The Impact of Cannabis Legalization on Michigan's Glassmaking Culture

Last weekend, glass enthusiasts from across Michigan convened in Detroit for the Michigan Glass Project, a festival celebrating the state's rich glassmaking culture, which has a strong connection to the cannabis community. Although I couldn't attend this year, the event sparked nostalgia for the head shops of the past.

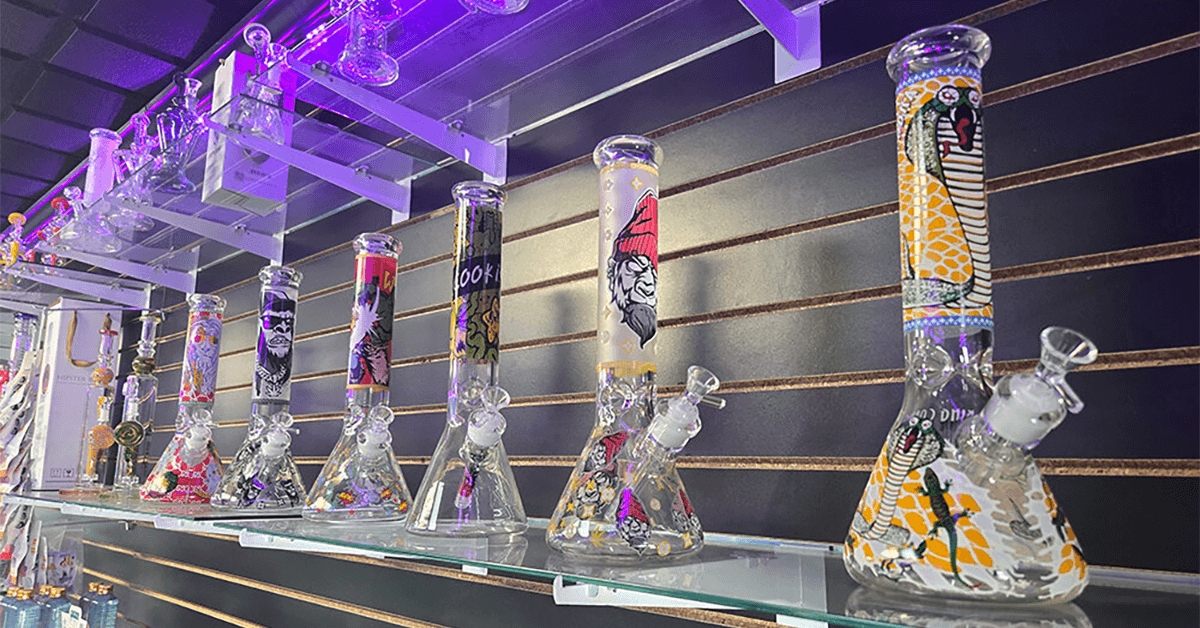

Before the legalization of medical and recreational cannabis, finding quality bongs and pipes was a challenge. Options were limited to a few sketchy gas stations offering a small selection of foreign-made, mass-produced bowls and plastic bongs. For higher-quality pieces, one had to venture to head shops like In Flight Sports, Su Casa Boutique, or Krazy Katz, all of which have since closed.

You might wonder why these longstanding head shops have closed despite the growing acceptance and use of cannabis. The answer lies in the influx of wealthy investors into the cannabis accessory market, mirroring the broader trends in the cannabis industry. Legalization has rapidly changed laws and attitudes, attracting large-scale operators to a market once dominated by small, local businesses.

In the not-so-distant past, selling bongs could lead to jail time. Cannabis pioneer Tommy Chong was infamously imprisoned for selling bongs and other cannabis accessories online just two decades ago. Back then, the accessory market was fraught with risks that deterred deep-pocketed businesses. Local head shops, often run by cannabis enthusiasts, were among the few places where accessories could be purchased, with products labeled as "novelties" or "for tobacco use only" to avoid legal trouble.

As the legal cannabis market expanded, the risks diminished, and the technology and delivery methods for both cannabis and tobacco evolved significantly. The rise of vaping transformed the landscape, with consumers shifting from cigarettes to vapes, leading to a surge in vape shops that soon began stocking cannabis accessories. Chains like Wild Bill's have proliferated across the state, bolstered by the increasing popularity of vaping and cannabis. Simultaneously, cannabis dispensaries have emerged, also selling accessories and glass.

This shift has made it difficult to find locally made glass unless you connect with artists directly through social media. Corporate chains and large cannabis dispensaries have largely replaced mom-and-pop shops. Before legalization, a vibrant community existed around cannabis, with local glass artists showcased in head shops, fostering a sense of pride in owning high-quality, locally-made glass. These shops also played a crucial role in educating consumers about good glass quality and functionality. Today, much of this knowledge and passion has been lost.

This trend is not unique to Lansing. In Grand Rapids, only two mom-and-pop head shops that existed before legalization remain. The growth of the cannabis industry has pushed local operators out of the accessory market. It's a significant loss, and consumers are encouraged to support local shops when purchasing glass. In the Lansing area, options are limited but include Level Up Smoke Shop in Frandor and La Casa Del Rew in Old Town. These shops often offer products at comparable prices to mass-produced glass, supporting individuals who have long been valuable resources to the cannabis community.

The Role of Cannabis Industry Donations in Supporting Michigan Nonprofits

Molly MacDonald, CEO of Southfield-based The Pink Fund, which offers financial assistance for nonmedical bills to breast cancer patients, appreciates the recent $50,000 donation from a local cannabis business, even though she's not familiar with the intricate federal regulations governing cannabis.

"We take financial donations from almost everyone," said MacDonald. Patients supported by The Pink Fund often struggle to pay rent, mortgages, utilities, and car loans due to income loss while undergoing medical treatments.

Non-cannabis companies frequently donate to nonprofits and benefit from tax deductions. However, the cannabis industry, which is legally obligated to meet social equity requirements, often donates without expecting such tax benefits. Josey Scoggin, executive director of the Great Lakes Expungement Network, highlighted that their group relies heavily on donations from cannabis businesses. She noted that 88% of their donors do not request receipts, aware that their contributions are not tax-deductible.

Cannabis companies navigate complex federal laws, which still classify cannabis sales and use as illegal. The IRS prohibits deductions beyond inventory costs for businesses involved in Schedule I or Schedule II drugs, including cannabis. This rule applies even in states where cannabis is legalized, as federal law under the Controlled Substances Act prevails.

Michigan, which legalized recreational cannabis use in 2018 and medical use in 2008, has seen its cannabis industry flourish. In May 2024, sales of recreational and medical cannabis products reached $279.6 million, a nearly 14% increase from May 2023's $245.9 million.

The U.S. Department of Justice is considering reclassifying cannabis from a Schedule I to a Schedule III drug, which would align it with substances like ketamine and anabolic steroids. This reclassification could open access to traditional banking systems and standard business-tax deductions for cannabis businesses.

Attorney James Allen explained that the Federal Controlled Substances Act currently hinders financial services for the cannabis industry, although legislation such as the SAFE Banking Act aims to change this. While the House has approved the Act, it awaits Senate approval.

Despite the federal restrictions, cannabis-related businesses manage their financial transactions through specialized institutions. The Justice Department focuses on illicit cannabis sales rather than state-approved activities, allowing some level of banking for the industry.

Cannabis business owners like Jerry Millen of The Greenhouse of Walled Lake advocate for national legalization to access standard banking services and reduce financial complexities. Millen employs a certified professional accountant specialized in cannabis and incurs high banking fees due to the intricate regulations.

Paul Tylenda, an attorney for cannabis businesses since 2019, noted that early cannabis companies in Michigan relied on specialty credit unions. As the industry grew, some regional banks began offering services, albeit at higher costs due to perceived risks.

Many cannabis companies now operate under larger holding companies that manage non-cannabis activities, allowing them to utilize standard business deductions, including for charitable donations.

Michigan's cannabis industry is awaiting the potential reclassification to Schedule III, which would integrate cannabis businesses into the mainstream economy, allowing for regular business operations and standard charitable contributions.

In October, Puff Cannabis, based in Madison Heights, announced a $50,000 donation from product sales to The Pink Fund and the Chaldean Community Foundation. The Pink Fund received $11,000 from Wana Brands and $40,000 from Oak Canna, partners in the Puff Cannabis donation.

Public comments on the proposed federal marijuana reclassification are open until July 22. More information can be found at the Federal Register's website.

Michigan's Economic Evolution: From Autos to Cannabis

Michigan, known for its natural beauty and rich history, has experienced significant economic shifts over the decades. Surrounded by the largest freshwater lakes globally, Michigan boasts vast forests, sandy beaches, beautiful state parks, pristine inland lakes, and some of the top golf courses in the country. Often referred to as the "Winter, Water Wonderland," Michigan is a top vacation destination featuring historic sites like Mackinac Island, which USA Today recently named the "Best Travel Destination" in the United States for 2024.

After World War II, Michigan epitomized economic prosperity. The state was home to the Big Three automakers – General Motors, Ford, and Chrysler – headquartered in Detroit. The booming auto industry created a prosperous middle class, attracting talent from across the nation and the globe, as people flocked to Michigan in pursuit of the American Dream.

However, the economic landscape has dramatically changed over the years. Starting in the 1980s, General Motors began shedding jobs, and since 1990, employment in auto plants, parts factories, and corporate offices has declined by 35%, according to the Bureau of Labor Statistics. This decline also affected ancillary businesses such as restaurants, hotels, gas stations, and real estate. Edmunds reports that domestic auto sales by GM, Ford, and Stellantis (formerly Fiat Chrysler) have plummeted from nearly 70% of the market in 1999 to 37% last year. Today, more people are employed in Michigan's hospitals than in its auto assembly plants.

Several factors contributed to this decline. Auto executives underestimated foreign competitors, believing American cars would always lead in quality and appeal. Meanwhile, the Auto Workers Union demanded high wages and benefits, driving up manufacturing costs and auto prices. This led to a scenario where foreign automakers could offer better cars at lower prices, ultimately outcompeting American manufacturers.

The decline of the auto industry had devastating effects on Michigan's cities. Flint, once a bustling hub for General Motors, became a ghost town almost overnight when GM closed its operations there. The city's economy was destroyed, and Flint later gained notoriety as "The Murder City." Lansing, Michigan's capital, faced similar devastation when GM shuttered its manufacturing operations there, and other towns across the state experienced comparable fates as production moved to states with lower labor costs and fewer union restrictions.

Despite these challenges, Michigan remains under Democratic leadership, which recently repealed the state's "Right to Work" law. This legislation had allowed Michigan to attract new businesses by not requiring workers to pay union dues. Its repeal could make it more difficult for Michigan to compete for new business opportunities.

Today, Michigan's economy is recognized for a different industry: cannabis. Michigan has surpassed California as the top cannabis market in the U.S. by sales volume, with per capita sales of $132.41, tripling California's $44.21. Market sales reached over $3 billion in 2023 and are projected to hit $4 billion by 2028. However, despite this success, Michigan's cannabis companies face intense competition and struggle to stay afloat in the recreational market.

In summary, Michigan has transitioned from being a global leader in automotive manufacturing to becoming a significant player in the cannabis industry. While the state's economy has seen better days, Michigan continues to adapt and find new avenues for growth and prosperity.

Houghton Welcomes New Nirvana Cannabis Shop

A new cannabis shop, Nirvana, celebrated its opening in Houghton on Thursday with a ribbon-cutting ceremony. This marks the tenth Nirvana dispensary in Michigan. The Keweenaw Chamber of Commerce facilitated the event.

Nirvana Houghton's Assistant Manager, Scott Curtin, described the company as laid-back and highlighted the distinctiveness of their offerings. "You can expect a lot more from what the others carry. We have our own brands that they won't have," Curtin said.

Curtin emphasized that the store's unique appeal lies in its superior products and competitive pricing. "We stand out more just because of our loyalty to the customers that we have that come in. We offer a very wide rewards system and loyalty system, and I think that really grasps a lot of people to come in," he added.

The new shop is situated on Ridge Street near Walmart. Its operating hours are from 9 A.M. to 8 P.M. Monday through Saturday, and from noon to 6 P.M. on Sunday.

Affordable Prices Propel Michigan to Top of Cannabis Market

Michigan has become the leading cannabis market in the United States in terms of units sold, surpassing even California, according to data from market intelligence firm BDSA. Since late 2022, Michigan consumers have purchased more packages of cannabis products, including gummies, pre-rolls, and grams of flower, than those in California. This shift is significant, given California's population is nearly four times larger than Michigan's.

The primary reason for this trend is the price difference between the two states. While California's cannabis market generates more revenue overall—over $5 billion last year compared to Michigan's $3.06 billion—cannabis products are significantly cheaper in Michigan. For example, a one-gram pre-roll of the Cookies' Ridgeline Lantz strain costs $17.50 at Dr. Greenthumb's Cannabis dispensary in Los Angeles but only $7 at Gage Cannabis in Ferndale, Michigan.

California's higher prices are largely due to its taxation system. The state imposes a 15% excise tax on cannabis sales in addition to state sales taxes that range from 7.25% to 10.75%. Municipalities can also add local taxes, pushing the total tax rate on cannabis purchases up to 38% in some areas. In contrast, Michigan has a 10% excise tax and a 6% sales tax, with no additional local taxes allowed.

These high prices in California discourage consumers from transitioning from the illicit market to the legal one. California has long been a major supplier of illegal cannabis, and the established black market continues to thrive, presenting a significant challenge to the legal market.

Michigan's rapid legalization and market expansion also played a crucial role in its current standing. The state legalized recreational cannabis in late 2019, with an approach that allowed for unlimited state-level licensing. This policy enabled swift growth in cannabis production, leading to an oversupply that caused prices to plummet from $494.77 per ounce in February 2020 to $88.15 in May 2023.

This price drop has made legal cannabis competitive with, and often cheaper than, illicit market cannabis, driving more consumers to purchase from legal sources. In May 2023, Michigan's cannabis industry sold over $278 million in recreational cannabis, and the state is on track to exceed $3.2 billion in sales for the year.

While other states like Colorado and Washington have seen declines in cannabis sales, Michigan's market continues to grow. A report from Oregon-based Whitney Economics indicates that over 75% of cannabis sales in Michigan occur within the legal market, compared to only 44% in California. This discrepancy suggests that California's overall cannabis market is worth more than $11.5 billion annually, while Michigan's is around $4 billion.

Despite Michigan's current success, it is unlikely to maintain this position indefinitely. California is already making efforts to address its market issues, including reducing or suspending local marijuana taxes to boost sales and considering regulatory changes. While the future of California's cannabis market remains uncertain, it is expected to stabilize and potentially reclaim its dominance.

For now, Michigan's cannabis industry can celebrate its achievements and focus on sustainable growth to maintain its market position. However, stakeholders should be prepared for changes as other states, especially California, work to resolve their market challenges.

Economic Growth in Mt. Pleasant Driven by Cannabis Retail

Mt. Pleasant has become a thriving center for cannabis retail, with 11 dispensaries opened in 2023 and four more planned. This growth has made cannabis sales a booming industry in central Michigan.

What Attracts Cannabis Sellers to Central Michigan?

We spoke with local cannabis industry professionals and city officials to understand why central Michigan, particularly Mt. Pleasant, is an attractive spot for cannabis businesses and how this influx of dispensaries impacts the town.

Economic Benefits and Urban Revitalization

The presence of these dispensaries has brought substantial economic benefits to Mt. Pleasant. According to Aaron Desentz, Mt. Pleasant city manager, the cannabis industry has spurred job creation, filled vacant buildings, initiated new constructions, and contributed to the city's budget through shared revenue.

"From job creation and wrap-around employment opportunities, to the revitalization of vacant buildings and new construction, and the addition to the city's budget from shared revenue, the growth has positive impacts in the community," Desentz explained.

Dispensaries have transformed old buildings into state-of-the-art facilities, improving the town's aesthetics and infrastructure. Matt Roman, director of government relations for Stash Ventures, emphasized their commitment to upgrading existing spaces. "We take traditional lower-use existing buildings and turn them into state-of-the-art facilities," Roman stated. He noted that their dispensaries, including Timber Cannabis Co. at 212 W. Pickard Street, aim to impress with their secure and welcoming environments.

Stash Ventures operates 17 dispensaries in Michigan, with headquarters in Mt. Pleasant. Roman highlighted their approach of not seeking incentives or tax abatements, focusing instead on community enhancement.

Community Contributions and Recognition

Lume, another prominent player in Mt. Pleasant, constructed two new buildings in 2021. Both locations, at 907 E. Broomfield and 1207 North Mission, received community beautification awards from the Mt. Pleasant Planning Commission.

In 2023, Mt. Pleasant added nearly $300,000 to its budget from the state's cannabis tax revenue. Michigan communities that opted for adult-use cannabis sales received over $87 million in revenue for 2023, with each eligible municipality and county receiving over $59,000 per licensed retail store and microbusiness.

Rapid Market Growth

The cannabis industry in Michigan has seen explosive growth. Desentz noted that marijuana sales revenue skyrocketed from $10 million in 2020 to $87 million in 2023. He anticipates Mt. Pleasant's share of revenue to increase as more dispensaries open.

In May 2022, the Mt. Pleasant City Commission removed license caps for marijuana businesses, allowing for more rapid growth. "After watching the first few retailers open for a year, the City Commission felt comfortable with the sustainability of the market," Desentz said. This decision also resolved legal disputes over license caps.

Employment and Community Engagement

Cannabis retailers have also bolstered the local employment base. Stash Ventures employs nearly 70 people, most of whom are full-time local hires. Lume has 25 employees across its two stores. Both companies are committed to community involvement and philanthropy.

Lume engages in various local events and supports initiatives like the annual Polar Plunge for Special Olympics and Habitat for Humanity fundraisers. "We are members of the community. We live and work here and are always looking for ways to get involved and give back," said Laurie Ralston, Lume area manager.

Stash Ventures, through its philanthropic arm Higher Hopes, has donated over $180,000 to local nonprofit organizations since 2020. The company involves its employees in selecting causes to support, ensuring their efforts have a meaningful local impact.

Market Sustainability and Future Outlook

Despite the rapid increase in cannabis retailers, concerns about market saturation remain. However, Roman is not worried about added competition, expecting some consolidation and price adjustments. Stash Ventures recently expanded by purchasing 11 stores from Cloud Cannabis, bringing their total to 17.

Lume, the largest single-state operator with 38 locations, remains committed to its long-term presence. With modern facilities and knowledgeable staff, Ralston believes in their sustained success.

Conclusion

The growth of cannabis dispensaries in Mt. Pleasant has brought economic benefits, revitalized urban spaces, and created jobs. As the industry continues to expand, the town remains optimistic about the future, focusing on sustainable growth and community involvement.

Helpful Links

Helpful Links