Michigan's Rising Star in the Cannabis Market: Growth and Consumer Trends

In a remarkable display of growth, Michigan's cannabis market has swiftly risen to become the second-largest in the United States, trailing only California. Within a span of four years, the state has developed a highly competitive market landscape, evidenced by over 2,100 active adult-use licenses, including 1,050 for growers and 734 for retailers. This rapid expansion is highlighted by the issuance of an additional 72 grower licenses between June and October.

The robustness of Michigan's market is further underscored by its substantial sales figures. Since June 2023, the adult-use sector has consistently generated over $250 million in monthly sales, indicating both growth and maturity in the market.

Consumer Trends: A Shift Towards Legalized Cannabis

Michigan's cannabis industry is increasingly attracting consumers, offering diverse products at competitive prices. Madeline Scanlon, a cannabis insights manager at Brightfield Group, notes a significant trend: the reduction in retail prices for an ounce of flower to under $200 in late 2021 significantly bolstered legal recreational market purchases. By the third quarter of 2023, with prices averaging around $100 per ounce, approximately 75% of consumers were patronizing recreational dispensaries. This trend also correlates with a decrease in the illegal market's share, which fell from 50% to 37% during the same period.

Demographic Insights: Who are the Consumers?

The Brightfield Group's data provides fascinating insights into the demographics of Michigan's adult-use cannabis consumers. Notably, women constitute the majority at 56%, with a substantial representation from Gen Xers and Baby Boomers, who make up 40% of the consumer base. Preferences among these consumers are clear, with flower (69%) and pre-rolls (67%) being the most popular choices, followed closely by gummies. Despite the affordability, a significant 80% of recreational shoppers prioritize price over other factors such as taste, effect, or dosage.

A Diverse and Competitive Business Landscape

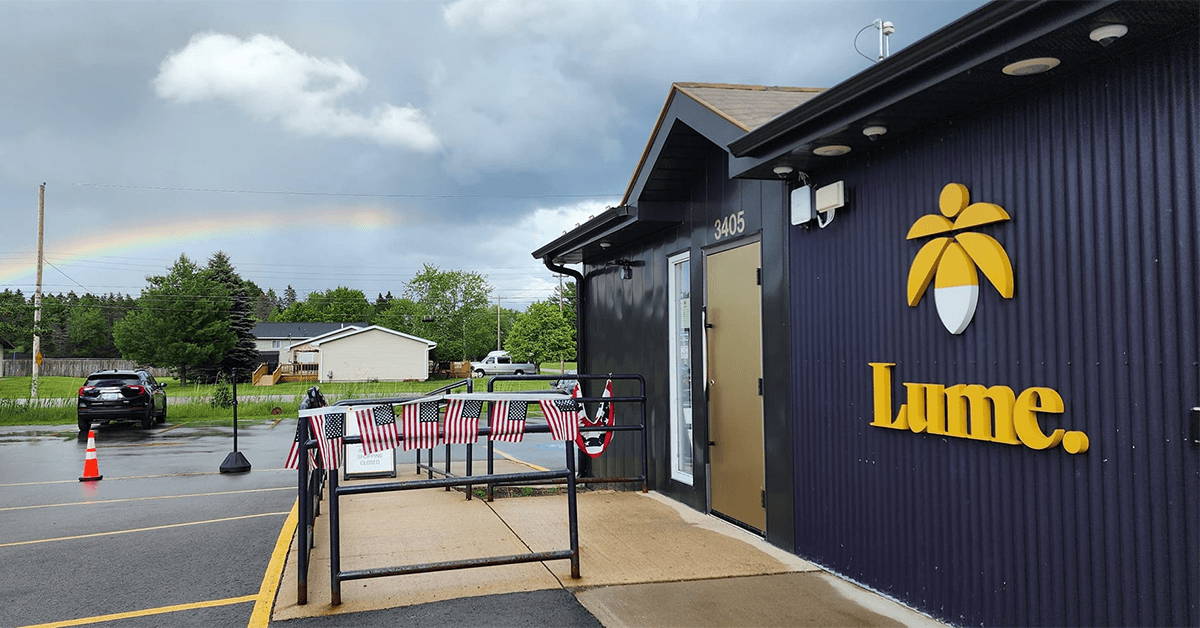

Michigan's cannabis industry is marked by intense competition among brands and retailers, each striving to differentiate itself with unique product offerings. This competitive environment has led to a staggering $6.4 billion spent on recreational cannabis since December 2019. Local brands, such as Lume Cannabis Co., contribute to this diversity, while multistate operators (MSOs) like PharmaCann, Ascend Wellness Holdings Inc., and Cresco Labs Inc. add to the competitive intensity with their comprehensive product ranges.

Market Impact and Future Outlook

Michigan's cannabis market is not only growing but also impacting consumer behavior and economic prospects. According to Brightfield's study, 23% of Michigan residents have purchased cannabis in the last three months, surpassing the national average. This expansion reflects a broader trend towards normalization and acceptance of cannabis, fostering an environment conducive to innovation and increased government revenue. The growing number of operators suggests a future of more accessible and affordable cannabis products, promising continued growth and evolution in the sector.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links