Cannabis Dispensary Owner Receives 24-Month Prison Sentence for Tax Fraud

In a significant legal development, Ryan Richmond, a businessman from Bloomfield Hills, Michigan, has been sentenced to 24 months in prison for tax evasion, failure to file tax returns, and obstruction of an IRS audit. Richmond, the owner and operator of Relief Choices LLC, a cannabis dispensary in Warren, Michigan, was found guilty of orchestrating a scheme to conceal the true extent of his business's income through cash transactions and third-party credit card payments.

Legal Proceedings and Sentencing

U.S. District Judge Linda V. Parker for the Eastern District of Michigan handed down the prison sentence, emphasizing the severity of Richmond's financial misconduct. In addition to the prison term, Richmond was ordered to serve one year of supervised release following his incarceration and to pay $2,777,684 in restitution to the IRS.

Financial Deception Unveiled

Evidence presented during the trial revealed that Richmond directed Relief Choices to conduct significant financial transactions in cash and routed credit card payments through unrelated third-party bank accounts. These actions were intended to obscure the business's gross receipts and evade regulatory scrutiny.

Richmond's legal troubles stemmed from his deliberate failure to report Relief Choices' substantial earnings on his personal tax returns for the years 2012 through 2014. This omission deprived the IRS of significant tax revenue and highlighted the extent of his financial deception.

Obstruction of IRS Audit

The situation worsened for Richmond when he obstructed an IRS audit in 2015 and 2016. Court records indicate that Richmond misled auditors by downplaying his involvement in Relief Choices and misrepresenting the business's profits. This obstruction impeded the IRS's efforts to uncover the truth and compounded Richmond's legal issues.

Government Response and Commitment

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department's Tax Division highlighted the case's importance, reaffirming the government's commitment to prosecuting individuals involved in tax evasion schemes. This case underscores the government's stance that financial misconduct will be met with severe consequences.

Investigation and Prosecution

The investigation into Richmond's activities was led by IRS Criminal Investigation, demonstrating the agency's dedication to combating financial fraud. Trial Attorneys Mark McDonald and Christopher P. O'Donnell from the Justice Department's Tax Division prosecuted the case, showcasing the collaborative efforts of regulatory and legal bodies to ensure justice is served.

Conclusion

Ryan Richmond's sentencing serves as a powerful reminder of the severe consequences of financial deceit and tax evasion. As regulatory agencies intensify their efforts to combat financial crimes, individuals engaging in illicit schemes must be prepared to face significant repercussions. Transparency and compliance with tax laws are essential to maintaining the integrity of the financial system and protecting public trust.

Vlasic Classic Golf Mixer Heads to Michigan to Support Cannabis Reform

The Vlasic Classic Charity Golf mixer recently celebrated its second annual event in Missouri, hosted by Vlasic Labs. This year's 18-hole tournament saw participation from 27 teams and over 100 attendees, including advocates and legislators from Missouri and beyond. The event, held at the Old Kinderhook Golf Club in the Lake of the Ozarks, successfully raised $43,000 for the Last Prisoner Project, a nonprofit dedicated to aiding individuals imprisoned for cannabis-related offenses. These funds will support legal efforts, reentry programs, and advocacy aimed at reintegrating these individuals into society.

Following the Missouri tournament's success, Vlasic Classic has announced its next event, which will take place at St. John's Resort in Michigan from August 16-18. "As Vlasic Labs prepares for the Michigan Vlasic Classic, the company is committed to continuing its tradition of philanthropy and community support," the company stated. The upcoming event aims to build on the momentum of the Missouri outing, further supporting the Last Prisoner Project and highlighting the shared values of the Vlasic family and their partners.

Vlasic Labs, known for its hemp-based wellness products including tinctures, topicals, and gummies, was co-founded in 2019 by Rick Vlasic and his son Willy. The brand continues the Vlasic family legacy of honest branding and community involvement. The family's history of philanthropy dates back to before World War II when Joseph Vlasic revolutionized milk delivery in the Midwest. His son Robert later established the iconic Vlasic Pickles brand and donated significant funds to institutions such as the Henry Ford Health System, the Michigan Humane Society, and the University of Michigan.

Rick Vlasic has expanded the family's innovative spirit into the cannabis wellness industry, driven by the same principles of quality, consistency, and value that made Vlasic Pickles a household name. The upcoming Michigan Vlasic Classic is anticipated to further these values, combining community engagement with philanthropic efforts.

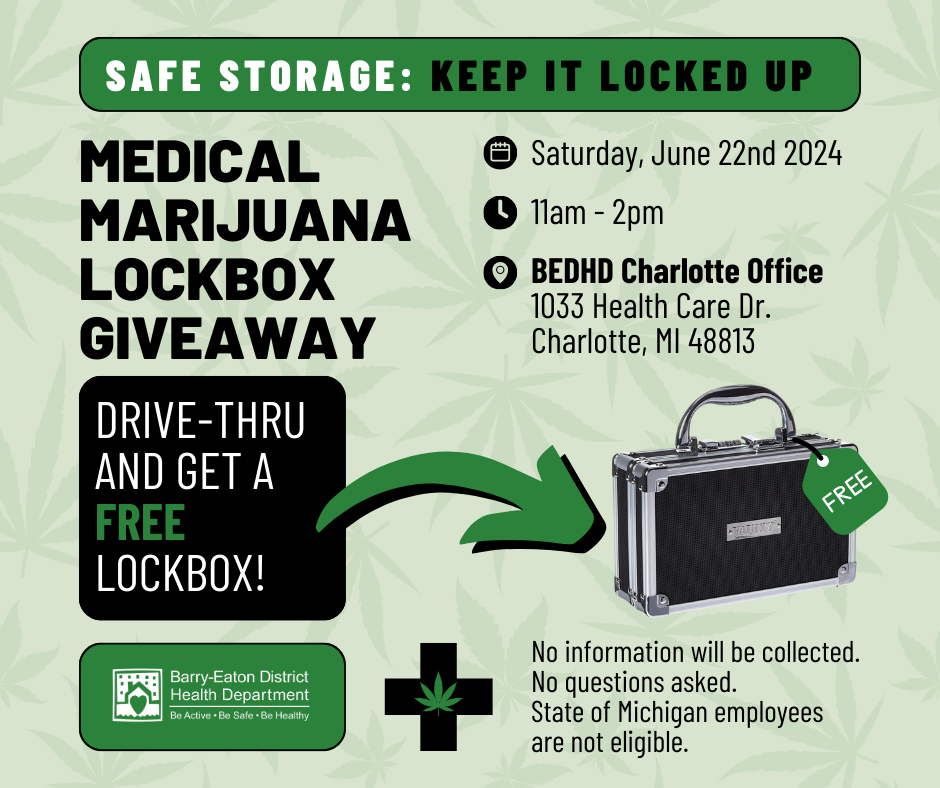

Free Cannabis Lockboxes Available for Eaton County Residents

The Barry-Eaton District Health Department (BEDHD) is set to host a drive-through cannabis lockbox giveaway on Saturday, June 22nd from 11am to 2pm. This event will take place at the main entrance of the BEDHD Charlotte Office, located at 1033 Health Care Dr. Charlotte, MI 48813. Residents of Eaton County can drive up to receive a free cannabis lockbox, with no questions asked and no personal information collected. It is important to note that State of Michigan employees are not eligible for this giveaway.

This initiative is funded through a grant from the Michigan Department of Licensing and Regulatory Affairs, Cannabis Regulatory Agency, via the Marihuana Operation and Oversight Grants for Counties for Eaton County. The Michigan Medical Marijuana Program (MMMP), which is part of the Cannabis Regulatory Agency, administers the Michigan Medical Marihuana Act passed by voters in 2008. Additionally, the Barry County Substance Abuse Task Force (BCSATF) is also a recipient of these grants for Barry County.

Even though medical and recreational cannabis are legal in Michigan, it remains crucial for community members to secure their cannabis to prevent accidental access. Lockboxes are an effective way for adults to keep cannabis products out of reach of children and pets, who are at risk of adverse health effects from accidental ingestion. A national study published in the journal Pediatrics highlighted a sharp increase in such incidents, with reported cases of accidental consumption of cannabis edibles by children under six rising from just over 200 in 2017 to 3,054 in 2021—a staggering increase of 1,375%. Utilizing cannabis lockboxes can significantly reduce these risks, ensuring community safety while supporting the medicinal use of cannabis in Eaton County.

For further information about cannabis, you can visit the BEDHD website at barryeatonhealth.org/marijuana. If you have any questions about the lockbox giveaway event or the Marihuana Operation and Oversight Grant, please contact Emily Smale using the information provided below.

Additionally, the Barry County Substance Abuse Task Force will be distributing lockboxes at another event on June 22nd, from 10am to 1pm, at the Barry County Community Mental Health parking lot located at 500 Barfield Dr. Hastings, MI 49058.

Elevated Exotics Marks Two-Year Anniversary with Expansion and Events

Elevated Exotics, a cannabis dispensary in the Upper Peninsula, is celebrating its two-year anniversary this Saturday, along with plans for further expansion.

The dispensary, which opened its first store in Republic on June 23rd, 2021, is marking the occasion with a celebration. Owner Nilsson Davis explained the significance of this milestone and the reason for the event.

"Our business continues to grow," Davis stated. "We opened a location in Escanaba last April, and we have plans for new stores in Marquette and New Buffalo."

Davis highlighted the importance of the dispensary's mission, stating, "It kind of goes back to the patients and the medical side of things. We feel that retail is the best way to reach patients and those in need of the highest quality product. We saw a significant demand here in the U.P. for top-tier cannabis."

The anniversary celebration will take place at The Delft in Escanaba, and attendees must be 21 or older. An RSVP is required due to limited space at the venue.

"We have a mass occupancy limit, and spots are filling up quickly," Davis noted. Interested individuals can reserve their spot by following the provided link.

In addition to the anniversary event, Elevated Exotics has several other upcoming activities, including its 3rd annual Summer's End Smokeout music festival from August 8th through 11th. This year, the festival will feature cultivator contests for the first time.

The Role of Cannabis Industry Donations in Supporting Michigan Nonprofits

Molly MacDonald, CEO of Southfield-based The Pink Fund, which offers financial assistance for nonmedical bills to breast cancer patients, appreciates the recent $50,000 donation from a local cannabis business, even though she's not familiar with the intricate federal regulations governing cannabis.

"We take financial donations from almost everyone," said MacDonald. Patients supported by The Pink Fund often struggle to pay rent, mortgages, utilities, and car loans due to income loss while undergoing medical treatments.

Non-cannabis companies frequently donate to nonprofits and benefit from tax deductions. However, the cannabis industry, which is legally obligated to meet social equity requirements, often donates without expecting such tax benefits. Josey Scoggin, executive director of the Great Lakes Expungement Network, highlighted that their group relies heavily on donations from cannabis businesses. She noted that 88% of their donors do not request receipts, aware that their contributions are not tax-deductible.

Cannabis companies navigate complex federal laws, which still classify cannabis sales and use as illegal. The IRS prohibits deductions beyond inventory costs for businesses involved in Schedule I or Schedule II drugs, including cannabis. This rule applies even in states where cannabis is legalized, as federal law under the Controlled Substances Act prevails.

Michigan, which legalized recreational cannabis use in 2018 and medical use in 2008, has seen its cannabis industry flourish. In May 2024, sales of recreational and medical cannabis products reached $279.6 million, a nearly 14% increase from May 2023's $245.9 million.

The U.S. Department of Justice is considering reclassifying cannabis from a Schedule I to a Schedule III drug, which would align it with substances like ketamine and anabolic steroids. This reclassification could open access to traditional banking systems and standard business-tax deductions for cannabis businesses.

Attorney James Allen explained that the Federal Controlled Substances Act currently hinders financial services for the cannabis industry, although legislation such as the SAFE Banking Act aims to change this. While the House has approved the Act, it awaits Senate approval.

Despite the federal restrictions, cannabis-related businesses manage their financial transactions through specialized institutions. The Justice Department focuses on illicit cannabis sales rather than state-approved activities, allowing some level of banking for the industry.

Cannabis business owners like Jerry Millen of The Greenhouse of Walled Lake advocate for national legalization to access standard banking services and reduce financial complexities. Millen employs a certified professional accountant specialized in cannabis and incurs high banking fees due to the intricate regulations.

Paul Tylenda, an attorney for cannabis businesses since 2019, noted that early cannabis companies in Michigan relied on specialty credit unions. As the industry grew, some regional banks began offering services, albeit at higher costs due to perceived risks.

Many cannabis companies now operate under larger holding companies that manage non-cannabis activities, allowing them to utilize standard business deductions, including for charitable donations.

Michigan's cannabis industry is awaiting the potential reclassification to Schedule III, which would integrate cannabis businesses into the mainstream economy, allowing for regular business operations and standard charitable contributions.

In October, Puff Cannabis, based in Madison Heights, announced a $50,000 donation from product sales to The Pink Fund and the Chaldean Community Foundation. The Pink Fund received $11,000 from Wana Brands and $40,000 from Oak Canna, partners in the Puff Cannabis donation.

Public comments on the proposed federal marijuana reclassification are open until July 22. More information can be found at the Federal Register's website.

Bad Axe Voters to Decide on Recreational Cannabis Ordinance in November

In a 4-3 decision, the Bad Axe City Council voted to place the marijuana ordinance on the November ballot during its June 17th meeting.

If approved by voters, the ordinance would allow up to four recreational cannabis facilities in Bad Axe, specifically zoned in commercial and industrial areas.

Mayor Kathleen Particka initiated the motion and voted in favor of placing it on the ballot. Council Members Steve Perez, Dan Glaza, and Nicholas Rochefort also supported the motion. Opposing votes came from Council Members Joel Harrison, Clark McKimmy, and Dave Rapson.

Bad Axe City Manager Rebecca Bachman emphasized that the November vote will ultimately determine the outcome of the ordinance.

During the public comment period, two residents voiced their opinions on the issue.

Resident Kim Rosenthal expressed support for the ballot initiative, stating, "I think we all can agree that it's gotten bigger than seven people making this decision. I highly recommend it be put on the ballot and let the people decide." Rosenthal has consistently advocated for putting the ordinance to a public vote, asserting that the decision should rest with the citizens of Bad Axe.

On the other hand, resident John Hunt, owner of J.W. Hunt located on M-19, opposed the ordinance. "We're very highly regulated and marijuana is a very touchy subject with the feds and the transportation industry," Hunt said. "I do have a concern. I realize in the state of Michigan it's legal, but federally it's not, and we're held under a different standard and it makes it very difficult to employ people."

Recreational cannabis was legalized in Michigan following the 2018 general election, where 56% of Michigan residents voted "yes" on Proposal 18-1. However, Huron County voters opposed the state proposal 8,261 to 5,479, with the city of Bad Axe voting against it by a narrow seven-vote margin, 541 to 534.

In early 2019, the city initially voted unanimously to ban cannabis facilities within city limits. In 2021, the council was approached by non-residents interested in establishing such facilities in Bad Axe, but the council voted down the discussions 4-2. Subsequently, the city authorized the Bad Axe Police Department to research ordinances from other municipalities.

The city eventually approved starting the ordinance process to allow recreational cannabis facilities in November 2023.

Helpful Links

Helpful Links