Former Battle Creek Caregivers Advocate for 'Clean' Cannabis Across Michigan

Five years ago, Melanie White-Lavender and her husband, Matt Lavender, began cultivating cannabis in their barn in southwest Michigan. What started as a modest caregiver operation aimed at helping a few patients has blossomed into a significant business driven by a mission to provide high-quality, clean cannabis to those who need it most.

The couple's journey into cannabis cultivation was deeply personal. White-Lavender's father, diagnosed with cancer, found relief in cannabis, allowing him to abandon pharmaceuticals and remain comfortable in his final years. Similarly, a close family friend, who survived a near-fatal motorcycle accident, used cannabis edibles to manage his pain and eventually made a full recovery.

"We've always believed more in the medicinal side of cannabis and treating it like the medicine that it is for so many people," White-Lavender said. "It's always been about helping people."

These experiences inspired the Lavenders to leave their day jobs in 2019 and launch Evolution Cannabis, a name reflecting their growing and evolving operation.

From Small Caregiver Operation to Major Producer

Today, Evolution Cannabis operates on a much larger scale while maintaining its original mission. The company expects to harvest over 10,000 pounds of cannabis this year from its 30,000-square-foot cultivation campus near Battle Creek. An on-site lab produces more than 36 million cannabis-infused gummies annually, distributed to nearly 200 dispensaries across Michigan. Additionally, with two House of Evolution dispensaries open and two more set to launch this year, the Lavenders have established a comprehensive supply chain.

"We just want to send people away with a great cannabis experience," White-Lavender said. "It's all about good vibes with us. We don't just churn and burn through our products. We don't cut corners. You need to treat these plants right, and a lot of that is just about having the right people, and keeping eyes, and ears, and all the attention on them."

Commitment to Quality and Safety

Despite their rapid growth, Evolution Cannabis has maintained a strong commitment to quality and safety. This includes stringent measures like requiring all staff and visitors to don protective gear and pass through an industrial air blower chamber to prevent contamination.

Automation plays a significant role in their cultivation process, allowing the staff to monitor and adjust light, airflow, temperature, humidity, and nutrient flow using a single iPad. This meticulous control ensures potent and flavorful harvests.

The company's products include vegan and gluten-free edibles made from scratch with natural ingredients, reflecting their dedication to quality and health.

"Many of our clientele are cancer patients and people with real medical needs, so we always take our time to do things the right way," White-Lavender said. "That's super important for us."

Avoiding Remediation for Purity

Evolution Cannabis stands out in the industry by refusing to remediate their cannabis—a process used to remove contaminants but which can negatively affect flavor, potency, and texture. By relying on their rigorous cultivation and processing standards, they aim to produce cleaner and more flavorful cannabis without the need for remediation, even if it means taking on greater business risks.

"Everybody cares about low prices, and it's getting to the point where some of this bottom-barrel stuff out there could really hurt people," White-Lavender said. "I'd love to be swimming in money right now, but this isn't about that. This is about giving people the best—and cleanest—product."

Looking Ahead

As Michigan's cannabis market continues to grow, White-Lavender hopes more consumers will recognize the value of brands that prioritize quality and safety. She envisions a "Clean Cannabis Campaign" to encourage other Michigan brands to adopt similar standards.

"Let's face it. It's hard to stay relevant in this market," she said. "We don't have giant pockets. We don't have the same crazy marketing budget as everybody else. We're keeping things tight because we're focused on the products, and we care about customers' pocketbooks as well. We want to offer a high-end product at an affordable price, and that's not always easy, but we're not quitters. There's a reason we've been able to come this far, and we're not going anywhere."

First Cannabis Provisioning Center Opens in Charlotte Amid High Hopes

After extensive research and community consultation, the City of Charlotte is opening its doors to cannabis dispensaries. This Monday marks the inauguration of the city's first cannabis provisioning center.

The idea of cannabis retail in Charlotte has been under consideration for several years, sparking both interest and controversy. Following approval by the local government last August, the city anticipates the arrival of multiple cannabis stores in the near future.

Mayor Pro-Tem Mike Duweck explained that the city has taken cues from other Michigan cities that host cannabis shops.

"Some residents are concerned about the potential increase in traffic these centers might bring. However, our police chief has conducted thorough research by reaching out to cities statewide to understand their experiences. The reality is that there have been virtually no issues," Duweck stated.

While the city has opted not to permit cannabis grow facilities, three provisioning centers have applied to open. One of these is Hollywood Jacks, founded by a local couple from Charlotte, aiming to open this summer.

"It's exciting. I've had to overcome the stigma and educate myself, much like many others," said Keisha Howe, Co-Owner of Hollywood Jacks.

Nearby, Harbor Farmz is preparing for a soft opening on June 10th, with a grand opening celebration scheduled for Saturday, June 15th.

"We are thrilled to be the first to open in Eaton County and the City of Charlotte. The community support, especially on social media, has been tremendous," said Mitchell Maltz, General Manager of Harbor Farmz.

For Charlotte, the addition of cannabis dispensaries is a strategic move to boost local revenue. Duweck anticipates significant financial benefits from the sales and property taxes generated by these businesses.

"Based on last year's data, each center could contribute approximately $65,000 annually to the city. For a town of our size, that's a substantial amount," Duweck noted.

High Society is the third facility to apply for a license in Charlotte, adding to the growing interest in cannabis retail within the community.

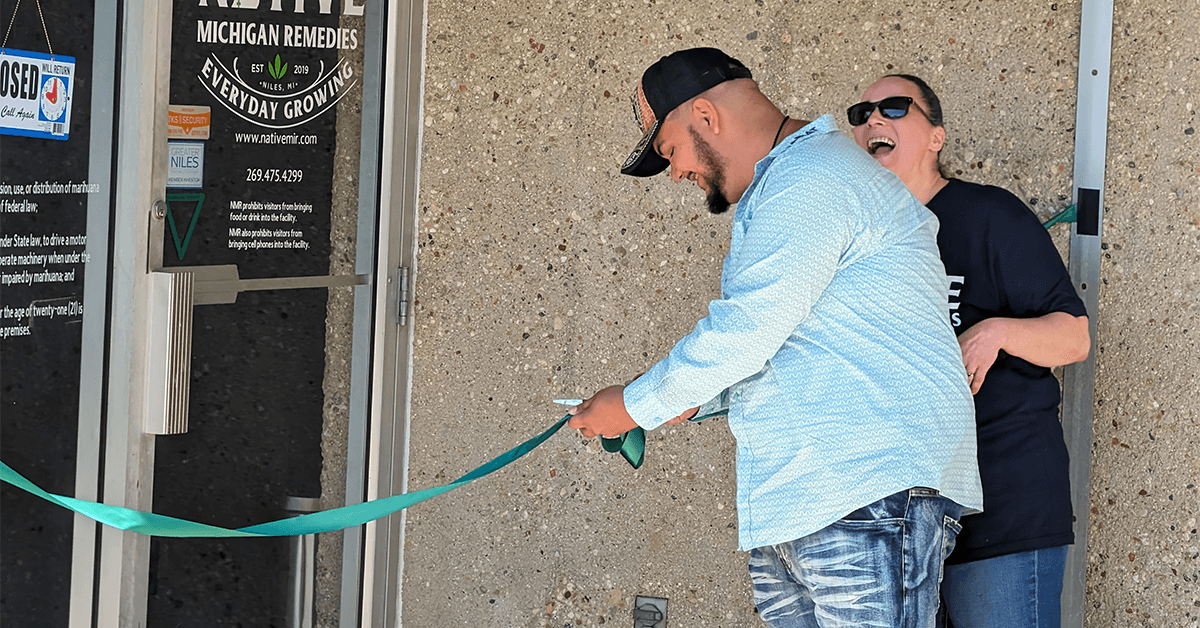

Native Michigan Remedies Launches Class A Microbusiness in Niles

An established cannabis business in Niles unveiled its new retail space to the community on Friday. After over five years of cultivating cannabis, Native Michigan Remedies (NMR) opened the doors to its Class A cannabis microbusiness at 2112 Industrial Dr., Niles, much to the delight of owner William Haas. The business marked the occasion with a ribbon-cutting ceremony on Thursday afternoon. NMR operates from 10 a.m. to 8 p.m., Wednesday through Monday.

"It feels good," Haas remarked. "It's a tough industry; it's not for the light-hearted or people with shallow pockets, so to finally have this open is great." The Class A microbusiness showcases a diverse range of "seed to shelf" NMR products alongside items from other growers. In Michigan, a Class A microbusiness license allows the holder to cultivate up to 300 cannabis plants, acquire mature plants from other licensed growers, and utilize external processors.

Haas co-founded NMR in 2019 with Brian Crespo, who now manages the NMR 2 processing lab with Haas' son, Skyler. NMR initially began as a cultivation facility before expanding to include the processing lab. The decision to pursue a microbusiness license was a strategic move to remain competitive in Michigan's dynamic cannabis industry.

"We're still small-town guys from Niles," Crespo said. "We know we have great products, and we understand the public demands our quality. To continue providing for our community and offering good jobs, we needed to pivot to a Class A microbusiness."

Both Haas and Crespo believe that their smaller operation enables them to produce high-quality products with meticulous attention to detail.

House of Dank Expands with New Cannabis Store in Kalamazoo

House of Dank is set to open its latest recreational cannabis retail store on June 14th in Kalamazoo. The new store, located at 1986 S Sprinkle Rd, MI 48906, will operate daily from 9 am to 10 pm, welcoming adults 21 and over with a valid photo ID.

This new location marks the eleventh addition to House of Dank's expanding network of cannabis retail stores in Michigan. The store will offer both in-store and online shopping options, featuring a secure, well-lit parking area, an ATM, and plans to introduce a delivery service soon.

Customers can expect excellent customer service, knowledgeable staff, a welcoming environment, competitive pricing, and the popular Clubhouse Rewards program that House of Dank's other locations are known for. The Kalamazoo store will carry products from well-regarded industry brands such as North Coast, Pressure Pack, STIIIZY, Mitten Extracts, and more. Additionally, House of Dank's exclusive CBD line and apparel collections will be available for purchase both in-store and online.

Marvin Jamo, the owner, shared his appreciation for the company's journey, stating, "We're really proud of where we started and how far we've come in the last nine years. Expanding into new markets allows us to provide every Michigan customer with a more personalized and better shopping experience."

In addition to the Kalamazoo opening, House of Dank is preparing to launch another store in Ann Arbor in the coming months.

Michigan Surpasses California in Legal Cannabis Sales

California has long been heralded as the largest legal cannabis market globally, with Governor Gavin Newsom reinforcing this claim as recently as the past two months. However, recent data suggests that Michigan has now surpassed California in legal cannabis sales volume, challenging the Golden State's longstanding dominance.

According to BDSA, a cannabis analytics firm, Michigan sold 22 million cannabis products in March, edging out California, which sold 21.3 million products. This data is significant as it marks the first time another state has outsold California in terms of unit sales. The firm's analysis relies on point-of-sale data from both states, though the exact timing of Michigan's market overtaking remains unclear.

Despite Michigan's lead in unit sales, California still leads in revenue. California's cannabis sales reached $1 billion in the first quarter of 2024, compared to Michigan's $786 million. The revenue disparity is largely due to Michigan's lower cannabis prices, making legal cannabis more accessible and affordable than in California.

The discrepancy between unit sales and revenue highlights differing market dynamics. Michigan's success in outselling California by units, despite having a smaller population, underscores significant challenges within California's cannabis market. According to Hirsh Jain, a cannabis consultant, California has failed to capitalize on its market potential, resulting in a robust illicit market that undermines legal sales.

Jain attributes California's struggles to high taxes and stringent regulations that inflate legal cannabis prices. Conversely, Michigan's approach includes low cannabis taxes and stringent enforcement against illegal sales, driving consumers to the legal market. This policy environment ensures affordability and convenience, key factors in Michigan's market success.

Moreover, Michigan benefits from neighboring states lacking legal recreational cannabis sales, attracting out-of-state customers. While this cross-border shopping contributes modestly to Michigan's sales, Jain estimates it accounts for only 5% to 10% of the state's total cannabis sales.

California's legal market continues to grapple with challenges. High taxes and regulatory costs push prices up, while insufficient enforcement against illegal operations allows untaxed, cheaper cannabis to thrive. Consequently, California has seen a decline in expected tax revenues from cannabis legalization, with the first quarter of 2024 recording the lowest legal sales in nearly four years. This decline impacts business sustainability and reduces government funding from cannabis taxes.

In contrast, Michigan's strategic approach, characterized by low taxation and strong enforcement, has created a flourishing legal market. The state's cannabis products are affordable for a broad demographic, driving robust legal sales.

The contrasting cannabis market landscapes between California and Michigan highlight differing regulatory approaches and market outcomes. Michigan's recent surge in cannabis sales volume reflects effective market strategies and poses critical lessons for other states aiming to balance regulation, taxation, and market health.

New Buffalo Township Reviews 47 Cannabis Dispensary Applications, Approves Four

On Tuesday night, the New Buffalo Township Planning Commission granted preliminary approval to four cannabis dispensary applications, marking the first step in a multi-stage approval process for these businesses.

This decision follows a one-year moratorium on new cannabis applications, which concluded with a surge of submissions just before Monday's deadline. Michelle Hannon, New Buffalo Township Clerk, emphasized that these approvals are preliminary and that the dispensaries must undergo additional scrutiny from various governmental entities before returning to the township board for final approval.

The commission's recommendation to approve the four dispensaries came after a public hearing and review. However, the journey for these businesses is far from complete. "They have to go through approval with various different government entities, and then they'll come back to the township board for final approval once those things are complete," Hannon explained.

In total, 47 applications were submitted and will be reviewed by the planning commission. The influx of applications has sparked concern among some community members. Cathy Ward, a local resident, voiced her worries about the township's priorities. "I wish they would put more money into the children's future in the schools and the childcare available in the area and look into providing some places like a CVS or somewhere to shop," she said.

Despite these concerns, officials note that not all 47 applications are guaranteed to move forward. The township stands to gain approximately $59,000 in annual tax revenue for each dispensary that successfully opens.

Hannon pointed out the uncertainty in the process, stating, "Well, it depends. Just because they have preliminary approval does not mean they have final approval. I mean, of those 47 applications, not even all have gone through this step. Things fall apart; you never know if they all will make it through. It's really hard to estimate at this point."

Helpful Links

Helpful Links