Ohio Embraces Recreational Marijuana, Becoming 24th State to Legalize

While today's news on Ohio's landmark decision to legalize recreational marijuana might not appear directly related to Michigan at first glance, it carries significant implications for our state. It's anticipated that Michigan will witness a dip in the tax revenue generated from cannabis sales as Ohioans, who previously might have crossed state lines for their purchases, will now be able to buy and use marijuana legally within their own state. This development presents both challenges and opportunities for Michigan's marijuana market and policy landscape.

In a landmark decision, Ohio has joined the ranks of states choosing to legalize recreational marijuana, marking it as the 24th state in the nation to take such a step. The passage of Issue 2 in the recent ballot measure has laid the foundation for a significant shift in policy, reflecting a broader national trend towards the acceptance of cannabis.

This historic vote comes after Ohioans gave the green light for medical marijuana in 2016. Now, with the "yes" vote on Issue 2, adults 21 and older will have the legal prerogative to use, grow, and sell marijuana under a state-imposed regulation and tax program, effectively regulating cannabis similarly to alcohol. The newly approved measure is slated to take effect within 30 days from the passing vote.

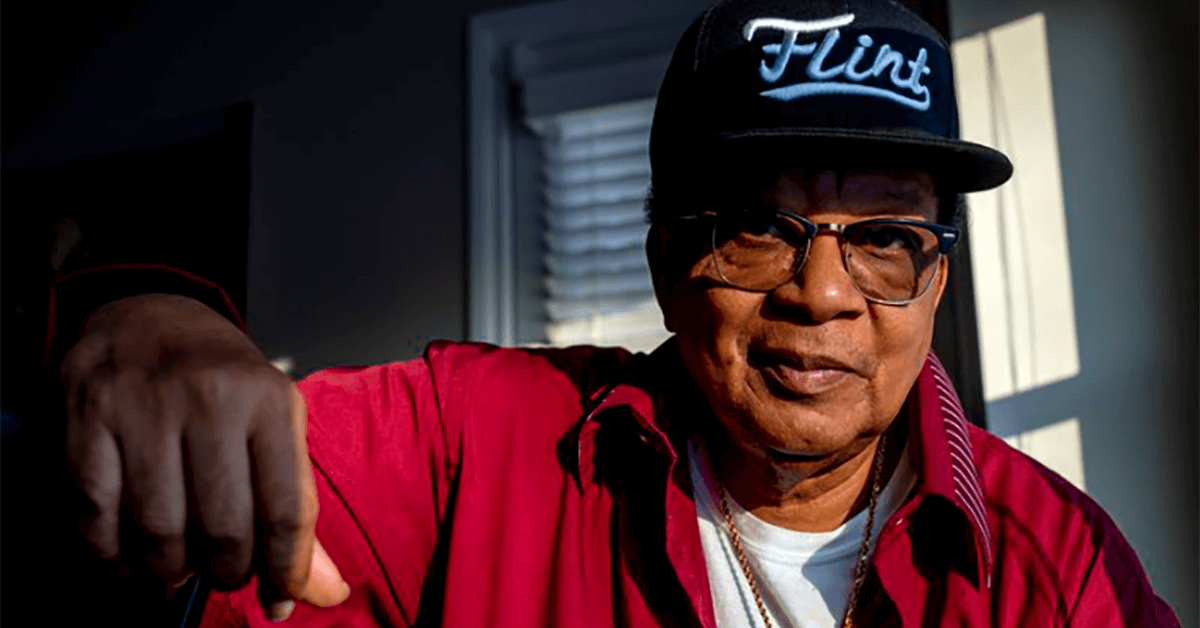

The legalization of recreational marijuana in Ohio is seen by many as part of a growing movement that is extending even into traditionally conservative regions. This sentiment echoes the statement by Tom Haren, a spokesperson for the Coalition to Regulate Marijuana Like Alcohol, who noted that Ohio's decisive action points towards a future where adult-use marijuana is legal and regulated.

Under the provisions of the new law, adults will be permitted to buy and possess up to 2.5 ounces of cannabis and to cultivate marijuana plants at their homes. Additionally, a 10% tax on marijuana sales is to be imposed, with the revenue earmarked for administrative costs, addiction treatment programs, municipalities hosting dispensaries, and for social equity and jobs programs aimed at bolstering the industry.

The journey towards legalization has not been without its challenges. The measure faced considerable opposition from GOP lawmakers, Republican Governor Mike DeWine, and various business and manufacturing organizations, concerned about potential impacts on workplace and traffic safety. In a campaign marked by stark contrasting views, opposition groups raised concerns about the sale of marijuana edibles to children and the broader societal implications. Despite these challenges, the measure passed, reshaping Ohio's legal and social landscape.

Ohio's step towards legalization was bolstered by substantial advocacy efforts, as proponents of Issue 2 significantly outraised opposition. It also comes on the heels of an Ohio State University study which forecasts a lucrative economic impact, with potential annual tax revenues between $276 million to $403 million by the fifth year following full legalization.

Issue 2 represents not just a legislative change, but also a cultural shift in Ohio's approach to marijuana. Despite the possibility of legislative adjustments post-passage due to it being a citizen-initiated measure, the electorate's decision carries considerable weight. The future of Ohio's cannabis policy, and indeed the broader national dialogue, has entered a new era of regulatory acceptance and economic opportunity.

As Ohio sets up its Division of Cannabis Control within the Department of Commerce, eyes will be on the state to see how it navigates this new terrain, balancing regulation with economic growth, public health, and social equity. This movement continues to gain momentum, with similar recreational marijuana ballot measures poised to be in front of voters in states like Florida, Nebraska, and South Dakota in 2024, signifying a potential continuation of this trend in American policy.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links