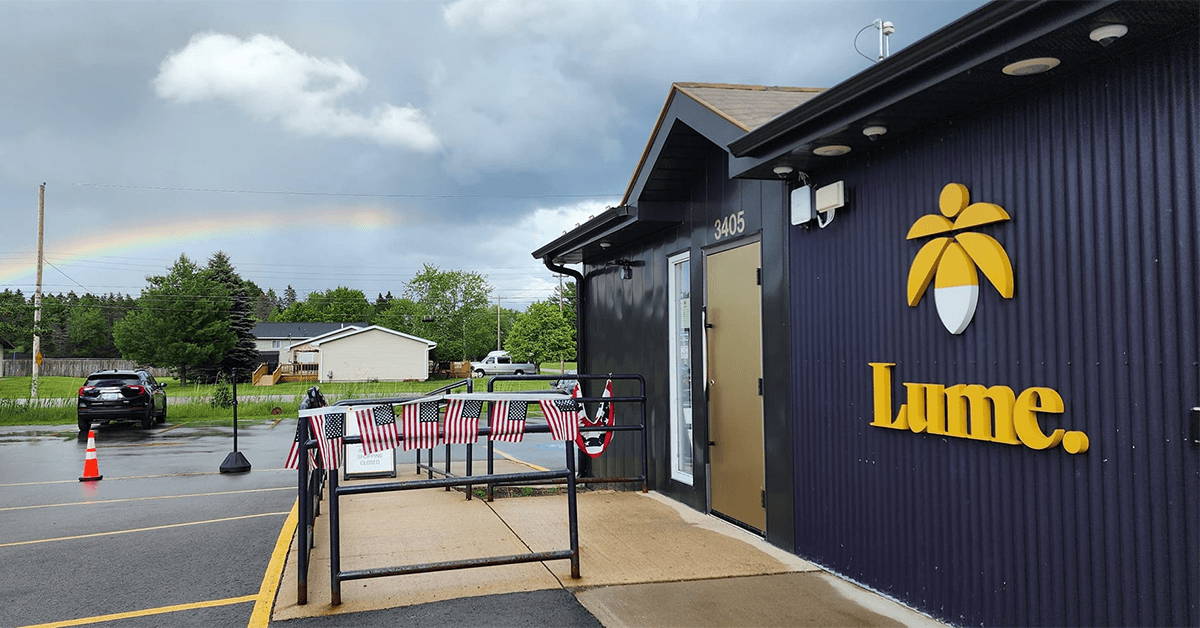

Navigating Growth and Challenges in Michigan's Cannabis Industry

In the face of market obstacles, Michigan's cannabis industry is gearing up for growth. A recent study titled "2023 Michigan Cannabis CFO Outlook" revealed that 25% of the state's cannabis enterprises are actively pursuing funds to broaden their operations, with an additional 45% intending to do so within the coming year.

The research, conducted by A&K Research and employed by Rehman Business Consulting, encompassed a variety of cannabis businesses, with revenues spanning from $5 million to over $100 million. A significant 47% of the respondents identified as vertically integrated companies.

The findings suggest that the average annual revenue per cannabis storefront in Michigan falls between $1 million and $3 million. However, the era of rampant mergers seems to be waning, as a mere 22% of respondents indicated a likelihood of finalizing an acquisition in the forthcoming year. Conversely, 61% of companies disclosed that they were unlikely to close any acquisitions in the same period.

A noteworthy 66% of Chief Financial Officers (CFOs) surveyed expressed no intention of selling their respective businesses. On the flip side, 17% are actively seeking an exit, while an identical 17% are contemplating a sale. Interestingly, the anticipated selling price for companies has seen a decline since 2022; while 44% of respondents believed they could fetch a selling price equating to 4x-5x EBITDA then, over half in 2023 have adjusted their expectations to a more modest 2x-4x.

Taxation is a prominent concern for Michigan cannabis operators, with respondents citing an effective tax rate of 41% or higher in 2023. Surprisingly, 53% claimed not to be utilizing any state or local tax exemptions. The interest rates faced by these companies vary considerably. While a fortunate 18% reported having no debt, and 24% indicated an interest rate below 7%, there were also 18% who reported rates of 10-12%, and a further 24% facing hefty rates of 16% or above.

When it comes to employee benefits, the majority of cannabis business owners in Michigan seem reluctant to distribute company equity, with 71% not offering equity grants to their staff. Furthermore, less than half of the companies surveyed cover at least 50% of their employees' healthcare costs.

Despite the challenges, Michigan's cannabis entrepreneurs remain optimistic. Nearly half anticipate market prices stabilizing in the next one to three years. Nonetheless, a substantial 32% conceded uncertainty, expressing no clear expectations regarding when the market will find its footing.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links