the market in 1999 to 37% last year. Today, more people are employed in Michigan's hospitals than in its auto assembly plants.

Several factors contributed to this decline. Auto executives underestimated foreign competitors, believing American cars would always lead in quality and appeal. Meanwhile, the Auto Workers Union demanded high wages and benefits, driving up manufacturing costs and auto prices. This led to a scenario where foreign automakers could offer better cars at lower prices, ultimately outcompeting American manufacturers.

The decline of the auto industry had devastating effects on Michigan's cities. Flint, once a bustling hub for General Motors, became a ghost town almost overnight when GM closed its operations there. The city's economy was destroyed, and Flint later gained notoriety as "The Murder City." Lansing, Michigan's capital, faced similar devastation when GM shuttered its manufacturing operations there, and other towns across the state experienced comparable fates as production moved to states with lower labor costs and fewer union restrictions.

Despite these challenges, Michigan remains under Democratic leadership, which recently repealed the state's "Right to Work" law. This legislation had allowed Michigan to attract new businesses by not requiring workers to pay union dues. Its repeal could make it more difficult for Michigan to compete for new business opportunities.

Today, Michigan's economy is recognized for a different industry: cannabis. Michigan has surpassed California as the top cannabis market in the U.S. by sales volume, with per capita sales of $132.41, tripling California's $44.21. Market sales reached over $3 billion in 2023 and are projected to hit $4 billion by 2028. However, despite this success, Michigan's cannabis companies face intense competition and struggle to stay afloat in the recreational market.

In summary, Michigan has transitioned from being a global leader in automotive manufacturing to becoming a significant player in the cannabis industry. While the state's economy has seen better days, Michigan continues to adapt and find new avenues for growth and prosperity.

Businessman Who Bribed Michigan Cannabis Board Writes Book from Prison

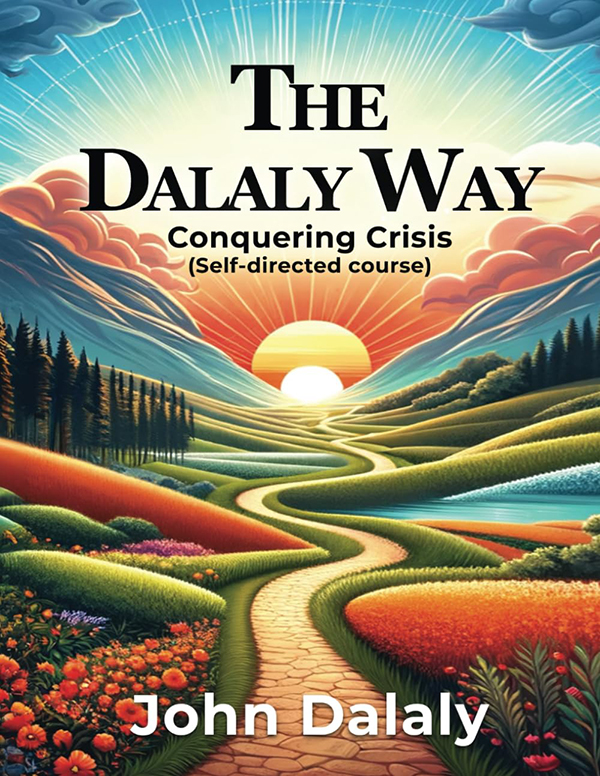

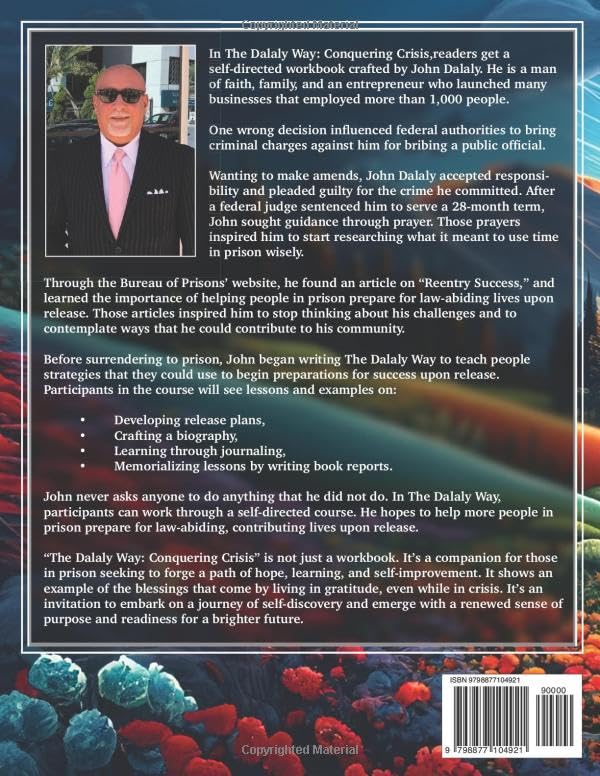

John Dalaly, an Oakland County businessman who pleaded guilty to bribing the chairman of Michigan's medical marijuana licensing board, has written a book titled "The Dalaly Way: Conquering Crisis" while serving his prison sentence.

The 194-page book, available on Amazon, aims to share Dalaly's "strategy of self-directed learning with others." It includes photos of Dalaly with current Michigan Gov. Gretchen Whitmer and former Gov. Rick Snyder, and primarily offers life advice and guidance on handling a prison term.

Dalaly briefly addresses the crime that led to his incarceration. He describes himself as an "industrialist" who entered the cannabis industry to "improve the lives of patients while creating jobs and supporting my family." He found obtaining a marijuana license to be difficult, leading him to seek assistance.

"I reached out to people I knew in the state to explore strategies for working with the licensing board," Dalaly wrote. "I thought I found my edge in a consultant connected to the government and leaped at the chance. In providing them compensation without doing my due diligence, my eagerness overcame my good sense. To my eternal shame, the compensation I provided this consultant was against the law."

Dalaly admitted to giving at least $68,200 in cash payments and other benefits to Rick Johnson, a former lobbyist and then-chairman of the licensing board, believing these expenditures would influence or reward Johnson, according to his plea agreement.

In September, a Michigan judge sentenced Dalaly to 28 months in prison. That same month, Johnson, a former Michigan House speaker, was sentenced to 55 months.

Dalaly, then 71, surrendered to a correctional facility in West Virginia on November 30.

His book states that federal prison policies permit inmates to prepare manuscripts for "private use or publication while in custody without staff approval."

"By documenting my journey through prison, I memorialize the various ways that a person can work to build mental health with a deliberate, intentional plan to prepare," Dalaly's book says.

Houghton Welcomes New Nirvana Cannabis Shop

A new cannabis shop, Nirvana, celebrated its opening in Houghton on Thursday with a ribbon-cutting ceremony. This marks the tenth Nirvana dispensary in Michigan. The Keweenaw Chamber of Commerce facilitated the event.

Nirvana Houghton's Assistant Manager, Scott Curtin, described the company as laid-back and highlighted the distinctiveness of their offerings. "You can expect a lot more from what the others carry. We have our own brands that they won't have," Curtin said.

Curtin emphasized that the store's unique appeal lies in its superior products and competitive pricing. "We stand out more just because of our loyalty to the customers that we have that come in. We offer a very wide rewards system and loyalty system, and I think that really grasps a lot of people to come in," he added.

The new shop is situated on Ridge Street near Walmart. Its operating hours are from 9 A.M. to 8 P.M. Monday through Saturday, and from noon to 6 P.M. on Sunday.

Baker College Partners with House of Dank for Cannabis Internship Program

Baker College has partnered with House of Dank (HOD), a well-known cannabis brand in Michigan, to offer cannabis-related internships in Metro Detroit. This collaboration aims to develop a skilled workforce for the cannabis industry while providing students with thorough education and training.

The private college in Oakland County is launching three specialized cannabis certificates to prepare students for careers in the marijuana industry. Each course, available fully online, takes nine weeks to complete.

"Partnering with House of Dank allows us to bridge the gap between education and employment," stated Kelley Suggs, public relations manager for Baker College. "Our goal is to ensure students not only gain valuable knowledge about the cannabis industry but also have the opportunity to apply these skills in real-world settings through internships and job opportunities."

Program Highlights

The cannabis certificate programs, developed in collaboration with Green Flower, a leader in cannabis education, cover three essential areas: Advanced Dispensary Associate Skills Training, Cannabis Manufacturing, and Cannabis Cultivation. These programs are designed to meet the growing demand for skilled workers in the expanding cannabis industry.

As part of this initiative, House of Dank will conduct open interviews and plans to hire interns from Baker College's programs, aiming to place them by Labor Day weekend, coinciding with the annual Soaring Eagle Arts, Beats & Eats festival in downtown Royal Oak, Michigan.

"House of Dank has always been about innovation and pushing our industry forward. In keeping with this tradition, we have partnered with Baker College and their new cannabis education program to create a new pipeline of careers for their students. Starting at this year's Arts, Beats & Eats festival, we will introduce the first class of their graduates and our paid interns. We're excited for all who will visit Dankland and/or Dankway this year," said Michael P. DiLaura, House of Dank chief of corporate operations.

Helpful Links

Helpful Links