Michigan's Cannabis Market Faces Minimal Impact from Ohio's New Sales

As Michigan approaches the fifth anniversary of legal cannabis sales, Ohio has joined the growing list of U.S. states offering recreational cannabis. Ohio's market officially opened on Tuesday, August 6th, with 120 stores licensed to sell cannabis to adults aged 21 and over who present valid identification.

In its first five days, Ohio's cannabis sales reached $11.5 million, averaging nearly $2.3 million per day, according to data from the Ohio Department of Commerce. In comparison, Michigan's cannabis market is generating approximately $9 million in daily sales—more than triple Ohio's average.

Despite Ohio's noteworthy launch, the new competition has had little noticeable impact on Michigan's cannabis market, even for retailers near the border who rely heavily on sales to Ohio residents.

Camden Miller, a manager at Pinnacle Emporium in Morenci, Michigan, located near the Ohio border, expressed minimal concern about Ohio's entry into the market. "At the moment, we're not too worried about it," Miller said. "The supply and demand isn't there yet in Ohio, and just like Michigan ... until you get it oversaturated, you're not going to see prices come down. Within the next few years, I'm sure it will start having more of an impact."

Projections suggest Ohio's cannabis market could reach $1.5 billion in its first year, potentially bringing in nearly $150 million in new excise taxes. However, Ohio currently has only a few stores within a 30-minute drive of the Michigan border, including two in Toledo and one in Bowling Green. The Ohio Department of Cannabis Control has plans to license more stores in the future.

For now, Ohio residents appear willing to travel to Michigan for better deals and more extensive product selections. Miller noted that a significant portion of Pinnacle Emporium's business comes from out-of-state customers, including many from Ohio, who often place large orders. "We've already had customers coming in and saying the prices in Ohio are crazy right now," Miller said.

Price discrepancies between the two states are striking. Ohio stores are reportedly selling 1.6 grams of cannabis flower for nearly $50, while Michigan retailers offer eighths (2 grams) for as low as $8. In Ohio, the average price for an ounce of cannabis during the first week of sales was about $266, whereas in Michigan, the average price dipped to just under $80 per ounce in July, according to the Michigan Cannabis Regulatory Agency (CRA).

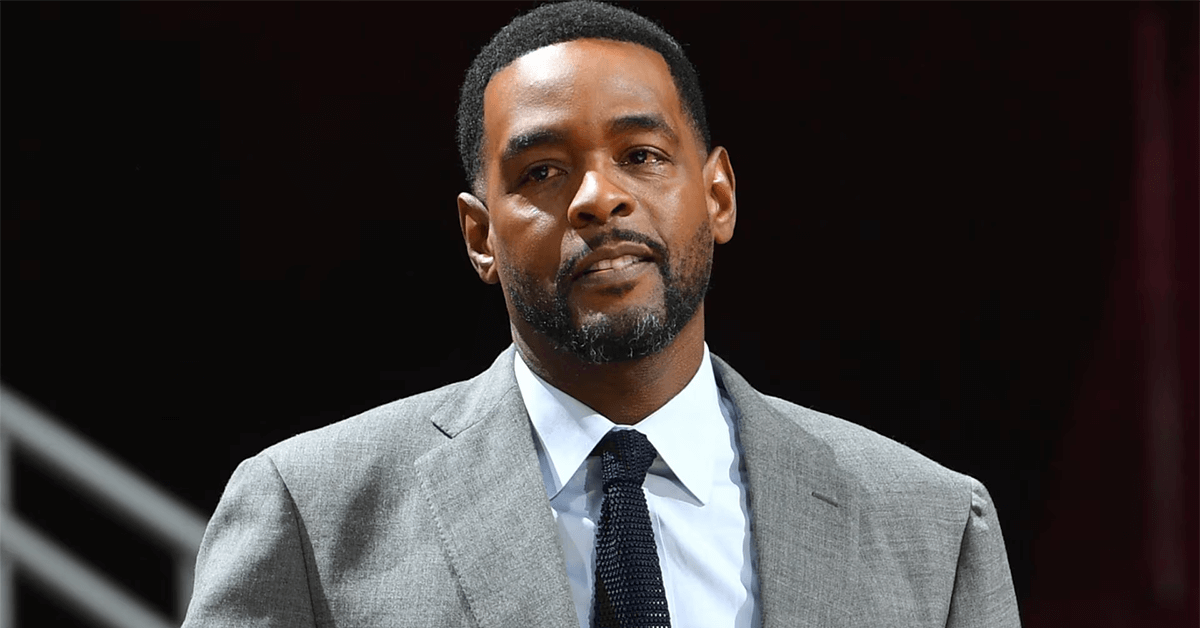

Harrison Carter, a manager and co-owner of NAR Cannabis in Monroe, Michigan, about 12 miles north of the Ohio border, emphasized the price advantage Michigan holds. "There is such a large price discrepancy with the abundance of supply that exists in Michigan and the under-supply that currently exists in Ohio that consumers are making decisions that are very much budget-based," Carter said.

Although Ohio's tax structure is slightly higher, with a 10% excise tax and a state sales tax of 5.75% (plus varying local taxes), compared to Michigan's 10% excise tax and 6% state sales tax, the higher product costs in Ohio may deter some consumers from shopping locally.

The Michigan Cannabis Regulatory Agency declined to comment on Ohio's market launch or its potential impact on Michigan. Meanwhile, Ohio officials have expressed satisfaction with the initial rollout of their recreational cannabis market. "The Division of Cannabis Control has been closely monitoring these first days of non-medical sales and has been extremely impressed with the level of seriousness and responsiveness the industry has shown in meeting the requirements," said Jamie Crawford, spokesperson for the Ohio Department of Commerce. "As we move forward, the division's top priority will remain on the safe and legal sale and regulation of both medical and non-medical cannabis for Ohioans who choose to use them."

Michigan's Mature Market

Michigan's cannabis market, which has been growing since the first licensed businesses began operating in December 2019, benefits from a more flexible licensing program than Ohio's. This has led to significant growth, with Michigan stores having sold nearly $10 billion in cannabis products to date, including approximately $1.3 billion in medical marijuana sales.

The recreational market in Michigan is expected to surpass $3.3 billion in sales over the next year. As of July, Michigan had over 800 licensed stores, with grow and processing operations managing 1.7 million cannabis plants in the pipeline.

In contrast, Ohio's cannabis infrastructure is still developing. The Ohio Department of Commerce recently listed 46 licensed processors, 37 growers, and 120 stores with certificates of operation. Ohio's Division of Cannabis Control, established following a November 2023 ballot initiative passed by 57% of voters, oversees the state's cannabis licenses, similar to a state liquor control commission. Local municipalities in Ohio can impose zoning restrictions or moratoriums on cannabis businesses, further limiting market growth.

Michigan's less restrictive licensing approach has led to clusters of cannabis shops in municipalities that permit recreational sales, particularly along state borders. For example, Monroe, Michigan, near the Ohio border, is home to 18 licensed cannabis shops despite a population of only about 20,300. In Morenci, there is one cannabis shop for every 450 residents.

This liberal licensing has resulted in unique market dynamics in Michigan, including low prices and high competition. Nearly 20% of the retail licenses issued since the market's inception no longer exist, reflecting the market's volatility. Despite these challenges, Michigan retailers view the competitive environment as beneficial for consumers, offering them a wide range of options at low prices.

"We're very much focused on ourselves here in Michigan," said Carter of NAR Cannabis. "We're continuing to offer not only good service but good products at affordable prices ... We're very much in an oversupply moment, and we're able to hit certain price points that a lot of Ohio consumers are frankly used to at this point."

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links