New Line Processing Launches Credit Solution for Michigan Cannabis Buyers

Michigan's cannabis industry has long faced financial challenges due to federal restrictions that prevent the use of traditional banking services for transactions. Specifically, credit card companies like Visa and Mastercard, which are federally chartered, have prohibited their use in cannabis-related transactions. This has left both dispensaries and customers in Michigan grappling with limited payment options, often resorting to cash-only transactions.

In response to these challenges, New Line Processing, a New York-based company, is stepping into the Michigan market with a new financial product designed to help cannabis businesses and consumers navigate these restrictions. Founded in 2014, New Line Processing focuses on supporting regulated and restricted industries, with cannabis being one of its core competencies.

A New Approach to Cannabis Transactions

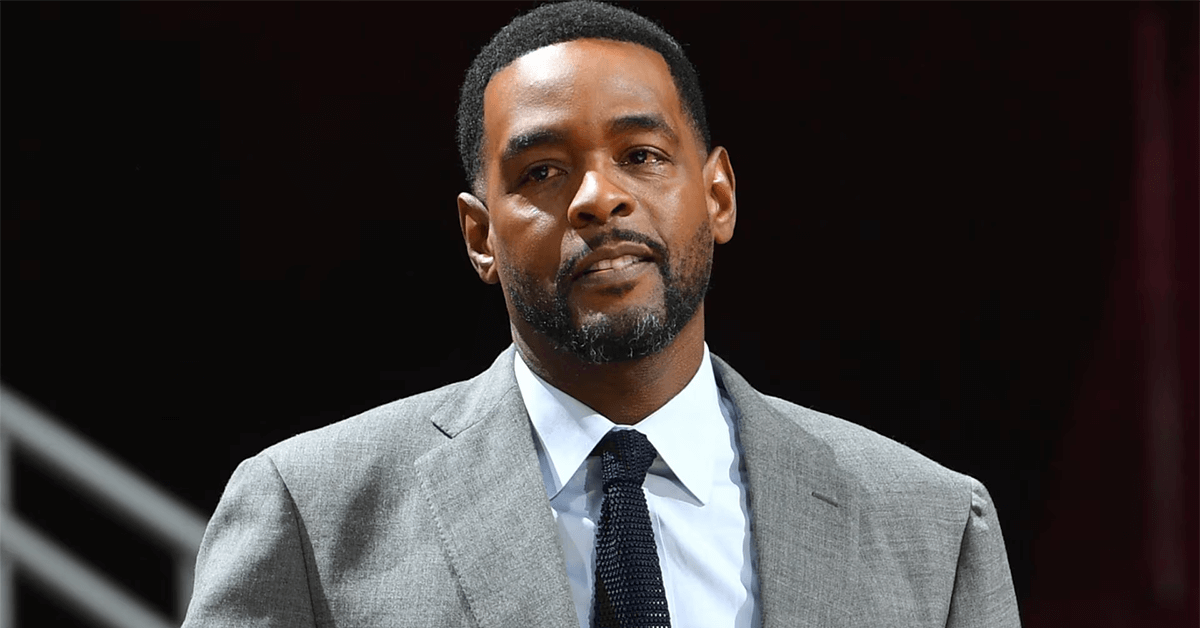

Dan Abadir, CEO of New Line Processing, recently shared details about their new product in an interview. The company is introducing a closed-loop credit system that provides cannabis consumers with revolving lines of credit, which can be used at participating dispensaries. This system, named Omn Credit, is designed to bypass the restrictions imposed by traditional credit card companies while ensuring compliance with state and federal regulations.

The credit limits offered through this system range from $250 to $1,000, depending on the creditworthiness of the applicant. This approach is particularly well-suited to the cannabis market, where the average transaction value hovers around $100 to $140. By offering modest credit limits, the system minimizes risk while providing consumers with convenient access to credit for their purchases.

How It Works

When a customer enters a participating dispensary, they will be screened using a device provided by New Line Processing. This device verifies the customer's identity and checks for any potential fraud, using data from the DMV and other sources. Once approved, the customer receives an SMS notification with a link to complete their account setup, which involves creating a user ID, password, and accepting the terms and conditions. Upon completion, the customer is issued a digital QR code, which serves as their credit account for purchases.

Unlike other financial instruments that act as intermediaries, such as stored-value cards, this revolving credit line functions similarly to traditional credit cards, except it operates entirely within the cannabis industry's legal framework. The dispensaries benefit from this system as well, receiving free equipment from New Line Processing to facilitate the credit application and transaction process.

A Step Towards Greater Financial Inclusion

While initially designed to assist consumers with limited or weak credit, the Omn Credit system aims to attract a broad range of customers, including those with prime and mid-prime credit ratings. The goal is to expand the product's footprint beyond the cannabis industry, eventually making it a general-purpose financial tool available across various sectors.

This innovative solution offers a much-needed financial service to Michigan's cannabis market, potentially setting a new standard for how transactions in regulated industries can be handled. As New Line Processing continues to grow, it aims to make Omn Credit a household name, providing consumers with a reliable and compliant way to finance their purchases in the evolving cannabis industry.

For more information about New Line Processing and their credit solutions, visit newlineprocessing.com.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links