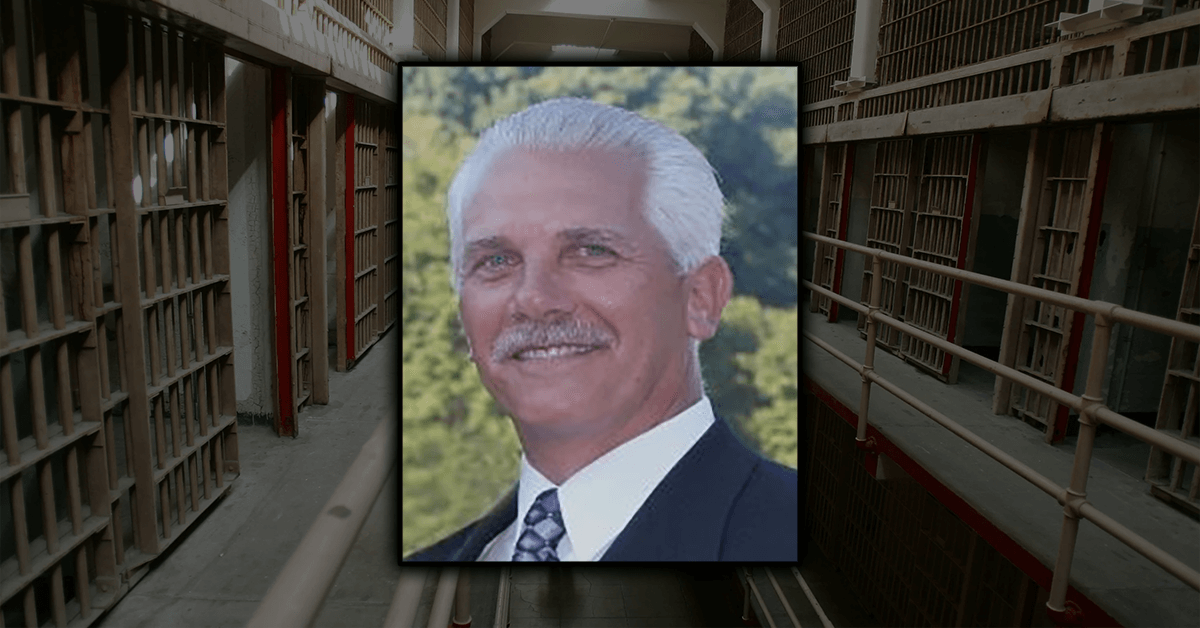

Cannabis Crowdfunding Scheme Leads to Legal Quandary for Michigan Man

In a recent development in a Michigan federal court, Robert Samuel Shumake Jr., also known as Bobby Shumake Japhia following a legal name change, has been directed to secure new legal representation or inform the court of his intention to self-represent. This directive comes in light of Shumake's failure to compensate his previous attorney, sparking allegations from the U.S. Securities and Exchange Commission (SEC) of orchestrating a fraudulent $2 million crowdfunding operation related to cannabis and hemp real estate ventures.

U.S. District Judge Matthew F. Leitman granted the withdrawal request from Jonathan Uretsky of PULLP, Shumake's former lawyer, citing nonpayment as a valid reason for the termination of legal services. Uretsky's request to withdraw highlighted a breakdown in the attorney-client relationship, compounded by unsuccessful attempts to establish a payment plan for the outstanding fees amounting to approximately $36,000 as of April 2022.

During a court hearing, Shumake mentioned his financial struggles and a recent personal bankruptcy filing in California, which he believed would temporarily halt proceedings against him. However, the SEC has contested this, urging the continuation of its lawsuit by arguing that its enforcement action falls under "police power," exempt from bankruptcy's automatic stay provisions.

Judge Leitman has given Shumake a window of 30 days to arrange for new legal representation or declare self-representation, after which he will have 21 days to address the SEC's allegations. These allegations stem from a September 2021 action initiated by the SEC against Shumake and principals of two companies accused of misappropriating funds from investors through deceitful crowdfunding offerings related to cannabis and hemp real estate projects between September 2018 and June 2020.

The SEC's investigations have revealed that Shumake was a pivotal figure in these offerings, concealing his involvement to obscure his prior criminal record related to mortgage fraud. Allegedly, he collaborated with Nicole Birch and Willard Jackson, misleading investors about the companies' management expertise in real estate and diverting substantial funds for personal use.

This case marks Shumake as the final defendant in a series of legal actions that have already seen settlements and judgments against other involved parties, including a significant disgorgement and civil penalties against Birch, a permanent securities law violation ban against Jackson, and a settlement with the crowdfunding platform Fundanna and its CEO.

Furthermore, Shumake's legal troubles extend beyond this case, with a guilty plea in 2017 for violating Michigan's Credit Services Protection Act in a separate mortgage audit services venture.

As the legal proceedings continue, the SEC, represented by John E. Birkenheier, Jerrold H. Kohn, and Dante A. Roldàn, declined further comments. The case, officially recorded as U.S. Securities and Exchange Commission v. Robert Samuel Shumake Jr. et al., remains pending in the U.S. District Court for the Eastern District of Michigan, reflecting ongoing challenges in regulating the intersecting worlds of crowdfunding, cannabis, and real estate investments.

Share this article:

Spotted a typo, grammatical error, or a factual inaccuracy? Let us know - we're committed to correcting errors swiftly and accurately!

Helpful Links

Helpful Links