SEC Continues Legal Battle Against Michigan Cannabis Fraud Case

In a significant development within the Michigan legal landscape, the Securities and Exchange Commission (SEC) is persisting with its fraud case against Robert Shumake, Jr., despite facing challenges related to bankruptcy claims and the uncertain prospect of financial restitution through fines. The case, which has garnered attention due to its implications for investor protection and the integrity of crowdfunding initiatives, underscores the complexities of enforcing securities law in the burgeoning cannabis industry.

The Allegations Unfold

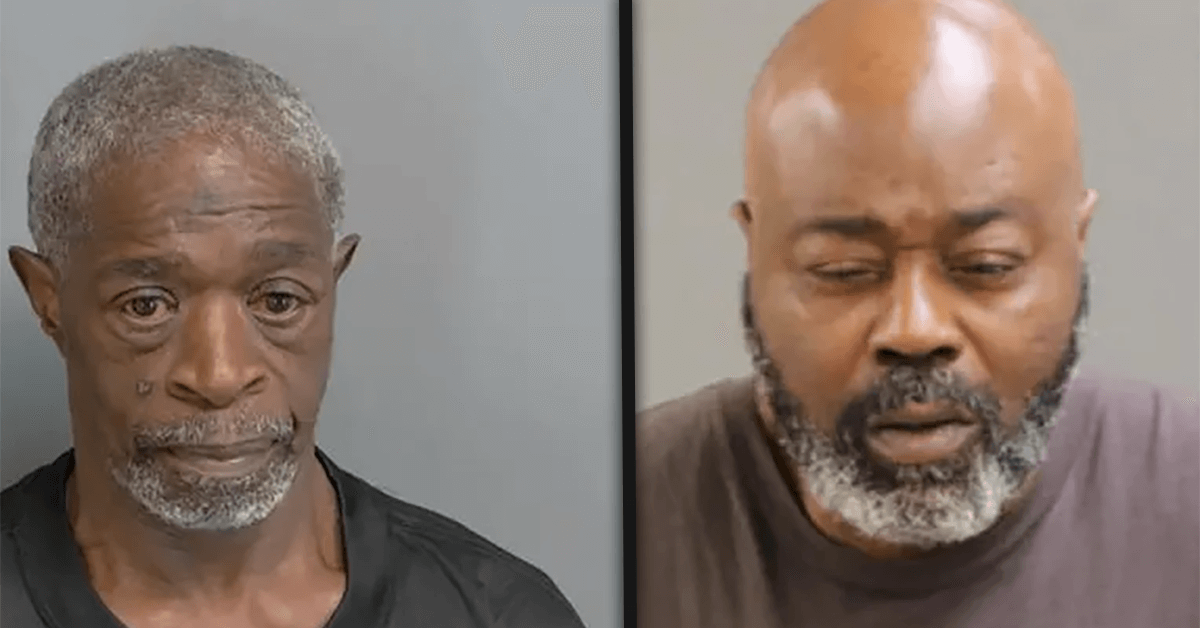

The crux of the SEC's allegations, first brought to light in 2021, involves fraudulent activities connected to unregistered crowdfunding offerings. Robert Shumake, Jr., along with Nicole Birch and Willard Jackson, is accused of orchestrating deceptive schemes through their involvement with two companies: Transatlantic Real Estate and 420 Real Estate. These entities were purportedly engaged in the cannabis and hemp sectors.

The SEC's complaint details how Shumake, in collaboration with Birch and Jackson, managed to raise substantial sums from retail investors—$1,020,100 through Transatlantic Real Estate and $888,180 via 420 Real Estate. However, instead of channeling these funds towards their stated investment purposes, the trio allegedly diverted them for personal use, betraying the trust of their investors.

The timeline of these unauthorized securities offerings spans from September 2018 through June 2020, with Shumake purportedly playing a pivotal role in both ventures. His attempt to conceal his involvement, due to a prior criminal conviction related to mortgage fraud, involved positioning Birch and Jackson in leading roles within the respective companies, thus maintaining a facade of legitimacy.

Legal and Financial Entanglements

Complicating the SEC's efforts to hold Shumake accountable is his strategic maneuver to declare bankruptcy, a move that potentially shields him from financial penalties. The SEC, however, argues that its enforcement actions are exempt from bankruptcy protections, emphasizing its mandate to safeguard investors and maintain market integrity. The agency contends that its pursuit of justice in this case falls within its "police power," a principle that transcends the limitations typically imposed by bankruptcy proceedings.

Adding a layer of intrigue to the proceedings is Shumake's decision to legally change his name to Bobby Shumake Japhia in May 2023. The SEC's attempts to adapt its documentation to reflect this change have been hampered by a lack of cooperation from Japhia's legal counsel, further complicating the legal landscape.

The Path Forward

As the case progresses, the departure of Japhia's legal representation due to unpaid bills underscores the financial instability surrounding his defense. The law firm's withdrawal, citing debts exceeding $36,000, signals a turbulent phase in the litigation process. Despite these challenges, the SEC remains committed to its mission of penalizing and preventing fraudulent activities within the securities market, highlighting the case's broader implications for regulatory oversight and investor protection.

This ongoing legal battle not only emphasizes the regulatory challenges associated with crowdfunding and investment in the cannabis sector but also serves as a cautionary tale for investors and industry stakeholders about the importance of due diligence and the risks of fraudulent schemes.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links