Federal Prison Sentence for Michigan Cannabis Business Owner for Tax Evasion

Ryan Richmond, the owner of the Warren-based medical cannabis dispensary Relief Choices LLC, has been sentenced to 24 months in prison for tax evasion and obstructing an IRS investigation, according to the U.S. Department of Justice.

Federal authorities revealed that Richmond engaged in extensive tax evasion practices. He reportedly paid operating expenses in cash and routed credit card payments through an unrelated third-party bank account to hide the company's gross receipts. This scheme allowed him to avoid paying approximately $1.1 million in taxes between 2011 and 2014.

Richmond was convicted in federal court in September. The case highlights the complexities and legal ambiguities surrounding the cannabis industry in Michigan during the early years of its medical cannabis law.

Legal Ambiguities in Michigan's Cannabis Industry

Michigan voters approved the state's medical cannabis law in 2008. However, due to ongoing court battles, the first medical cannabis operating licenses were not issued until 2018. Relief Choices operated in this legal gray area, technically outside the state's formal regulatory framework, yet did not face enforcement from state authorities amid the ongoing legal disputes.

Banking Challenges and Cash Operations

Federal prosecutors noted that Richmond's business primarily used cash, a common practice among cannabis businesses at the time due to their exclusion from the traditional banking market. While most cannabis businesses now bank with credit unions willing to accept the associated risks, cash operations remain prevalent.

Federal Tax Obligations

Despite the legal ambiguities, cannabis businesses are still obligated to pay federal income taxes on all income, including from illegal sources, under Section 61(a)(2) of the Internal Revenue Code. This precedent was set in 1961 in the case of James v. United States, involving union official Eugene James, who faced restitution but not criminal charges for tax evasion.

Richmond's case is particularly severe. In addition to his 24-month prison sentence, he must pay $2.8 million in restitution to the IRS, which is more than twice the amount of taxes he owed. Richmond failed to file a personal tax return in 2014 despite Relief Choices generating $1.8 million in revenue, prompting an IRS audit that revealed further discrepancies.

Historical Context and Section 280E

The effective tax rate for cannabis businesses can be as high as 75% due to Section 280E of the IRS Tax Code, which disallows the deduction of business expenses for income from controlled substances listed under Schedule I, including cannabis. This section was established after Jeffrey Edmondson, a drug dealer, successfully claimed business expense deductions in 1981, leading Congress to close this loophole by enacting Section 280E in 1982.

Potential Changes in Federal Law

Efforts are underway to reclassify cannabis as a Schedule II drug, which would eliminate Section 280E and potentially improve cash flow for dispensaries. This change could also encourage more cannabis business operators to comply with tax regulations, altering the cost-benefit analysis currently influenced by high tax rates.

House of Dank Expands with New Cannabis Store in Kalamazoo

House of Dank is set to open its latest recreational cannabis retail store on June 14th in Kalamazoo. The new store, located at 1986 S Sprinkle Rd, MI 48906, will operate daily from 9 am to 10 pm, welcoming adults 21 and over with a valid photo ID.

This new location marks the eleventh addition to House of Dank's expanding network of cannabis retail stores in Michigan. The store will offer both in-store and online shopping options, featuring a secure, well-lit parking area, an ATM, and plans to introduce a delivery service soon.

Customers can expect excellent customer service, knowledgeable staff, a welcoming environment, competitive pricing, and the popular Clubhouse Rewards program that House of Dank's other locations are known for. The Kalamazoo store will carry products from well-regarded industry brands such as North Coast, Pressure Pack, STIIIZY, Mitten Extracts, and more. Additionally, House of Dank's exclusive CBD line and apparel collections will be available for purchase both in-store and online.

Marvin Jamo, the owner, shared his appreciation for the company's journey, stating, "We're really proud of where we started and how far we've come in the last nine years. Expanding into new markets allows us to provide every Michigan customer with a more personalized and better shopping experience."

In addition to the Kalamazoo opening, House of Dank is preparing to launch another store in Ann Arbor in the coming months.

Michigan Surpasses California in Legal Cannabis Sales

California has long been heralded as the largest legal cannabis market globally, with Governor Gavin Newsom reinforcing this claim as recently as the past two months. However, recent data suggests that Michigan has now surpassed California in legal cannabis sales volume, challenging the Golden State's longstanding dominance.

According to BDSA, a cannabis analytics firm, Michigan sold 22 million cannabis products in March, edging out California, which sold 21.3 million products. This data is significant as it marks the first time another state has outsold California in terms of unit sales. The firm's analysis relies on point-of-sale data from both states, though the exact timing of Michigan's market overtaking remains unclear.

Despite Michigan's lead in unit sales, California still leads in revenue. California's cannabis sales reached $1 billion in the first quarter of 2024, compared to Michigan's $786 million. The revenue disparity is largely due to Michigan's lower cannabis prices, making legal cannabis more accessible and affordable than in California.

The discrepancy between unit sales and revenue highlights differing market dynamics. Michigan's success in outselling California by units, despite having a smaller population, underscores significant challenges within California's cannabis market. According to Hirsh Jain, a cannabis consultant, California has failed to capitalize on its market potential, resulting in a robust illicit market that undermines legal sales.

Jain attributes California's struggles to high taxes and stringent regulations that inflate legal cannabis prices. Conversely, Michigan's approach includes low cannabis taxes and stringent enforcement against illegal sales, driving consumers to the legal market. This policy environment ensures affordability and convenience, key factors in Michigan's market success.

Moreover, Michigan benefits from neighboring states lacking legal recreational cannabis sales, attracting out-of-state customers. While this cross-border shopping contributes modestly to Michigan's sales, Jain estimates it accounts for only 5% to 10% of the state's total cannabis sales.

California's legal market continues to grapple with challenges. High taxes and regulatory costs push prices up, while insufficient enforcement against illegal operations allows untaxed, cheaper cannabis to thrive. Consequently, California has seen a decline in expected tax revenues from cannabis legalization, with the first quarter of 2024 recording the lowest legal sales in nearly four years. This decline impacts business sustainability and reduces government funding from cannabis taxes.

In contrast, Michigan's strategic approach, characterized by low taxation and strong enforcement, has created a flourishing legal market. The state's cannabis products are affordable for a broad demographic, driving robust legal sales.

The contrasting cannabis market landscapes between California and Michigan highlight differing regulatory approaches and market outcomes. Michigan's recent surge in cannabis sales volume reflects effective market strategies and poses critical lessons for other states aiming to balance regulation, taxation, and market health.

Michigan Police Struggle with Post-Legalization Search Tactics

Police have long utilized the scent of cannabis as a pretext for searching vehicles during traffic stops in areas where cannabis remains illegal. This practice enables them to confiscate cash and even the vehicles themselves. Once in possession of these assets, law enforcement agencies can employ civil forfeiture, a legal process allowing them to permanently keep the seized property. This practice, akin to legalized highway robbery, operates with court approval.

No arrest or conviction is necessary for civil forfeiture. Once the procedure concludes, participating agencies can divide the proceeds. From 2000 to 2019, state and federal forfeiture revenue in Michigan exceeded $439 million.

Civil forfeiture has become a lucrative enterprise, often initiated by the mere whiff of cannabis. However, Michigan's legalization of recreational cannabis in 2018 has complicated matters for the police. While consuming cannabis in a vehicle remains illegal, possessing it does not, thus eliminating the officers' primary justification for conducting warrantless searches.

The Detroit Police Department struggles to adapt to this new reality. On October 8th, 2020, five Detroit officers on their way to a compliance check stopped when one corporal claimed to smell cannabis emanating from a parked Jeep Cherokee. She then conducted a roadside interrogation of the driver and her passenger, Jeffery Scott Armstrong.

"How long you been smoking weed in the car?" the corporal demanded, according to a transcription of bodycam footage. "I can smell it from outside. Don't act shocked. I can smell it."

Prior to 2018, such an encounter would have been standard procedure. However, the mere smell of cannabis no longer constitutes a crime. The corporal should have continued on her way, but she opted to stop and search the vehicle, infringing on the occupants' Fourth Amendment rights against unreasonable search and seizure.

The officers discovered a firearm under Armstrong's seat and arrested him for being a felon in possession of a firearm, although no cannabis was found. This outcome is unsurprising, as cannabis odor can linger long after its legal use or exposure to others smoking it. Moreover, officers can be mistaken or dishonest. A study in Philadelphia revealed that contraband was found in fewer than 10% of the 3,300 cannabis odor-based vehicle searches conducted by police.

Despite their poor success rate, police remain confident in their olfactory abilities. In 2019, three Indiana officers even testified that they detected less than one gram of unlit cannabis in a closed container from a moving car over 100 yards away, despite a breeze cutting across traffic.

Drug-sniffing dogs also have a high error rate, often failing to differentiate between legal hemp and cannabis. These canines cannot specify whether they detect cannabis or other narcotics like cocaine, rendering them ineffective in states like Michigan where cannabis is legal.

Both human and canine cannabis sniffers need to adapt to the changing legal landscape. Armstrong's case provided Michigan courts with an opportunity to offer clarity when he filed a motion to suppress evidence from the 2020 search. A trial court granted his motion, and the Michigan Court of Appeals upheld the decision in 2022. Dissatisfied, the state petitioned the Michigan Supreme Court, which agreed to hear the case.

Our public interest law firm, the Institute for Justice, alongside the Cato Institute, submitted a friend-of-the-court brief supporting Armstrong. Our argument is straightforward: If a substance is legal, its odor should not constitute probable cause for a search.

Armstrong's case highlights the need for thorough judicial review of probable cause determinations made by officers in the field. Civil forfeiture can bias these decisions, fostering aggressive policing due to financial incentives.

Although Armstrong did not lose cash or his vehicle, many others are not as fortunate. Innocent property owners often suffer when officers exploit the scent of cannabis as a pretext for warrantless searches.

Michigan Voters Show Growing Support for Psychedelic-Assisted Therapy

We understand this isn't directly related to cannabis, but given the evolving landscape of alternative therapies and their intersection with mental health treatment, we believe this topic is highly relevant to our readers. Exploring the legalization of psychedelic-assisted therapy offers valuable insights into broader trends in therapeutic practices and regulatory changes, much like the developments we've witnessed with cannabis.

Michigan is among several states considering legislation to legalize psychedelic-assisted therapy using compounds such as psilocybin. To understand Michigan voters' stance on this issue, the Reason Foundation conducted an online survey using platforms Amazon Turk and Pollfish. The majority of the 450 respondents, who identified as registered voters in Michigan, expressed support for professionally supervised psychedelic-assisted mental health treatment.

This support aligns with a broader national sentiment captured by the University of California, Berkeley researchers. Their 2023 hybrid online and phone poll, conducted by the UC Berkeley Center for the Science of Psychedelics, surveyed 1,500 registered voters and found that 61% support legalizing regulated therapeutic access to psychedelics, with 35% showing strong support.

Support for Regulated Psychedelic Market in Michigan

Following the example of Oregon and Colorado, which passed statewide initiatives to legalize supervised psychedelic services, several states, including California, Arizona, and New Jersey, have begun introducing similar legalization bills. In Michigan, the Reason Foundation's survey asked respondents about their support for a bill that would allow licensed mental health professionals to prescribe psychedelic substances to patients with diagnosable mental illnesses.

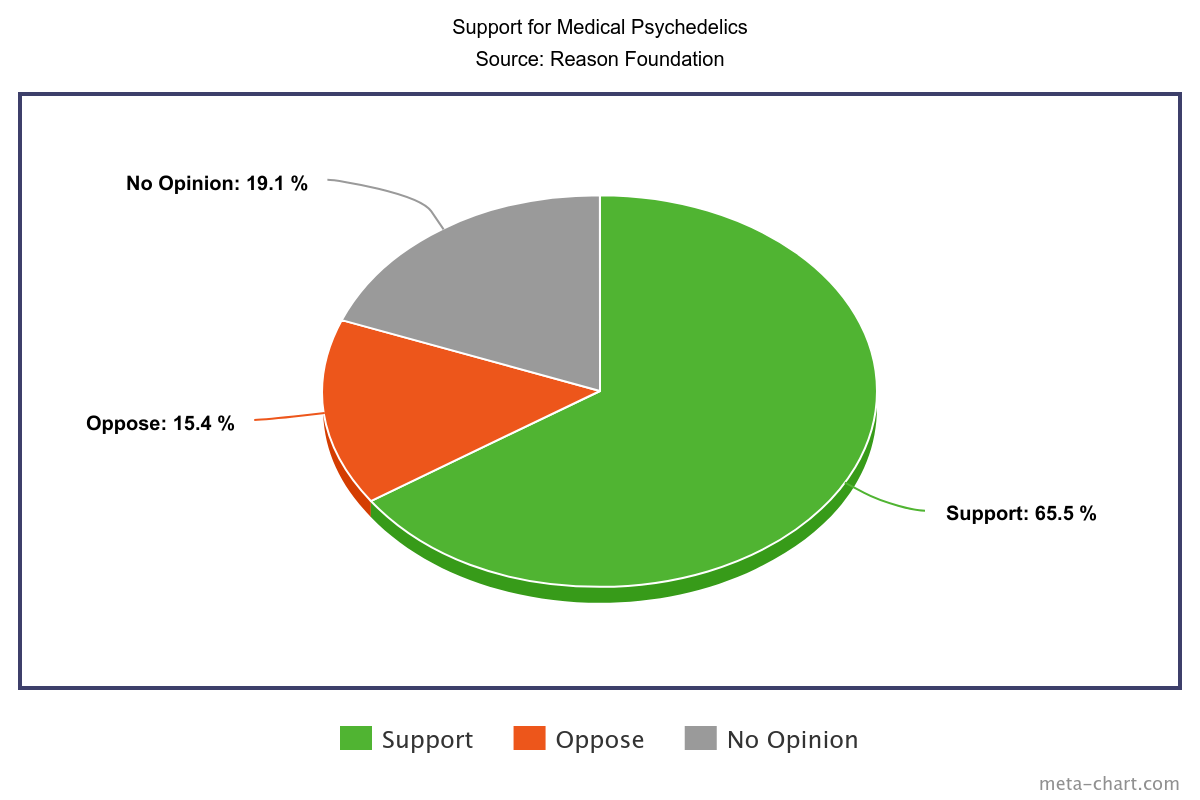

Results from the combined Amazon Turk and Pollfish platforms indicated that 65% of Michigan's registered voters support such legislation, while 15% opposed it, and 19% remained undecided.

The poll also provided respondents an opportunity to comment on their positions regarding psychedelic legalization. Many respondents not only were aware of psychedelic-assisted therapy but also shared personal experiences. This familiarity is consistent with a national survey by Columbia University, which suggests that about 5% of the public has used psychedelics in the past year.

One Michigan respondent on Amazon Turk noted, "I am aware of research showing how micro-dosing of psilocybin helps treat clinical depression and with some addictions. Psilocybin could be a more natural alternative to the heavy drugs used today to treat depression. The positives that could come with legalization greatly outnumber the negatives."

Another respondent shared a personal experience: "I myself have taken them and have seen first-hand how they are helpful when it comes to anxiety and depression. I fully believe if taken correctly, they can significantly reduce anxiety and the feelings of depression."

Mixed Views on At-Home Use of Psychedelics with Teletherapy

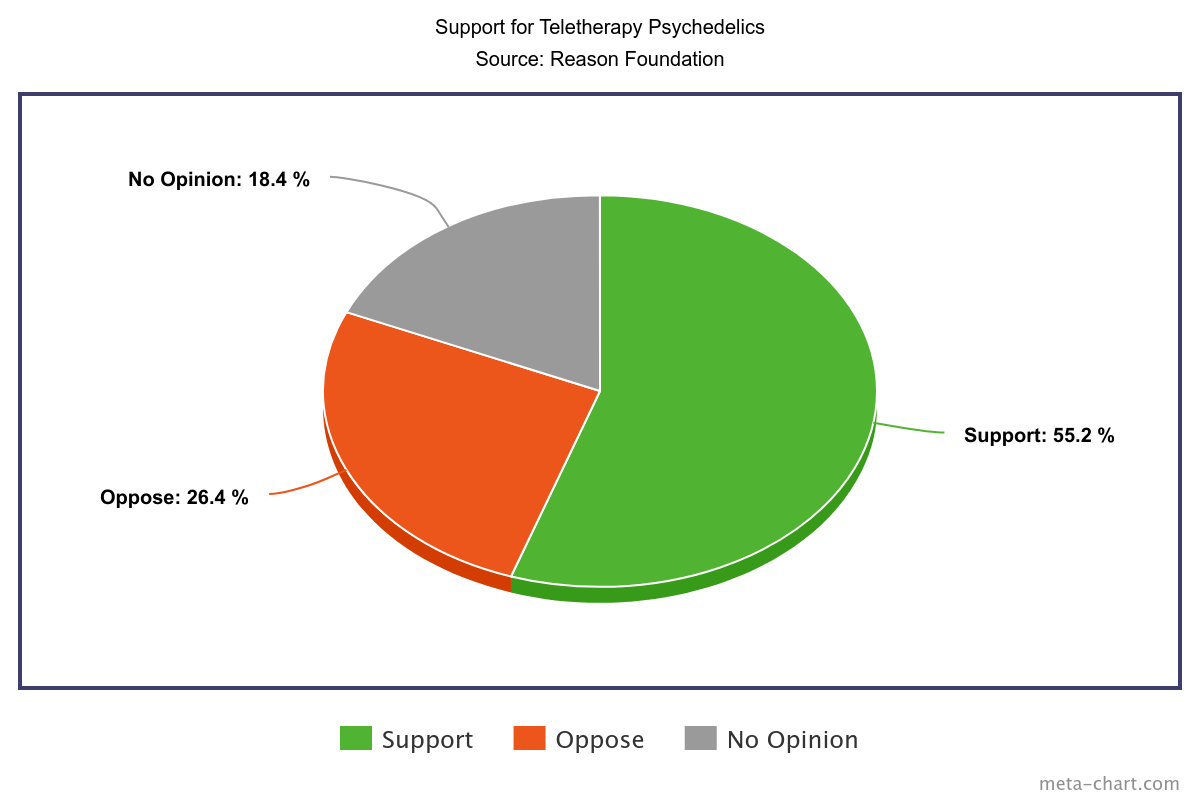

The Reason Foundation's survey also explored the possibility of allowing psychedelics to be prescribed for at-home use under professional supervision, similar to regulations for medical cannabis in some states. The question posed was whether respondents supported a state bill that would permit licensed mental health professionals to prescribe psychedelics for at-home use, provided patients were educated on safe use and had regular check-ins with a mental health professional.

A slight majority of 55% of Michigan respondents supported this idea, 26% opposed it, and 19% said they lacked sufficient information to form an opinion.

One respondent expressed cautious support for supervised at-home use: "If they are being monitored, I think it is the best way, then they can not only make sure it is working but to make sure they are not abusing it."

Methodology and Potential Bias in Polling

The survey methodology included responses from two online polling sources: Amazon Turk and Pollfish. A total of 450 responses were collected—322 from Pollfish and 138 from Amazon Turk. Respondents were provided with a brief background on the issue before answering the survey questions. This background highlighted the potential benefits of psilocybin for treating mental health conditions and noted ongoing clinical trials.

Public polling, especially online opt-in polls like those used in this survey, can face challenges such as nonresponse bias and demographic representativeness. Pew Research Center has noted that online polls can have a bias upwards of 11 points on some issues. To mitigate this, pollsters can re-weight samples to reflect the general population's demographics or use verification questions to ensure respondents' authenticity.

In this survey, respondents were asked to provide their registered voting zip code to limit false reporting. While there is a small chance of duplicate responses from merging the two platforms, the survey results still offer valuable insights into public opinion.

The University of California-Berkeley poll had a margin of error of 2.5%, while the Reason Foundation's survey estimated a margin of error of about +/- 3% using a bootstrap method. Given the potential bias and margin of error, there is a moderate likelihood that more than 50% of Michigan voters support professionally supervised psychedelic therapy. However, support for the at-home therapy option falls within the margin of error and potential bias.

Conclusion

As Michigan and other states consider the legalization of psychedelic-assisted therapy, public opinion appears to be shifting toward support for regulated, professional use of psychedelics. While there are concerns and mixed views about at-home use, the overall trend suggests growing acceptance of psychedelics as a legitimate treatment for mental health conditions. This evolving perspective mirrors the national trend, indicating a potential shift in future mental health treatment paradigms.

New Buffalo Township Reviews 47 Cannabis Dispensary Applications, Approves Four

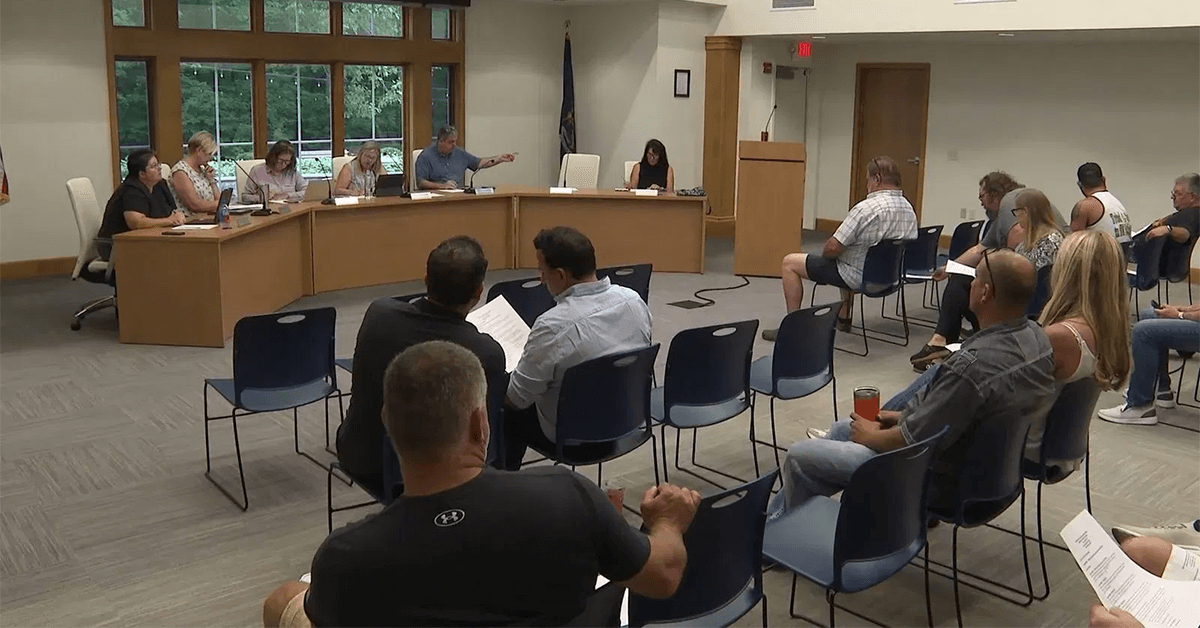

On Tuesday night, the New Buffalo Township Planning Commission granted preliminary approval to four cannabis dispensary applications, marking the first step in a multi-stage approval process for these businesses.

This decision follows a one-year moratorium on new cannabis applications, which concluded with a surge of submissions just before Monday's deadline. Michelle Hannon, New Buffalo Township Clerk, emphasized that these approvals are preliminary and that the dispensaries must undergo additional scrutiny from various governmental entities before returning to the township board for final approval.

The commission's recommendation to approve the four dispensaries came after a public hearing and review. However, the journey for these businesses is far from complete. "They have to go through approval with various different government entities, and then they'll come back to the township board for final approval once those things are complete," Hannon explained.

In total, 47 applications were submitted and will be reviewed by the planning commission. The influx of applications has sparked concern among some community members. Cathy Ward, a local resident, voiced her worries about the township's priorities. "I wish they would put more money into the children's future in the schools and the childcare available in the area and look into providing some places like a CVS or somewhere to shop," she said.

Despite these concerns, officials note that not all 47 applications are guaranteed to move forward. The township stands to gain approximately $59,000 in annual tax revenue for each dispensary that successfully opens.

Hannon pointed out the uncertainty in the process, stating, "Well, it depends. Just because they have preliminary approval does not mean they have final approval. I mean, of those 47 applications, not even all have gone through this step. Things fall apart; you never know if they all will make it through. It's really hard to estimate at this point."

Helpful Links

Helpful Links