Holly Village Council's Marijuana Retail Licensing Decision Upheld in Court

In June 2022, Holly Village Council authorized two marijuana retail licenses following a rigorous selection process, with The Brand Labs and Lume Cannabis Co. emerging as the successful applicants. This decision was grounded in the strict adherence to the 11 criteria outlined in Ordinance 468, which guides the village council's licensing decisions. During the council meeting, a roll call vote was conducted, wherein each council member announced their top two choices, leading to The Brand Labs and Lume Cannabis Co. being the top contenders, receiving six and four votes respectively.

Had there been a tie, the tied applicants would have been invited to present their cases in further detail at a subsequent council meeting. The locations for these new businesses were also confirmed, with The Brand Labs set to occupy a former auto dealership building near the Dollar General Store, and Lume Cannabis Co. opening its doors on Grange Hall Road.

However, the licensing process faced legal scrutiny when Green Stones, Inc., an unsuccessful applicant, filed a complaint in the Oakland County Circuit Court. The complaint alleged that Holly Village Clerk Deborah Bigger and the council engaged in a non-transparent and subjective selection process, contrary to the requirements of the ordinance. Green Stones sought a Writ of Mandamus, compelling the council to reevaluate its application in line with the ordinance.

The complaint listed several counts, including a petition for Writ of Mandamus, superintending control, violations of due process and equal protection of the law, and a request for injunctive relief. After a series of legal deliberations, the court sided with the defendants on the first two counts and noted ongoing negotiations regarding the remaining issues. The court found the application process to be aligned with the government's legitimate purpose of licensing a marijuana retail facility and did not find evidence of arbitrary council actions or disparate treatment.

The request for injunctive relief was also dismissed, as Green Stones failed to establish viable legal claims against the defendants. Finally, on December 8th, the court ordered the dismissal of the case. The legal proceedings incurred a total cost of $6,641 to Holly Village, as reported by Village Manager Jerry Walker.

Snoop Dogg Unveils 'Do It Fluid': A New Line of Cannabis-Infused Beverages

Snoop Dogg, the renowned rapper and entrepreneur, has recently ventured into the burgeoning cannabis beverage market with the launch of his new line of THC and CBD-infused drinks. The collection, named 'Do It Fluid', offers a variety of flavors including Blood Orange, Blue Razz, Cherry Limeade, and Peaches N' Honies. These beverages come in two types: one solely containing CBD, priced at $4.99 per can, and another combining CBD with hemp-derived Delta-9 THC, available at $5.99 per can. Consumers can purchase these drinks online through the Death Row Cannabis and Hill Beverage websites.

The inception of Hill Beverage Co. marks a significant collaboration between Snoop Dogg and CEO Jake Hill, a prominent figure in the cannabis industry known for founding Grow Automations, a company enhancing the efficiency of cannabis cultivation. This partnership led to the development of these innovative drinks, utilizing Grow Automations' technology. Snoop Dogg, in a statement, emphasized the natural and high-quality attributes of these beverages, presenting them as an ideal choice for consumers at any time of the day.

Despite his long-standing association with traditional cannabis consumption, Snoop Dogg continues to innovate within the industry. He initially launched his marijuana brand, Leafs By Snoop, in 2015. However, following his acquisition of Death Row Records in 2022, he transitioned to the new Death Row Cannabis brand, which has been gaining traction in California and Michigan, with further expansion plans in the pipeline. Additionally, Snoop Dogg's D*gg lbs cannabis products have made their way into markets in Ontario, Canada, and Israel.

The Do It Fluid line includes the Dogg Lbs. label for Cherry Limeade and Peaches N' Honies, while Tha Shiznit Blue Razz and G'Dup Blood Orange flavors are branded under Death Row Records. Tiffany Chin, CEO of Death Row Records Cannabis, highlighted Snoop Dogg's ambition to pioneer functional cannabis and hemp beverages, acknowledging the growing consumer preference for alternative modes of cannabis consumption beyond smoking or vaping.

The CBD-only version of these beverages is presented in 12-ounce cans containing 25 milligrams of CBD. The combined THC and CBD drinks are available in 8-ounce cans, featuring 5 milligrams of CBD and 3mg of Delta-9 THC. Notably, the THC used in these drinks is derived from hemp, offering a psychoactive experience while maintaining legal compliance. The Peaches N' Honies flavor stands out as the lowest-calorie option, with the Blood Orange flavor having the highest calorie count.

These drinks are crafted with carbonated water, cane sugar, fruit juice concentrate, monk fruit, natural flavor, and other ingredients, including terpenes – the compounds responsible for the aroma and flavor in cannabis and hemp. A unique aspect of the Do It Fluid line is its proprietary terpene cannabinoid blend, designed to deliver the effects of THC and CBD within minutes, significantly faster than the typical onset time of competing products.

Jake Hill assures that the Do It Fluid line offers a refreshing and enjoyable taste, ideal for various social and relaxation settings. The Dogg Lbs. drinks are praised for their refreshing taste, suitable for leisure activities, while the Death Row Records beverages are described as full-bodied with a sweet, refreshing kick. As for the effects, Hill notes that the drinks can enhance sociability, reduce anxiety, promote relaxation, and aid in restful sleep, depending on the consumer's setting and mood.

North Coast Cultivators Expands Operations in Marquette with Class C License

Marquette's cannabis industry is set to experience significant growth, following the Marquette City Planning Commission's recent approval of a Class C Marijuana Grower license. This milestone was achieved by North Coast Cultivators, a prominent player in the Upper Peninsula's marijuana market, operating from 1917 Enterprise St. North Coast Cultivators, known for supplying cannabis to local dispensaries such as the Fire Station, Melo Cannabis, and Whacky Jackz, is poised to expand its cultivation capabilities substantially.

This expansion, moving from a Class B to a Class C license, allows North Coast Cultivators to grow a larger number of plants. This increase in production capacity is seen as a crucial development for the company in maintaining its competitive edge in the rapidly evolving cannabis industry.

Meghan Poglese, co-owner of North Coast Cultivators, expressed optimism about the new license, highlighting its potential to introduce a wider variety of cannabis strains and meet consumer demand more effectively. "This is a significant step forward in diversifying our strain offerings and ensuring our products excite our customers," Poglese stated.

While the final steps of securing the license with the State of Michigan are still underway, North Coast Cultivators anticipates initiating the cultivation of new plants within the next 30 days, marking a new chapter in the company's growth and the region's cannabis industry.

Springfield Man Pleads No Contest in Marijuana-Related DUI Incident

In a recent development in Branch County, Michigan, Raymond Root III, a 46-year-old man from Springfield, has entered a no contest plea to charges of operating a vehicle under the influence of marijuana, resulting in serious injury. This incident, stemming from a collision on April 7th on Marshall Street near Taylor in Coldwater, has brought to light the complexities surrounding marijuana use and driving safety.

Root was apprehended on August 31st by Coldwater police following investigations that linked the presence of THC, the psychoactive compound in marijuana, in his bloodstream at the time of the accident. This discovery was made following tests conducted by the Michigan State Police labs.

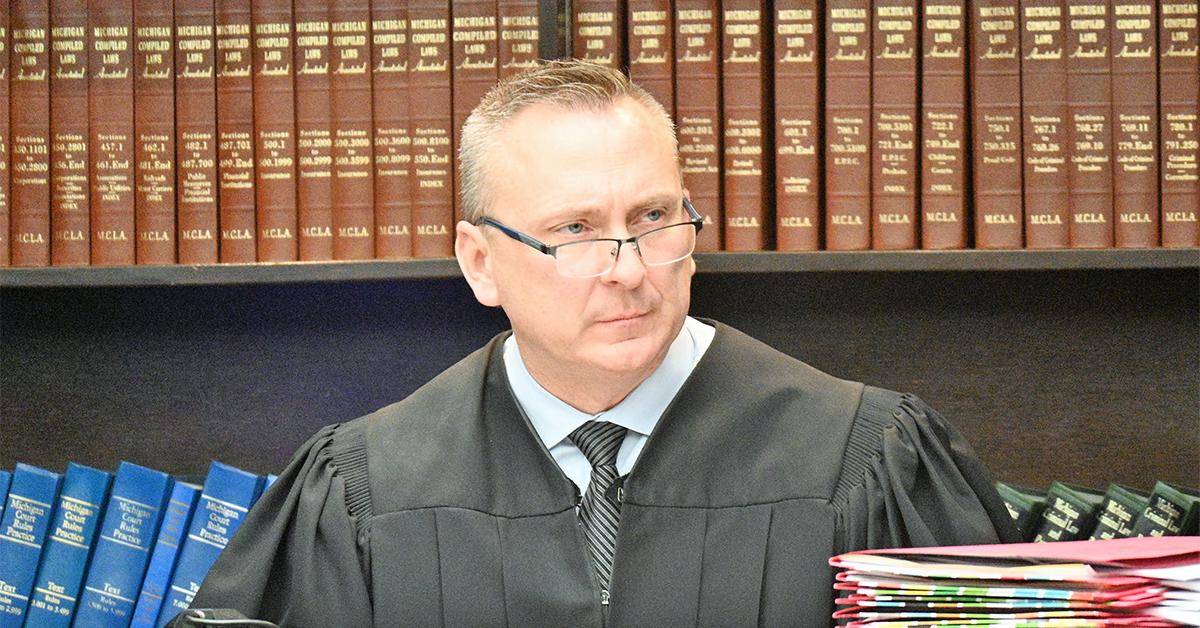

The case, presided over by Circuit Judge Bill O'Grady in the Branch County Circuit Court, saw Root admitting to his continued use of marijuana, even after the arrest. He disclosed to the court that his last usage was a mere couple of days before the hearing. Root, who had previously been qualified for medical marijuana, expressed his view of not considering legalized marijuana as a drug.

In response, Judge O'Grady commented on Root's continued marijuana use despite the gravity of the situation, pointing out the implications it has on his character. The judge's remarks underscored the legal and ethical considerations surrounding marijuana consumption, especially in relation to operating vehicles.

Prosecutor Zack Stempien, acknowledging Root's plea, agreed to a cap on jail time, proposing a maximum of six months. This agreement will be finalized when Root is sentenced on February 19th. Concurrent charges against Root were also dismissed as part of the plea arrangement.

The consequences Root faces extend beyond incarceration. He is expected to undergo probation, participate in rehabilitative programs, and bear the financial responsibilities associated with the prosecution, including fines, costs, and government reimbursement for emergency responses linked to the accident.

The seriousness of the incident is further highlighted by the injuries sustained by the other party involved in the crash, a 60-year-old woman. She suffered a fractured vertebra, necessitating extensive surgeries. At the scene of the accident, police noted Root's impaired state, though no alcohol was detected. His uncooperative demeanor led to the issuance of a search warrant, which resulted in a blood draw at ProMedica Coldwater Regional Hospital, confirming the presence of THC.

This case brings to the forefront the ongoing discussions about the legal and societal implications of marijuana use, particularly concerning driving and public safety. It serves as a reminder of the responsibilities and consequences associated with marijuana consumption, especially when it intersects with the operation of motor vehicles.

Judge Upholds Milan's Marijuana Permitting Procedures

In a significant legal development, Milan, Michigan's administration has upheld its marijuana dispensary permit awarding process in court. The Washtenaw County Trial Court, under Judge Julia Owdziej, ruled in favor of the city, resolving a dispute initiated by a cannabis company, HQP Retail II, LLC, which operates as Hayat. The company had contested the allocation of the city's exclusive two dispensary permits, alleging procedural discrepancies.

On December 8th, Judge Owdziej endorsed the city's approach by granting Milan's motion for summary disposition. This decision effectively dismissed the legal challenge brought forth by Birmingham-based HQP Retail II, LLC, in July. The contention revolved around the company's claim that the permit allocation process, as conducted by Milan City Council on July 5th, was flawed, particularly in the scoring of applications.

City Administrator Jim Lancaster, addressing the ordinance's goals, emphasized that the selection process was strategically designed to integrate the best-fit models into Milan's economic development plans. The city, opening its doors to the marijuana industry in 2022 for the first time, introduced a point system to objectively assess and select two proposals that best aligned with the city's criteria.

Under these regulations, preference was given to proposals targeting development of vacant or blighted properties and those suggesting mixed-use structures combining commercial or residential spaces. Lancaster noted, "We received four commendable proposals, but the ordinance limited us to select only two based on our point system."

The permits were ultimately awarded to Oz Cannabis and Green Ink 420. Oz Cannabis proposed to renovate a coin-operated laundromat and car wash at 1132 Dexter Street. Green Ink 420 planned a strip mall-style development with commercial spaces and apartments adjacent to Love's Travel Stop on Plank Road.

HQP, which ranked third in the scoring process, proposed a new building on 800 Dexter Street near Dollar General, featuring a cannabis shop with an additional drive-thru style restaurant. Despite their proposal, HQP alleged irregularities in the review process and accused the city of violating Michigan's marijuana regulations and the state Open Meetings Act through undisclosed meetings that allegedly skewed the scoring in favor of their competitors. The city refuted these claims, stating the scoring process was individually handled by the city administrator, and as such, the Open Meetings Act did not apply.

Judge Owdziej's ruling dismissed HQP's motions and closed the case, validating the city's procedural integrity. Looking ahead, Lancaster shared that both Oz and Green Ink are advancing through the necessary approvals to commence their projects. Oz Cannabis has already received planning commission approval and is progressing towards construction. Green Ink is expected to present its plans to the commission soon, with significant progress anticipated on both sites during the 2024 construction season.

Metro Detroit Communities Weigh Economic Benefits and Challenges of Recreational Marijuana

In a significant development, four prosperous communities in the metro Detroit area—Grosse Pointe Park, Keego Harbor, Rochester, and Birmingham—recently voted against allowing recreational marijuana sales. This outcome represents a notable setback for advocates of recreational marijuana in Michigan, who argue that access to legal cannabis remains limited, especially in the outer suburbs of Detroit. Despite Michigan legalizing recreational marijuana in 2018, a mere fraction of its municipalities, less than 10% according to the latest figures from the state's Cannabis Regulatory Agency, permit recreational marijuana businesses.

Denise Pollicella, founder of Cannabis Attorneys of Michigan, highlighted a stark division in attitudes towards cannabis between wealthier metro Detroit communities and those facing economic challenges. Affluent areas often oppose cannabis businesses, citing a lack of necessity for the economic and tax benefits these enterprises could bring. This contrasts sharply with less affluent communities, where older, sometimes blighted, buildings and distressed areas might benefit from the revitalization that cannabis businesses could offer.

Grosse Pointe Park Mayor Michele Hodges commented post-election, noting that their community feels self-sufficient without cannabis businesses. Hodges emphasized that cannabis products are readily accessible in their area, including through delivery services, suggesting a perceived lack of need for local dispensaries.

The reluctance of some communities to allow cannabis sales is partly influenced by legal concerns. As Pollicella pointed out, cities like Detroit have faced numerous lawsuits while establishing their recreational marijuana ordinances. These legal challenges can cause significant delays; in Detroit's case, they postponed the start of recreational marijuana sales for years. Even after overcoming these hurdles, Detroit continues to grapple with litigation, such as a recent lawsuit concerning the location of a marijuana facility near a school.

Pollicella observed that fear of litigation is a major deterrent for municipalities considering the legalization of recreational marijuana businesses. However, she noted that this trend is diminishing and suggested ways to avoid legal complications, such as not imposing a cap on the number of available licenses.

The decision to opt out of recreational marijuana commerce has fiscal implications. Over 1,300 Michigan communities that have chosen not to allow these businesses are consequently not receiving tax revenue from marijuana sales, which is levied at 10%. In the fiscal year 2023, this tax generated a substantial $266.2 million, marking a near 50% increase from the previous year. This revenue is distributed among the communities and counties hosting dispensaries, Michigan's school aid fund for K-12 education, and the state's transportation fund.

An inquiry into how communities with legal recreational marijuana sales utilize their tax revenue revealed diverse approaches. Hazel Park, an early adopter of recreational marijuana sales, directs its revenue towards pension obligations. In contrast, cities like Ferndale, Hamtramck, Inkster, Lake Orion, and Coldwater channel the funds into their general budgets, supporting various municipal services including police, fire, and parks and recreation.

For some municipalities, the revenue is a welcome boost. The city of Wayne, for instance, found the additional $207,364 from four dispensaries earlier this year beneficial for its financially distressed general fund. Similarly, Madison Heights uses the revenue to fund general services, with added benefits from property investments increasing the taxable value and hence the tax revenue.

In Center Line, Macomb County, the new revenue source has enabled the city to undertake community projects without raising taxes, such as improvements in recreational parks, municipal complexes, and library facilities. The Village of Oxford has utilized its share of the revenue to expand its police force, enhancing community safety.

However, not all communities see a significant impact from this revenue stream. Lincoln Park's City Manager James Krizan noted that for them, the revenue from marijuana sales, although helpful, represents only a small portion of their total budget and is not transformative.

This diverse array of responses from Michigan communities underscores the complex interplay between economic interests, legal considerations, and community values in the ongoing debate over recreational marijuana. While some see it as a promising source of revenue and revitalization, others remain cautious, weighing potential benefits against concerns about community character and legal challenges.

Helpful Links

Helpful Links