Agrify's Debt-to-Equity Conversion Ensures Nasdaq Compliance

Agrify (NASDAQ: AGFY), a cannabis technology company, has successfully converted approximately $13.8 million in debt to equity, enabling it to regain compliance with Nasdaq's stock listing rules.

CP Acquisitions, an entity under the control of Agrify's Chair and CEO Raymond Chang, alongside board member I-Tseng Jenny Chan, converted $11.5 million of its senior convertible notes into a prefunded warrant. This warrant is exercisable for up to roughly 8.6 million shares of Agrify's common stock, according to a recent news release.

Additionally, GIC Acquisitions, another entity controlled by Chang, converted $2.29 million of its junior secured notes into a prefunded warrant. This warrant can be exercised for up to about 3.2 million shares of common stock.

These prefunded warrants include adjustment provisions that may be activated if Agrify engages in equity financing within the 12 months following these conversions, pending shareholder approval.

With these conversions, Agrify's shareholder equity will surpass $2.5 million, allowing the company to regain compliance with Nasdaq listing standards. Agrify trades on Nasdaq under the ticker symbol AGFY.

In a statement, CEO Raymond Chang remarked, "The decision to convert a substantial portion of the senior debt demonstrates the management and shareholders' commitment to the future of Agrify."

Earlier this week, Agrify announced the cancellation of its plan to acquire the ag-tech firm Nature's Miracle (NASDAQ: NMHI), citing "unfavorable conditions."

For those interested in the financial side of the cannabis industry, an exclusive opportunity awaits. By signing up through our Robinhood referral link, you might secure a free portion of Agrify stock, making you a part of the groundbreaking journey of companies like Agrify in the cannabis sector. Explore this chance and potentially start your investment journey in the burgeoning cannabis market.

ReLeaf Center Joins Dowagiac Community with Symbolic Ribbon Tying

On Wednesday, the ReLeaf Center officially joined the Dowagiac business community with a unique ribbon tying ceremony. This event, held at 29402 Amerihost Dr, brought together Chamber of Commerce representatives and local business owners to celebrate the occasion. The ribbon tying, in contrast to the traditional ribbon-cutting, symbolized the unity between the business and the community.

The ReLeaf Center, which also operates a facility in Niles at 1840 Terminal Rd., is involved in the cultivation, processing, and provisioning of cannabis. While the company has several locations in eastern Michigan, the Niles site was the first to grow cannabis plants, which are then processed and distributed to other ReLeaf locations. The Dowagiac center marks the second provisioning site in the city.

"We help a lot of people and it's just great to see," said General Manager Lisa Frank. "I'm so very happy to be part of all this. It's just been a great experience for me." The ReLeaf Center operates from 9 a.m. to 8 p.m. Monday through Wednesday, 9 a.m. to 9 p.m. Thursday through Saturday, and 9 a.m. to 4 p.m. on Sunday. It also offers a drive-thru service.

Owner Michael E. Gelatke expressed his enthusiasm for the new location, stating, "It means a lot. The cooperation with the city has been great. We've built these in other places and the cooperation isn't always very good, but this town has been great. We're happy to be here."

Breweries Exploit Legal Loophole to Create THC-Infused Beverages

Cycling Frog and Delta Light are among the brands offering euphoric and relaxing effects through their canned beverages infused with THC, the main psychoactive ingredient of the cannabis plant. These drinks, which are non-alcoholic but capable of inducing a high, are increasingly distributed by alcohol companies from Connecticut to Texas to offset declining alcohol sales.

Unlike federally restricted cannabis products, these THC drinks are legal in many states because they are made with THC derived from hemp. Hemp, a form of the cannabis plant containing less than 0.3% THC, was legalized under the 2018 Farm Bill, which primarily intended to promote hemp for industrial uses. However, beverage makers have exploited this loophole to create psychoactive hemp concentrates.

Charlotte, North Carolina-based Drink Delta offers six varieties of hemp-derived THC drinks and describes the market opportunity as "like finding a loophole in the Matrix." This burgeoning market has attracted traditional alcohol distributors who are lobbying to maintain this legal loophole. This puts them at odds with lawmakers and established cannabis companies, which face strict regulations.

Unlike marijuana-derived THC products, hemp-derived THC products can be shipped interstate, utilize large national banks, accept credit cards, and benefit from tax deductions. Cannabis companies, which sell products like raw flower, edibles, pre-rolled joints, and tinctures, are restricted from these advantages because marijuana remains illegal at the federal level.

While 24 states allow recreational use of marijuana-derived THC, it remains federally illegal, awaiting reclassification. The Justice Department has initiated steps to reclassify marijuana as a less dangerous drug.

Regulators express concerns that poorly labeled hemp-derived drinks could expose consumers, especially children, to unexpected intoxication or unknown toxins. Currently, distributors of these beverages do not require special licenses, allowing them to display these products alongside traditional alcoholic beverages.

Some states are taking action to regulate these drinks. New York has banned drinks with more than 1 milligram of THC per serving since last summer, and Connecticut recently advanced similar legislation. Attorneys general from 20 states and Washington, D.C., are lobbying for explicit federal guidelines allowing states to ban high-potency products.

Joe Grabowski of Sarene Craft Beer Distributors LLC testified against Connecticut's proposed restrictions, arguing that such laws would harm his business, which has seen growth due to hemp-derived products amid declining alcohol sales. He suggested age restrictions, safety testing, and new taxes as better alternatives.

Minnesota serves as a model for regulated hemp-derived THC products, requiring businesses to register with the state and restricting sales to those 21 and older. The state, which only recently legalized recreational marijuana, sees significant demand for hemp-derived products, generating annual sales of about $180 million.

Even established cannabis companies are entering the hemp-derived THC market. Curaleaf Holdings Inc. announced plans to add these drinks to its product lineup, citing them as a "long-term growth driver."

The cooperation between alcohol distributors and the hemp industry is accelerating the availability of these products. In Texas, Bayou City Hemp Co. expanded its reach to over 1,000 stores through a deal with Silver Eagle Houston, a distributor for Anheuser-Busch InBev NV.

However, the U.S. Cannabis Council (USCC) warns against the unregulated market for hemp-derived drinks. In a letter to Congress, USCC Executive Director Edward Conklin cautioned that the lack of regulation could lead to a "Prohibition-era" crisis. The USCC advocates for hemp-derived THC to be regulated similarly to marijuana.

Despite regulatory uncertainties, the support from the alcohol industry is driving confidence in the legal status of hemp beverages. Farmers are preparing for increased demand, with projections showing a significant increase in hemp acreage dedicated to consumption.

"Once alcohol starts getting involved and starts pushing their lobbying dollars against the other side, there's no way you beat that," said Drink Delta's CEO Jack Sherrie.

Cannabis Tech Merger Falls Through as Agrify and Nature's Miracle Halt Plans

The anticipated merger between cannabis technology provider Agrify Corp. (NASDAQ: AGFY) and controlled-environment agricultural technology firm Nature's Miracle (NASDAQ: NMHI) has been called off due to "unfavorable market conditions," according to announcements made by both companies on Monday.

Stock Market Reactions

Following the news, Agrify Corp. (AGFY) saw its shares plummet nearly 15% on the Nasdaq exchange, dropping from 33 cents per share at the opening to 28 cents by midday. Similarly, shares of Nature's Miracle (NMHI) fell more than 20%, decreasing from 74 cents in the morning to just under 54 cents by midday trading.

Details of the Merger

The merger, initially announced in April, aimed to consolidate Agrify and Nature's Miracle in a significant deal that valued the equity of publicly traded Agrify at $6.3 million. Under the terms, Nature's Miracle was to purchase $750,000 worth of LED lighting equipment from Agrify and assume its debt, owned by businesses controlled by Agrify CEO Raymond Chang, for an unspecified amount of cash and stock.

Additionally, Raymond Chang was slated to become president of a new Agrify division within Nature's Miracle and secure a seat on the combined company's board. Nature's Miracle planned to issue 0.45 common shares to Agrify shareholders for each Agrify share held, aiming to close the transaction in the latter half of 2024. Post-merger, Agrify shareholders were expected to own approximately 30% of the combined company's common stock, which would focus on indoor vertical farming and cannabis extraction.

Agrify's Financial Struggles

The cancellation of the merger follows Agrify's troubling financial disclosures. The company reported an annual net loss of $18.7 million in its earnings call and expressed "substantial doubt" about its ability to continue as a going concern in its annual 10-K report. Despite these financial challenges, Agrify CEO Raymond Chang highlighted the company's strong momentum and growth in both cultivation and extraction business divisions.

Official Statements and Future Plans

In the announcement regarding the terminated merger, Raymond Chang stated, "Agrify continues to see strong momentum and pipeline growth quarter after quarter in both cultivation and extraction business divisions. We believe that it is in Agrify's best interest to stay the course and continue to execute." Chang emphasized that Agrify's management team and board are committed to exploring all strategic options to maximize shareholder value.

James Li, CEO of Nature's Miracle, echoed similar sentiments in their press release, stating, "Based on the current unfavorable market conditions, we've determined this is in the best interest of our shareholders and the long-term value of our business. At Nature's Miracle, we will continue to focus on our core indoor growing products, including grow light, dehumidifier, and container growing systems, where we are seeing strong momentum. We extend our appreciation to the Agrify team for their cooperation."

The abrupt decision to cancel the merger highlights the volatility and challenges within the cannabis industry, particularly amid uncertain market conditions. Both companies appear poised to continue their independent operations with a focus on their core competencies and market strategies.

For those interested in the financial side of the cannabis industry, an exclusive opportunity awaits. By signing up through our Robinhood referral link, you might secure a free portion of Agrify stock, making you a part of the groundbreaking journey of companies like Agrify in the cannabis sector. Explore this chance and potentially start your investment journey in the burgeoning cannabis market.

Michigan Cannabis Sales Rise in April Despite Lower Revenue

Michigan cannabis retailers experienced a 9.3% increase in sales volume in April compared to March, although the revenue generated saw a 3.5% decrease.

In April, Michigan retailers sold a total of 573,206 pounds of cannabis. Of this, 569,620 pounds were purchased by adult-use customers, and 3,586 pounds by medical marijuana patients, generating a total of $278,546,444. Recreational consumers spent $276,685,183, while medical marijuana patients accounted for $1,861,261 of the sales, according to the Michigan Cannabis Regulatory Agency (CRA).

In contrast, March saw the sale of 524,285 pounds of cannabis, with 520,469 pounds sold to recreational users and 3,816 pounds to medical patients. The total revenue for March was $288,843,279, with $286,790,258 from adult-use customers and $2,053,021 from medical marijuana patients, as reported by the CRA.

The decline in revenue despite the increase in sales volume can be attributed to a drop in the average price per ounce. The CRA noted that the average price for an ounce of recreational cannabis fell from $90.70 in March to $86.61 in April. Similarly, the average price for an ounce of medical cannabis decreased from $101.22 in March to $99.74 in April.

Despite the falling retail prices, there remains strong interest in cannabis cultivation. The state continues to receive numerous applications for Class C cultivation licenses, which allow for the cultivation of up to 2,000 cannabis plants. In April, 335 out of 336 new medical marijuana business applications were for Class C grow licenses. Additionally, 30 of the 117 new adult-use business applications were for Class C cultivation permits, according to the CRA.

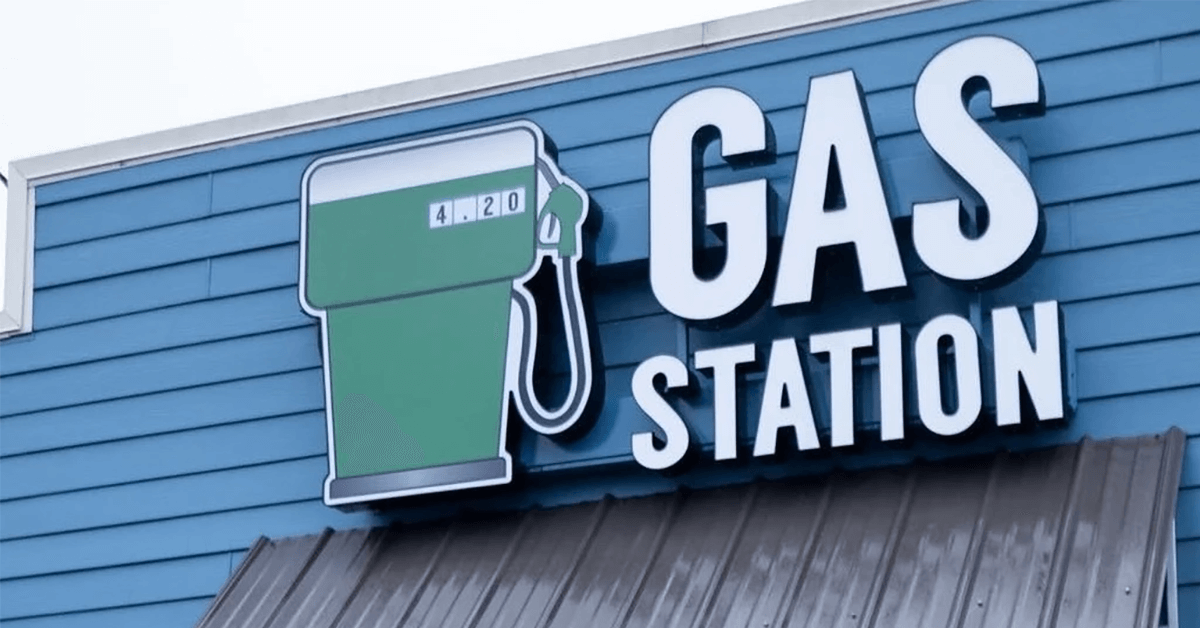

The Gas Station Set to Open as Wayland's Latest Cannabis Retailer

Jarred Biggs and Dennis Weiss, the business duo behind Middleville's inaugural cannabis dispensary, are expanding their footprint with a new venture, The Gas Station, slated to open next month in Wayland, Michigan. The new dispensary is located at 1124 W. Superior St., strategically positioned less than half a mile east of the U.S. 131 interchange.

Biggs, who has familial ties to the area, selected the Wayland location for its proximity to Gun Lake Casino, approximately 4 miles south. The casino is currently undergoing significant renovations and a $300 million expansion that includes a new 252-room hotel, spa, pools, and a restaurant. This development influenced Biggs' decision, as he aims to capitalize on the regional growth.

"The current developments are an opportunity we couldn't overlook," Biggs remarked. He, along with Weiss and their partners from Grand Rapids, entrepreneurs Jonathan Jelks and Willie Jackson, have previously collaborated on The Botanical Co., which opened in Middleville in October 2023.

Both The Botanical Co. and The Gas Station have been constructed with the expertise of Grand Rapids-based CopperRock Construction Inc., each project representing an investment of $1.6 million. While The Gas Station will resemble The Botanical Co. in design and operation, it will be slightly smaller in scale.

Beyond Wayland, the team is planning to expand further, aiming to establish five to six more stores across Michigan, with aspirations to venture into other states. All future outlets will operate under The Gas Station brand. According to Biggs, the focus will soon shift towards Grand Rapids for their next opening.

Biggs noted a distinct lack of local ownership in West Michigan's cannabis market, with many operators and growers based elsewhere in the state. This gap presents a strategic advantage for his group, emphasizing local ties and commitments.

Their strategy includes not just retail but also cultivation, with Biggs spearheading the opening of a 2,000-plant grow facility, Bigg Canna, in Edmore in fall 2023. Additionally, he launched the cannabis brand "Pablo" and is developing a second, larger Class C grow facility in Manistee.

"This vertical integration is crucial for our growth. It not only allows us to control product quality across our locations but also helps in securing shelf space in other dispensaries," explained Biggs.

Their arrival in Wayland marks a new chapter, as the city already hosts established cannabis retailers, unlike Middleville, which was a new market for the industry. This situation requires a more calculated approach to marketing and customer service, as Biggs acknowledged the need for a competitive edge.

Jelks, who has a diverse background in the beverage and bar industry, finds the partnership with Biggs beneficial, leveraging his deep understanding of the cannabis sector. "Our combined efforts, particularly in innovative marketing strategies, set us up for positive momentum," Jelks commented.

Helpful Links

Helpful Links