Unpaid Invoices Plague Michigan's Cannabis Market

The competition between Michigan and California in the cannabis industry extends beyond regulated recreational sales. Michigan's operators also rank high in terms of unpaid invoices, posing significant financial challenges within the market. According to Brett Gelfand, managing partner at Cannabiz Collects and founder of the Cannabiz Credit Association, Michigan is emerging as one of the most problematic states for unpaid debts in the regulated cannabis industry.

Rising Concerns in New Markets

Gelfand noted that while Oregon and Colorado were previously significant markets for debt collection, many companies in those states have been "weeded out," leading to a decrease in collection activity. However, new markets like Michigan are increasingly contributing to the issue.

Whitney Economics, an Oregon-based cannabis data and research company, forecasts that delinquent payments in the U.S. cannabis industry could exceed $4 billion in 2024.

Banking and Capital Access Issues

A primary factor contributing to unpaid invoices in the cannabis industry is the lack of access to traditional banking and capital. Unlike other businesses, cannabis operators often cannot obtain credit cards or standard operating capital. This forces them to rely on trade credit, effectively making them act as banks without the necessary expertise or safeguards.

When cannabis companies extend net-15 or net-30 terms, they take on the role of financial institutions but without the recourse available to banks, such as credit checks or liens. This puts them at a disadvantage, as they feel compelled to extend credit to secure sales, risking financial instability.

Impact on Industry Sectors

The retail sector is most notorious for nonpayment, triggering a domino effect across the supply chain. Retailers' unpaid debts affect producers and brands, which in turn delay payments to testing labs and other service providers. Larger ancillary companies, such as grow-supply and lighting businesses, are generally more cautious and less likely to extend credit freely due to their experience in the industry.

Best Practices for Managing Accounts Receivable

To mitigate financial risks, cannabis companies should implement several best practices:

-

Dedicated Collections Role: Assign someone responsible for collecting payments to ensure accountability and follow-through.

-

Clear Policies and Procedures: Document and enforce a comprehensive policy for managing accounts receivable.

-

Customer Analysis: Evaluate a company's creditworthiness before extending credit terms.

-

Onboarding Agreements: Use legally reviewed agreements with default clauses to protect against nonpayment.

-

Personal Guarantees: Secure personal guarantees for significant credit extensions to safeguard against default.

With many retail chains struggling financially, vendors are often left with little recovery, emphasizing the need for these protective measures.

Challenges in Reporting Defaults

Many cannabis operators hesitate to report default accounts to collections due to concerns about their reputation. They fear being perceived negatively in the industry. However, Gelfand argues that this mindset needs to change. Not fulfilling payment obligations can lead to severe consequences for other businesses, potentially causing them to fail.

Risks of Informal Reporting

Operators must also be cautious about informal reporting through Facebook or WhatsApp groups dedicated to exposing delinquent companies. While well-intentioned, these groups can violate antitrust laws, especially if they deter sales to specific businesses. It's crucial for industry participants to share information in a regulated manner to avoid legal repercussions.

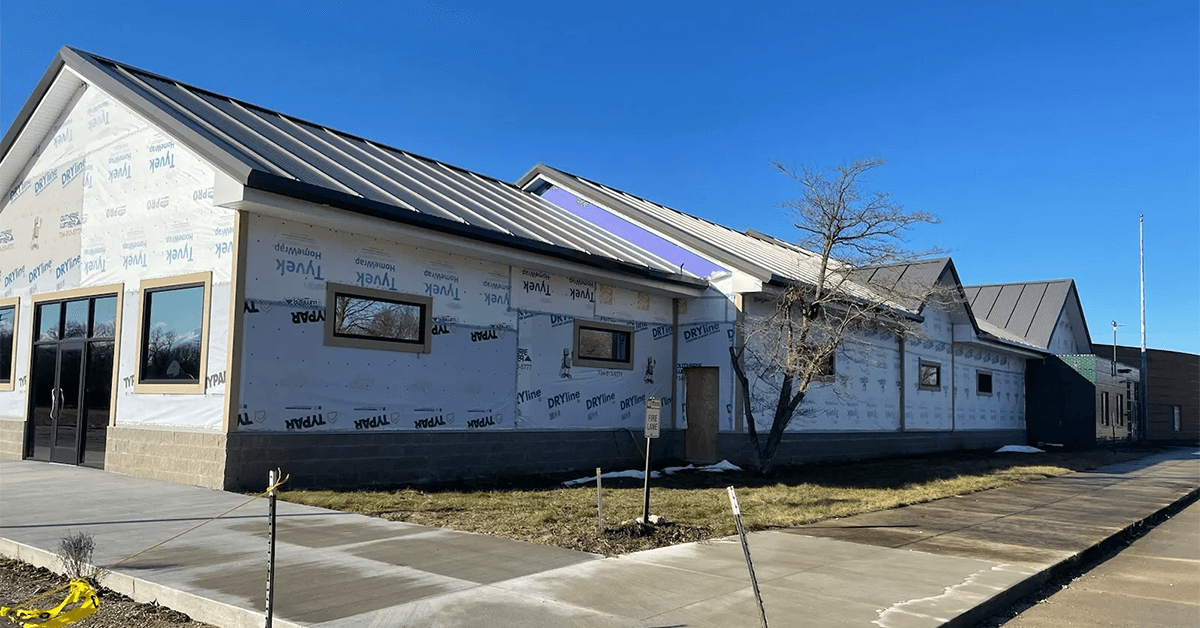

Pinckney Officials Reluctantly Advance Cannabis Projects

Pinckney moved forward with plans for two recreational cannabis businesses on Monday, but not without some hesitation from local officials.

The Pinckney Planning Commission re-approved the final site plan for The Means Project, a cannabis retail, growing, and processing facility located at the former Pinckney Elementary at 935 M-36. Additionally, the commission gave preliminary approval to Essence, a proposed marijuana microbusiness that will include a retail showroom, grow room, storage, and processing facility. This development is planned for a vacant plot at 1268 E. M-36, between Wendy's and Taco Bell. Essence will need final site plan approval in the future.

Concerns Surround The Means Project

Initially, the commission voted 4-2 against The Means Project without explanation, with Vice Chair Joe Hartman and Council President Linda Lavey voting in favor. Later in the meeting, Hartman encouraged a re-vote after discussing some commissioners' concerns, resulting in a 5-1 vote to approve with contingencies. Chair Christine Oliver voted "no" the second time.

The previously approved site plan for The Means Project expired due to construction delays and a legal dispute, with no changes made to the plans in the interim.

Jacob Kahn, an attorney for The Means Project, was surprised by the initial denial, citing that village officials had already extended a special land use permit, which was a prerequisite for final site plan approval.

"We are not actually allowed to vote 'no'; that would be illegal," Hartman explained later in the meeting.

"It would probably get us sued," added Lavey. "I also hate that marijuana has come to town, but people voted, so it's here. It's a legal business. They have a site plan that was already approved. So, what's stopping us tonight?"

Commissioners Oliver and Alex Smith expressed concerns about the project's completion, given its history of delays.

"Given the history and the track record, that's where my concerns come from," Smith noted.

Commissioner Trisha Wagner cited traffic concerns as her reason for initially voting "no."

Village Zoning Administrator Julie Durkin reminded the commission that The Means Project has a new general contractor and a performance guarantee in place. She also noted that the Michigan Department of Transportation oversees traffic on M-36.

The commission then voted to approve the project.

Essence Microbusiness Receives Preliminary Approval

Marco Lytwyn, representing Pinckney Developments, LLC, proposed Essence, a 3,200-square-foot Class A microbusiness. In Michigan, such microbusinesses can grow up to 300 plants on-site to process and sell.

While some commissioners expressed reluctance, the commission approved the proposal with a 5-1 vote, with Smith voting against.

Commissioner Deborah Grischke voiced concerns about traffic, questioning a report predicting about 100 vehicles a day. She also sought more information about potential impacts on the watershed after public concerns about nearby Honey Creek.

Lytwyn must address contingencies, including a third-party traffic study and county approval of a drainage plan, among other conditions.

Motor City Rockers Team Up with Cloud Cannabis for New Season

The Motor City Rockers, a professional minor league ice hockey team based in Fraser, Michigan, are thrilled to announce a new partnership with Cloud Cannabis for the upcoming 2024-25 season. As the tenth team to join the Federal Prospects Hockey League, the Rockers continue to enhance their fan experience with exciting new collaborations.

Cloud Cannabis, known for its eleven locations throughout Michigan, offers the nearest store to Big Boy Arena in Utica. Fans interested in learning more about Cloud Cannabis locations, their Rewards Program, or placing an order online are encouraged to visit their official website.

Through this partnership, members of the Cloud Club Dispensary Rewards Program can enjoy exclusive benefits, including discounted tickets to the Rockers' game against the Prowlers on Saturday, December 14th. Additionally, the Rockers and Big Boy Arena are proud to introduce a new "Smoking Lounge Presented by Cloud Cannabis," which will be conveniently located just outside the Box Office at the entrance of Priority Rink 1.

$1 Million Investment for New Cannabis Dispensary in Grand Rapids

John McLeod, co-founder of Cloud Cannabis Co., has announced plans to invest approximately $1 million to open a new dispensary in Grand Rapids. The dispensary will be located in a former credit union office on the city's northeast side. McLeod acquired the property, located at 600 Plymouth Ave. NE, on February 1st, 2023, and intends to transform it into a processing and retail facility operating under The Bloomery brand.

McLeod, who sold Cloud Cannabis Co.'s 11 retail stores to Stash Ventures earlier this year, now serves as the director of new markets for The Bloomery. As one of Michigan's largest cannabis retailers, Cloud Cannabis Co.'s sale marked a significant shift in McLeod's career, leading him to focus on new ventures.

The new Grand Rapids location presents a unique challenge due to its relatively small size of 2,500 square feet. "We really wouldn't look at a store this size, but we just feel it's a unique opportunity in an area not served by cannabis," McLeod stated. He emphasized the need for creativity and efficient use of space, given that only 625 square feet can be allocated for retail operations due to the property's industrial zoning.

The plan for the dispensary has already received special land use approval from the city. The remaining space will be utilized for processing activities. The dispensary, potentially branded as a "Bloomery Express" or an outlet-style store, will undergo significant renovations, including the removal of an existing vault. Metric Structures, a Grand Rapids-based company, will oversee the project as both the owner's representative and general contractor. The project is expected to be completed by the end of the year.

McLeod expressed his enthusiasm for expanding The Bloomery's presence in Grand Rapids. "We love Grand Rapids, the people, and the city, so it was important for us to get another store there after we sold the Cloud stores," he said. He highlighted the importance of adaptability in the ever-evolving cannabis industry.

This investment is part of McLeod's ongoing commitment to the West Michigan cannabis market. Besides his role at The Bloomery, McLeod also heads new markets for Mitten Distro, a grow and processing facility in Kalamazoo. Despite fluctuating cannabis prices, retail sales continue to show slight growth year over year, encouraging further investment in the industry.

House of Kush Expands to Michigan with Pleasantrees Collaboration

House of Kush, a cannabis genetics brand with a history in sports and science, has announced a partnership with Pleasantrees, a vertically integrated cannabis cultivator based in Michigan. This collaboration aims to introduce House of Kush's genetics to the Michigan market.

House of Kush has established its presence in Missouri, Maryland, and Ohio by focusing on preserving legacy strains and maintaining high standards in cannabis genetics. The brand's connections to the sports world and efforts to change the cannabis narrative have garnered attention among cannabis enthusiasts.

"We are excited to partner with Pleasantrees, a company that shares our commitment to quality," said Reggie Harris, CEO of House of Kush, in a statement to Benzinga. "Michigan has a growing cannabis community, and we look forward to introducing our genetics and products to this market. Pleasantrees' focus on cultivating premium cannabis aligns with our goals."

Focus on Social Justice

Harris pointed to Pleasantrees' involvement with Rick Wershe Jr., known as White Boy Rick, who was released from prison in July 2020 after serving 33 years. This connection underscores Pleasantrees' commitment to social justice, education, and community involvement, aligning with House of Kush's approach to the industry. "We need strong partners and recognition in the industry, and Pleasantrees adds credibility to our efforts," Harris noted.

Harris also highlighted Michigan as a significant cannabis market, emphasizing the importance of competing in such a prominent market.

Mutual Expectations for Innovation

Bryan Wickersham, President of Pleasantrees, expressed anticipation about the partnership, noting the potential for Michigan consumers to experience the genetics curated by House of Kush. "The product innovation from the HOK team will be noteworthy," Wickersham stated.

Financial Collapse of Cannabash: Over $100K in Unpaid Dues Reported

Cannabash, a once-promising concert series in Michigan, has recently descended into turmoil, leaving a trail of unpaid debts and disappointed stakeholders in its wake. The event, organized by Grams & Jams and managed by CMS Consulting LLC, has issued over a dozen bad checks, ranging from $500 to $50,000. These checks have resulted in more than $100,000 in unpaid dues to artists, stage crew, and various vendors. The total amount owed, including unpaid staff, security, marketing costs, talent buyers, and sponsorship refunds, continues to grow as more claims are reported.

Personal Accounts and Financial Woes

Former staff members have come forward to share their experiences of financial betrayal. One former employee recounted how Daniel & Connie Sparrow (the organization's leadership) had jokingly mentioned the possibility of going bankrupt after the event as early as April, but assured everyone that the show would go on. Many staff members, some of whom had known the organizers for over two decades, initially saw no reason for concern. However, within a month and a half, paychecks stopped arriving. By the time the event occurred, some staff members found their final paychecks being withheld. One individual disclosed that they were owed just under $5,000, while acknowledging that others were owed even larger amounts.

Attempts to contact Grams & Jams or CMS Consulting LLC for comments have been unsuccessful. In a text message to former employees, the organizer suggested removing negative posts on social media in exchange for payment. An email to talent buyers revealed the organizer's frustration, stating, "I was willing to discuss payouts, but after the abusive, threatening, and traumatic behavior, I'm not vested in ensuring anything." No concrete evidence of the alleged threats or abusive behavior has been presented at this time.

In another email to a vendor, the organizer stated, "After consulting with my corporate counsel, there is nothing more required at this time. I will send you the dissolution certificate when I receive it tomorrow. There is no need to contact my attorney. The company is no longer operational."

Legal and Financial Ramifications

While some vendors have received a certificate of dissolution, the only evidence of a formal bankruptcy filing consists of emails and text messages from the owner of CMS Consulting to artists and former staff. One such message read, "I'm filing for bankruptcy and receivership. If you could please back off, I would appreciate it."

Victims are currently reporting their cases to the Muskegon County Sheriff's Department and the Department of Licensing and Regulatory Affairs (LARA). Additional reports are anticipated as more individuals come forward with their experiences and claims.

Community Reaction

The community's reaction to the Cannabash fallout has been one of disappointment, frustration, and anger. One vendor reflected on their financial losses over the years, noting that while the first year was profitable, subsequent years resulted in significant losses due to poor event management and placement. This year, the vendor decided against participating and, upon seeing the current situation, felt validated in their decision.

Another community member highlighted the potential for criminal charges, stating that writing bad checks in Michigan over $500 is a felony. They emphasized that if the allegations prove true, the bankruptcy court may offer little relief for those owed money.

The broader impact on the cannabis event management sector has also been a topic of discussion. Some community members expressed their hesitance to re-enter the formal cannabis industry due to similar negative experiences. There is a call for greater accountability and transparency to prevent such incidents in the future.

Cannabash 2024 Turnout

Broader Implications for the Industry

The Cannabash incident serves as a stark reminder of the importance of financial integrity and ethical management within the cannabis industry. As the community grapples with the fallout, it is clear that there is a need for stricter oversight and better practices to protect all stakeholders involved in cannabis-related events.

The scandal has also prompted a broader conversation about the overall state of the cannabis industry in Michigan. Many believe that the industry is plagued by unscrupulous actors who take advantage of the community's passion and commitment. There is a growing demand for more rigorous vetting processes and legal protections to ensure that such financial disasters do not recur.

Looking Forward

Moving forward, the Cannabash fallout highlights the critical need for event organizers to maintain transparent and honest financial practices. It also underscores the necessity for regulatory bodies to enforce stricter compliance measures to protect vendors, artists, and employees from financial harm.

The community's response suggests a collective desire to rebuild trust and establish a more secure and reliable industry framework. As legal proceedings unfold and more information comes to light, stakeholders hope that this incident will serve as a catalyst for positive change within the cannabis event management sector.

Helpful Links

Helpful Links