Oakland County Cities Prevail in Legal Battle Over Cannabis Ballot Questions

A recent ruling by the Michigan Court of Appeals has blocked ballot proposals in four Oakland County cities—Farmington, South Lyon, Sylvan Lake, and Wixom—that sought to allow cannabis retailers to operate within their limits. The court decision upholds the cities' efforts to keep these proposals off the November ballot.

The dispute centers around attempts by local ballot committees to amend city charters to permit two adult-use cannabis retailers in each city. The cities argued that these proposed amendments violated state law, specifically Michigan's cannabis regulations, and would improperly limit municipal authority over local business regulation. The proposed amendments also contained zoning and administrative provisions that, according to the cities, would strip them of their ability to manage business regulations and improperly favor the cannabis industry.

Judges Michelle Rick, Michael Kelly, and Philip Mariani agreed with the cities, ruling that voter-initiated petitions cannot be used to amend city charters to establish regulatory and licensing frameworks for cannabis businesses. The court emphasized that under Michigan's marijuana law, local regulations are allowed within specific parameters, but using a charter amendment to create a regulatory scheme exceeds what is legally permissible.

"The state marijuana act permits local regulations within certain set parameters, and to honor that intent, local regulation must be permitted within those parameters," the court wrote. The ruling reaffirmed the trial court's earlier decision, concluding that voter-initiated charter amendments are not a valid way to implement local cannabis regulations under the state's marijuana laws.

The court further clarified that the Michigan Regulation and Taxation of Marihuana Act (MRTMA) only allows voter initiatives in a limited capacity—specifically, when voters seek to prohibit or set the number of cannabis retail businesses in a community. The act does not extend the same authority to more detailed regulatory or zoning proposals, such as those in the contested ballot initiatives.

John Fraser, attorney for the ballot question committees, declined to comment on the Court of Appeals decision.

The legal battle began in July when the four cities filed a lawsuit in Oakland County Circuit Court, seeking to have the ballot proposals rejected. On August 8th, Judge Nanci Grant ruled in favor of the cities, stating that the requests made in the proposals went beyond the limits of state law. She noted that the ballot measures attempted to alter city charters in a way that conflicted with existing zoning ordinances and police powers granted to municipalities.

Judge Grant pointed out that Michigan's cannabis law is clear about the limits of voter-initiated petitions, which are confined to ordinances that either ban cannabis businesses or set the number of establishments allowed. Proposals that attempt to amend city charters to bypass these limitations, she said, are inconsistent with both the MRTMA and the Home Rule City Act (HRCA).

Despite the court rulings, the committees behind the ballot initiatives filed a counter-lawsuit, arguing that they were acting to safeguard the rights of voters. They claimed the cities were unjustly preventing the electorate from deciding on the issue, accusing the municipalities of "unlawful interference" and asserting that the cities' refusal to allow a vote was based solely on their opposition to the content of the petitions.

The legal tug-of-war is part of a broader conflict in Michigan, where municipalities have the authority to determine whether to permit recreational cannabis businesses. Since Michigan voters legalized cannabis in 2018, several cities have been involved in legal disputes over local licensing and zoning for cannabis businesses. Similar attempts to force cities to allow cannabis retailers have been seen in places like Rochester, Keego Harbor, Grosse Pointe Park, Birmingham, and Troy, though many of these efforts have been unsuccessful. Voters in Grosse Pointe Park, Keego Harbor, Rochester, and Birmingham rejected cannabis-related ballot initiatives, while Troy's initiative failed to make it onto the ballot at all.

As the legal landscape around cannabis continues to evolve, the ruling underscores the limited scope of voter influence over local cannabis regulations and reaffirms municipalities' rights to control how and where cannabis businesses operate within their boundaries.

Discussing Legal Cannabis With Your Children: Expert Tips for Michigan Parents

In Michigan, where adult-use cannabis has been legal since 2018, parents face the challenge of discussing cannabis in a way that is both informed and thoughtful. Establishing boundaries and fostering open, honest conversations about cannabis use has become a crucial task for families, especially as cannabis becomes more normalized in society.

One key piece of advice that experts offer parents is to approach these discussions with honesty—not only with their children but with themselves regarding their own cannabis use.

"And by being honest, that can also mean parents being transparent with themselves about how they use cannabis," said Christine Murray, a licensed social worker and child therapist.

Since Michigan legalized recreational cannabis for adults 21 and older, conversations about responsible use have become more important. The American Academy of Pediatrics continues to advise against cannabis use for anyone under 21, citing the impact of cannabis on the developing brain. According to Murray, the teenage brain is still forming crucial neural pathways, making it especially vulnerable to the effects of cannabis.

"People often think that cannabis is harmless, but they don't always understand the potential complications for a child or teen's brain development," Murray explained. "The brain undergoes significant changes during adolescence, so using cannabis at that age is very different from an adult starting after the age of 25."

For this reason, health professionals emphasize that conversations about cannabis should begin early. Parents should clearly communicate the risks of cannabis use and share any concerns they may have.

Even though cannabis is legally restricted to adults, its increasing presence in Michigan's communities can influence how children perceive it. Colleen Oakes, a prevention specialist, pointed out that young people often mirror the behaviors of the adults around them. This means that the way adults approach cannabis use—whether in moderation or excess—can shape a child's perception of what is normal.

"Parents are role models for their kids," Oakes said. "We encourage adults to be mindful of how they use substances like cannabis, alcohol, and tobacco around their children. Modeling responsible behavior is one of the most effective tools parents have."

In households where cannabis use is legal for adults, setting clear boundaries is crucial. Murray stressed that parents should secure cannabis products in a place where children and teens cannot access them. Additionally, if parents smoke cannabis, it's advised they avoid doing so in front of their children and change clothes afterward to limit exposure.

It's also important to explain to children the difference between adult cannabis use and the risks of underage consumption. By framing the discussion in terms of health and safety, parents can create a more productive and open dialogue.

When parents suspect their children may be experimenting with cannabis, Murray emphasized the importance of approaching the conversation with understanding, rather than judgment.

"When talking to teenagers, it's not about catching them doing something wrong. It's about understanding their experience and helping them navigate it," Murray said. "Parents can ask questions like, 'What makes you want to try cannabis?' or 'What are other ways you can cope when you're feeling stressed?'"

Some teens may use cannabis as a way to manage stress, anxiety, or other emotions. However, Murray cautioned against using substances as a coping mechanism, as it often only provides short-term relief while leading to long-term challenges.

"Teens frequently say, 'It helps me calm down,' or 'It helps me focus,' but just because something feels good in the moment doesn't mean it's good for your overall health," Murray noted.

Parents should be clear about their household's rules and expectations regarding cannabis use, reinforcing that it is not allowed for anyone underage. "Parents shouldn't hesitate to say that cannabis use isn't permitted in their home," Murray said.

For Michigan parents looking for guidance on how to handle these complex conversations, resources are available. Programs like the "Talk. They Hear You." campaign, provide support for families aiming to have honest, productive conversations with their children about substance use.

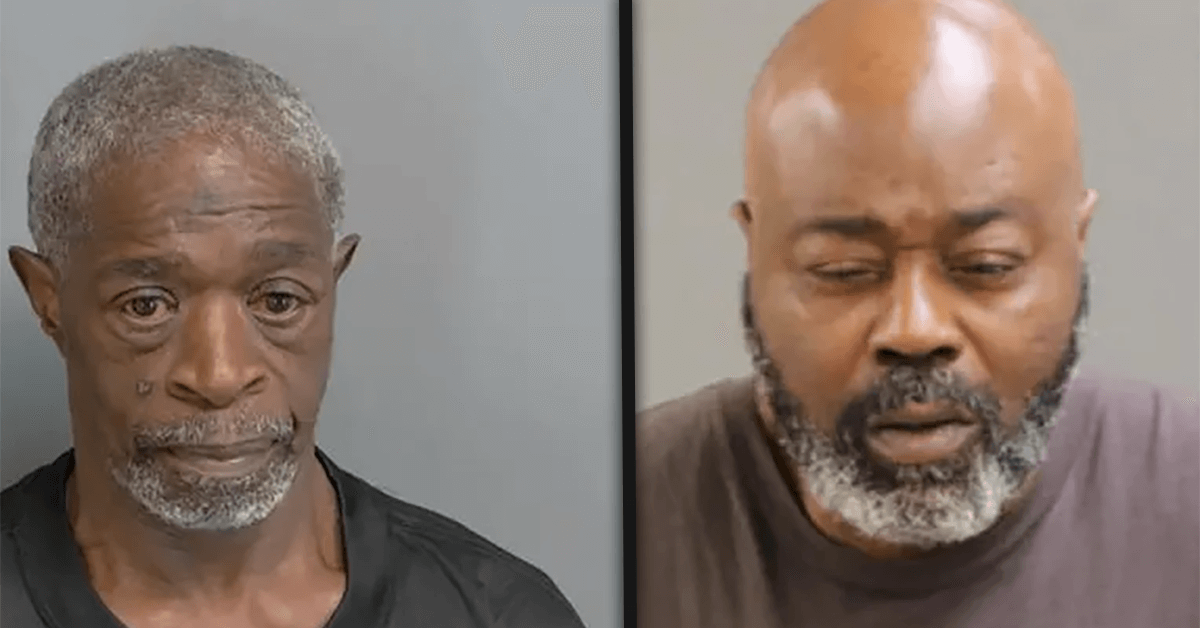

Jury Convicts Two Men in Violent Warren Dispensary Robbery

Two men have been convicted of multiple felonies related to a robbery at a cannabis dispensary in Warren that occurred last year. One of the convicted individuals was employed at the dispensary during the time of the crime.

Lavall Perkins, 64, from Detroit, and Michael Graham, 48, from Eastpointe, were both found guilty by a jury of assault with intent to murder, conspiracy to commit armed robbery, and armed robbery. The charges stem from an incident in June 2023, when the two stole a safe from the Bring Me A Bag dispensary.

The crime took place on June 9th, when Perkins, along with an unidentified accomplice, created a disturbance outside the dispensary. The unidentified accomplice fired shots through the glass door of the business, hitting a victim. After unlocking the door, the assailant fired again as the victim attempted to retreat. Following the attack, both the accomplice and Perkins entered the dispensary and stole a safe before fleeing the scene in a Chevrolet Tahoe.

Graham, who was behind the wheel of the getaway vehicle, was employed at the dispensary at the time of the robbery.

The convictions came after an eight-day trial, during which the jury weighed the evidence and testimonies presented.

"These convictions underscore our community's commitment to holding violent offenders accountable," said Macomb County Prosecutor Peter Lucido. "The jury's decision reflects the compelling evidence and the bravery of the victims who testified. We hope this verdict offers some closure to those impacted by this senseless act of violence."

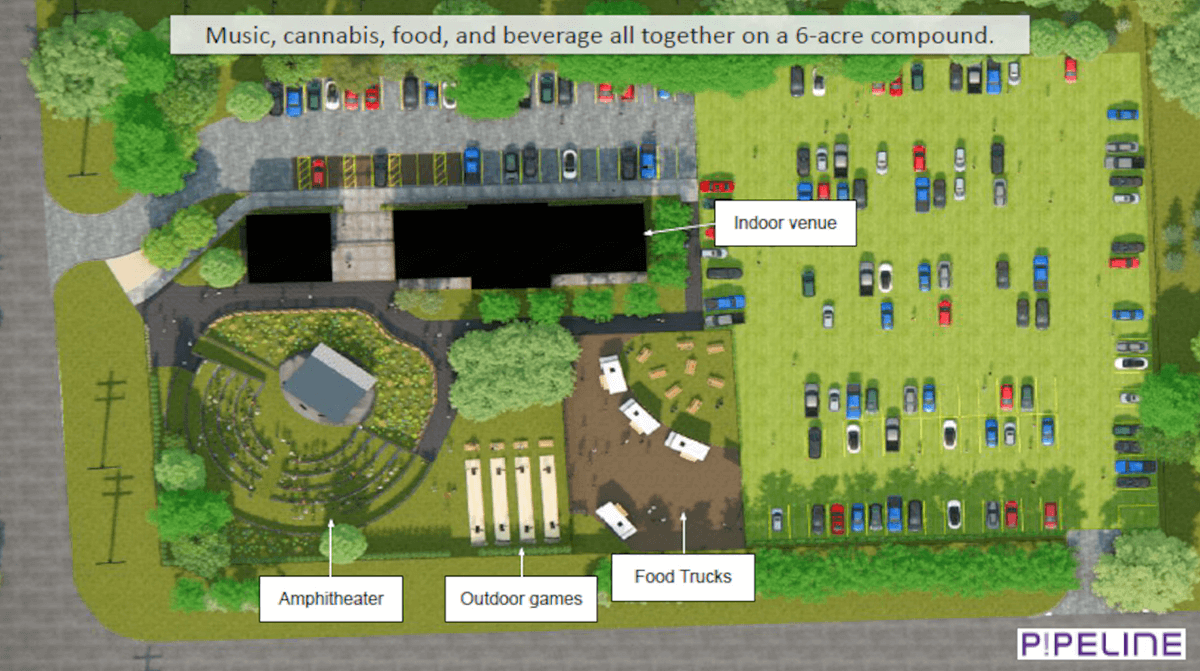

Michigan's First Music and Cannabis Lounge Could Open Near Ypsilanti

A developer has proposed what could become Michigan's first combined music venue and cannabis-consumption lounge near Ypsilanti. The project, preliminarily approved by the Ypsilanti Township Planning Commission on August 27th, involves transforming 3.87 acres at 2525 S. State St. into a unique space that integrates live music and cannabis use.

The plan includes a 4,300-square-foot indoor lounge, an outdoor amphitheater, and a 1,260-square-foot storage building. Michael Ludtke, the landowner and applicant, who is also developing a nearby dispensary, has named the venue "Pipeline" as a nod to the underground cannabis market, often referred to as the "black market."

Ludtke, who has long envisioned blending music with cannabis in a permanent setting, emphasized the lack of spaces where cannabis consumers can enjoy the substance in a social, experiential environment. "As a cannabis consumer, we really don't have anywhere to enjoy cannabis with any type of experience," Ludtke stated.

According to Ludtke, this venue would be the first in the state to offer both indoor and outdoor cannabis consumption. The indoor facility would host events year-round and welcome a broad range of music genres. Ludtke mentioned that Detroit's rap scene, classic hippie-style bands reminiscent of the Woodstock era, electronica, and DJ performances are among the potential genres that could be featured, all within a cannabis-friendly environment.

The outdoor amphitheater will include spaces for food trucks and will be enclosed by a non-visibility fence to comply with state regulations. The venue plans to operate three days a week, accessible to anyone aged 21 or older for a $25 entry fee, or for free with a $50 purchase at the adjoining dispensary. Planned operating hours range from noon to 10 p.m. or 5 to 10 p.m., depending on the day, with one day each week reserved for private events such as weddings or parties.

Pipeline will be situated just south of where Ludtke is establishing Frost Cannabis, a dispensary and cultivation facility at 1250 Watson Ave. Although these projects are distinct, both developments are on Ludtke's six-acre property, which was divided into two parcels in April 2023 to comply with state requirements for separate parcels.

Security at the venue will be stringent, with indoor and outdoor areas under continuous video surveillance. Footage will be stored for 60 days, with access provided to law enforcement as required by state law. Additionally, Ludtke mentioned that a noise study has been conducted, and adjustments have been made to minimize noise impact on the nearby West Willow Neighborhood.

Ludtke also commented on the broader concept of cannabis consumption lounges, describing them as a "hollow idea" if they only offer a space to consume cannabis without additional experiences. He believes that combining cannabis use with music and social activities will create a more appealing environment.

In Michigan, only three cannabis consumption lounges currently operate, the most recent of which opened in February in Kalamazoo. For the Pipeline project to proceed, developers must finalize an agreement with the township board, addressing conditions such as the number of large events, temporary parking needs, security measures, portable toilets, capacity, hours of operation, lighting, and waste management.

Meet Michigan's Certified Ganjier: Bridging Education and Cannabis

One of the distinguishing features of Neighborhood Provisions, a cannabis dispensary, is the presence of a certified ganjier, Andreas Hantzis. This role, akin to a sommelier in the wine world, represents a growing professional standard in the cannabis industry.

Just as wine enthusiasts rely on sommeliers for expert guidance, the cannabis community now looks to ganjiers. These professionals undergo rigorous training to master the complexities of cannabis, from cultivation to consumption. The certified ganjier program, based in California, is designed by some of the most esteemed figures in the cannabis field and mirrors the structure of traditional sommelier courses.

Earning the ganjier title is no small achievement. The certification process involves over 1,800 hours of online study through 35 lectures, two days of hands-on training, and a demanding final exam. Globally, only 320 individuals have earned this certification, with only a few based in Michigan.

As cannabis sales expand across the United States—with 41 states permitting medical use and 23 allowing recreational sales—there is a growing need for knowledgeable professionals to guide consumers. The ganjier program was created to meet this demand, equipping experts like Hantzis with the tools to educate and assist cannabis consumers.

"Education is key to dispelling the stigma surrounding cannabis and helping the community understand its many benefits," Hantzis said.

Today, cannabis extends far beyond traditional smoking. The market includes a wide array of products such as CBD-infused topicals, edibles, tinctures, and more, each offering unique benefits. Many older adults are turning to cannabis as an alternative treatment for health issues like chronic pain and insomnia.

"They've been told all their lives that it was 'the devil's lettuce,' but cannabis has many medicinal and therapeutic qualities that are finally being recognized," Hantzis added. "Researchers are now uncovering how various cannabis molecules interact with our bodies. In the past, you never knew what was in the cannabis you were consuming. Today, with strict safety and compliance measures, we can ensure a clean and tested product. The stereotypical stoner image is outdated—times have changed."

Lume Cannabis Employees in Escanaba Vote to Unionize

Employees at Lume Cannabis in Escanaba are on the verge of making history by forming the first unionized cannabis workforce in Michigan's Upper Peninsula. The group, known internally as "luminaries," recently took significant steps toward unionizing, signaling a new chapter in the labor movement within the region's cannabis industry.

The decision to unionize was driven by the workers themselves, as noted by Marie Werth, secretary-treasurer of UFCW Local 1473. "They were encountering issues within their company," Werth explained. "They wanted to ensure their voices were heard. Organizing into a union was the path they chose to achieve that."

Currently, there are 290 cannabis dispensaries across the country affiliated with the United Food and Commercial Workers International Union (UFCW). If successful, Lume's Escanaba location would be the first in the Upper Peninsula to join their ranks.

The unionization process is being guided by UFCW Local 1473, with President Jake Bailey outlining the crucial steps involved. "You never file for an election until you've reached out to everyone eligible in the unit and secured support from at least 70% of them through authorization cards," Bailey said. "That support is essential before moving forward with a petition to the National Labor Relations Board."

On July 23rd, 14 out of the 18 budtenders at Lume Escanaba voted in favor of unionizing, surpassing the required threshold with a 78% approval rate.

In response, Lume Cannabis Co-President and COO Doug Hellyar expressed the company's commitment to its employees. "At Lume, we value and respect our amazing employees," Hellyar stated. He highlighted the company's efforts to provide industry-leading wages, benefits, and professional growth opportunities. According to Hellyar, over 500 Lume employees have been promoted internally, reflecting the company's focus on developing talent from within.

Hellyar also pointed to Lume's contributions to the Upper Peninsula, including donations of $25,000 to the Marshfield Medical Center-Dickinson Cancer Center in Iron Mountain and $17,000 to the Walton Blesch Stadium Legacy Foundation for infrastructure improvements at a historic high school field in Menominee.

For the Lume Escanaba luminaries, the primary motivations behind their unionization effort are wages, benefits, and guaranteed working hours. With the initial vote completed, negotiation meetings for the collective bargaining agreement are expected to commence in the coming months.

Helpful Links

Helpful Links