Michigan Marijuana Farm Wins Tax Classification Battle

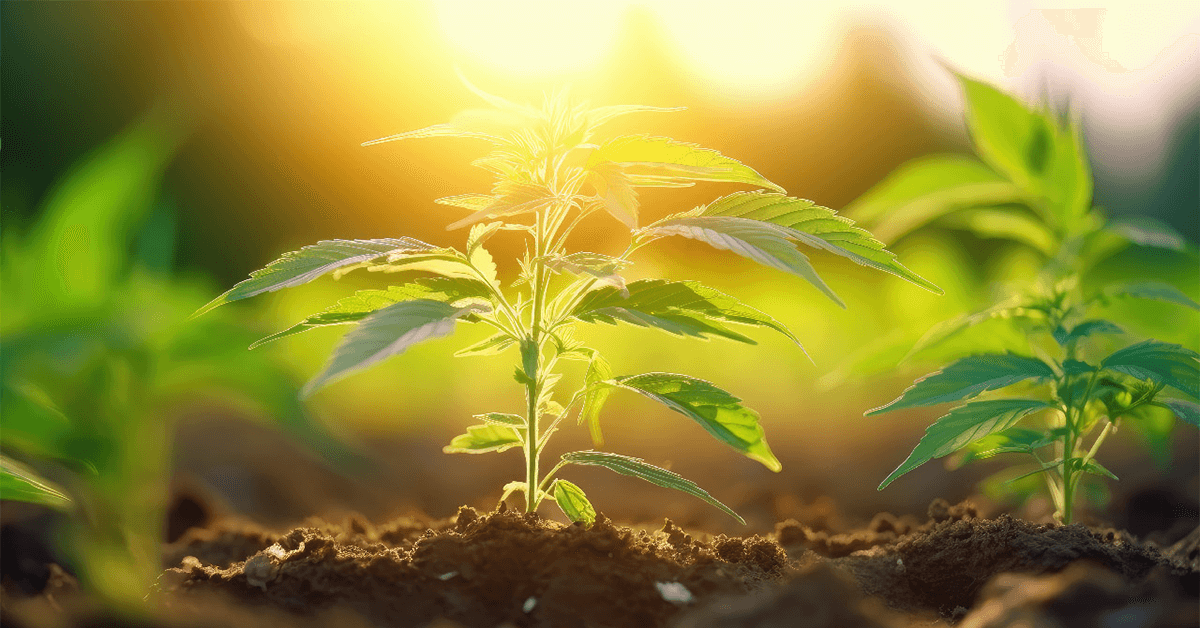

In Michigan, sprawling cannabis fields are indistinguishable from traditional farms, with plants reaching skyward from fertile ground and laborers busy during the autumn harvest. Advances in agricultural technology, like specialized grow lights and regulated temperatures, have made it possible for cannabis to flourish indoors as well.

Yet, there's a difference that Michigan's taxation department has held onto: marijuana isn't classified as agriculture when it comes to taxes. However, this perspective is being challenged.

A recent court decision, stemming from a 16-month legal tussle, permitted a southwest Michigan cannabis grower to enjoy farm tax exemption privileges. This groundbreaking move, the first for Michigan, was orchestrated by Detroit attorney Carl Rashid Jr. of Dykema Law, who represented HRP Cassopolis LLC, an indoor cannabis cultivator associated with several brands and a dispensary in Cassopolis.

The contention started when HRP Cassopolis, which possesses four Class C licenses allowing for up to 2,000 stackable plants, was told their farm was commercial property for tax purposes. Their efforts to change this classification via the March Board of Review and the Michigan State Tax Commission were unsuccessful.

HRP Cassopolis's argument was clear: given the Michigan Department of Agriculture and Rural Development's classification of cannabis as an "agricultural commodity," why was their property deemed commercial? Yet, the state remained steadfast, insisting cannabis cultivation wasn't agricultural.

Their perseverance led to an appeal in the 43rd District Court of Cass County, where the state tax commission's broad definition of agriculture was highlighted. Ultimately, Cass County Circuit Court Judge Carol Montavon Bealor confirmed cannabis cultivation's place within the agricultural sphere.

While this win signals potential tax benefits for other marijuana growers, it also opens conversations on how cannabis integrates into Michigan's massive $104 billion agricultural industry. Will Bowden, CEO of Grasshopper Farms, emphasized the need for recognition of outdoor cannabis cultivation as pure farming.

The majority of cannabis cultivation occurs indoors, yet farms like Grasshopper Farms in Paw Paw, with over 6,000 plants spread across 32 acres, and Lume, set to harvest 40,000 plants on a 70-acre plot, underscore the growing trend of outdoor cultivation, marrying traditional farming methods with modern crops.

Despite the ruling, cannabis growers must navigate the appeals process for tax reclassification, as the court's decision isn't nationally binding. Only rulings from higher Michigan courts would cement the status quo. As Mark Magyar from Dykema Law notes, cannabis cultivators now stand on the precipice of a defining moment, with this opinion offering a compelling argument.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links